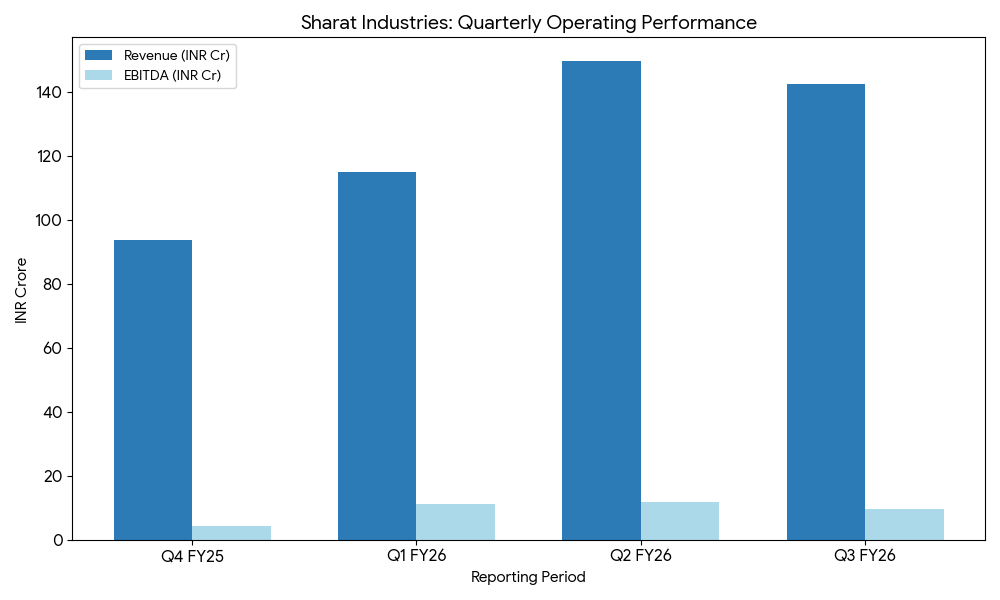

Sharat Industries Ltd (BSE: 519397) for the third quarter ended December 31, 2025 (Q3 2026), reported consolidated revenue from operations of 142.55 crore rupees, a 47.8% increase from 96.44 crore rupees in the same period last year. Net profit for the quarter rose 79.6% to 4.74 crore rupees, up from 2.64 crore rupees in the prior-year period.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) reached 9.51 crore rupees, representing a 21.9% year-over-year increase. The EBITDA margin for the quarter was 6.67%, compared to 8.09% in the third quarter of the previous fiscal year.

Nine-Month Overview

During the nine months ended December 31, 2025, the company recorded a revenue of 407.47 crore rupees, marking a 42.2% growth compared to 286.63 crore rupees in the corresponding period of the previous year. Net profit for the nine-month period rose 68.3% to 15.85 crore rupees. The directional trend for the fiscal year to date shows expansion in both top-line revenue and overall profitability.

Business & Operations Update

The company attributed the growth to geographic diversification and an increased focus on value-added shrimp products.

- Market Expansion: Increased traction in non-U.S. markets, specifically Russia and Asia, was reported as a driver for volume growth.

- Operational Shifts: Management noted enhancements to the product portfolio to include higher-realization value-added offerings.

- Regulatory Environment: The company is monitoring the European Union’s revised Anti-Microbial Resistance (AMR) framework and potential duty-free import limit changes in the Union Budget.

Management Q&A Focal Points

During the Q&A session the following points were discussed:

- U.S. Tariff Impact: Management stated that while U.S. tariffs created a challenging environment, the company mitigated the impact by diversifying export destinations.

- Margin Compression: Regarding the dip in EBITDA margins, the response cited higher operating expenses and logistics disruptions, partially offset by better net profitability through disciplined expense management below the EBITDA level.

- Supply Chain: In response to questions on supply chain friction, management highlighted that recent government measures to ease export formalities are expected to benefit temperature-sensitive shipments.

Guidance & Outlook

Sharat Industries identified several factors to watch in the coming quarters:

- Progress on India-EU and India-U.S. trade discussions.

- Implementation of higher duty-free import limits for processing inputs.

- Potential for increased domestic consumption following GST rationalization on certain seafood categories.

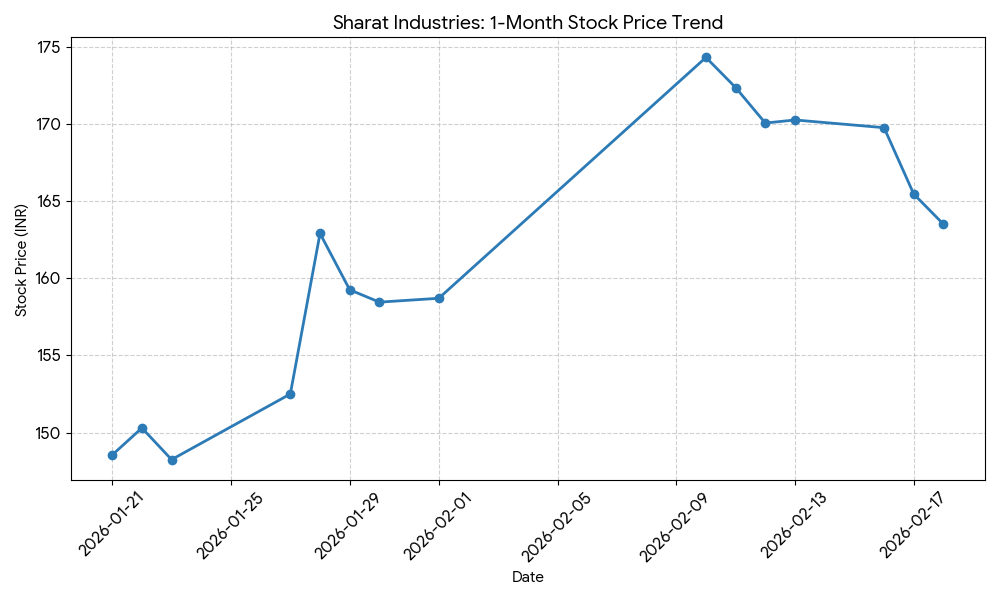

Performance Summary Sharat Industries shares declined 1.18% today to close at 163.50. The company reported a 47.8% rise in quarterly revenue and a 79.6% surge in net profit. Growth was driven by non-U.S. export markets and value-added product segments despite a slight contraction in operating margins.