Sharda Cropchem is principally engaged in export of agrochemicals (technical grade and formulations) and non-agro products such as conveyor belts, rubber belts/sheets, dyes and dye intermediates to various countries across the world.

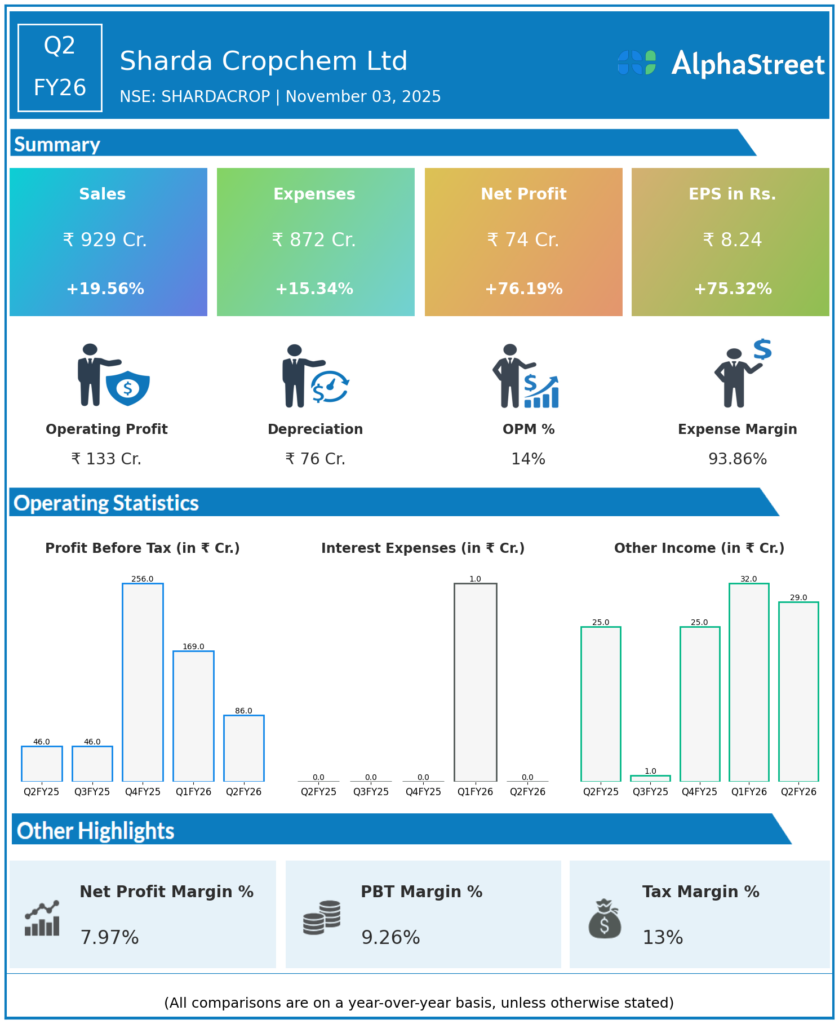

Q2 FY26 Earnings Results:

-

Revenue from Operations: ₹929.11 crore, up 19.6% YoY; down 5.7% QoQ.

-

Profit After Tax (PAT): ₹74.31 crore, up 75.2% YoY; down 47.9% QoQ.

-

EBITDA: ₹138.9 crore, up 71% YoY.

-

EBITDA Margin: 15.0%, up 450 bps YoY, down QoQ from 21.9%.

-

Gross Profit Margin: 34.5%, expanded 690 bps YoY.

-

Strong volume growth in agrochemical segment (+27% YoY).

-

Total expenses up, but well-managed, with cost control focus.

Management Commentary & Strategic Insights:

-

Positive outlook with strong volume momentum and margin improvement.

-

Continued capex plans (~₹450-500 crore) focused on expanding capacity and product registrations.

-

Emphasis on maintaining EBITDA margins between 15-18% for FY26.

-

Improved product mix with growth in specialty and non-agrochemical segments.

-

Managing price volatility and global market uncertainty proactively.

Q1 FY26 Earnings Results:

-

Revenue: ₹984.8 crore, up 25% YoY.

-

PAT: ₹142.8 crore, up 424% YoY.

-

EBITDA: ₹142 crore, up 67% YoY.

-

Volume growth: 13.2% YoY in overall sales.

-

Focused on R&D and product registrations with 2,981 registrations and 1,021 pending approvals.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.