Shalby Ltd is engaged in healthcare delivery space in India. It operates a chain of multi-specialty hospitals across India. The business of the company is to offer tertiary and quaternary healthcare services to patients in various areas of specialization such as orthopaedics, complex joint replacements, cardiology, neurology, oncology, renal transplantations, etc. The company is the global leader in knee replacement surgery and one of the top Indian hospitals in joint replacement surgery. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

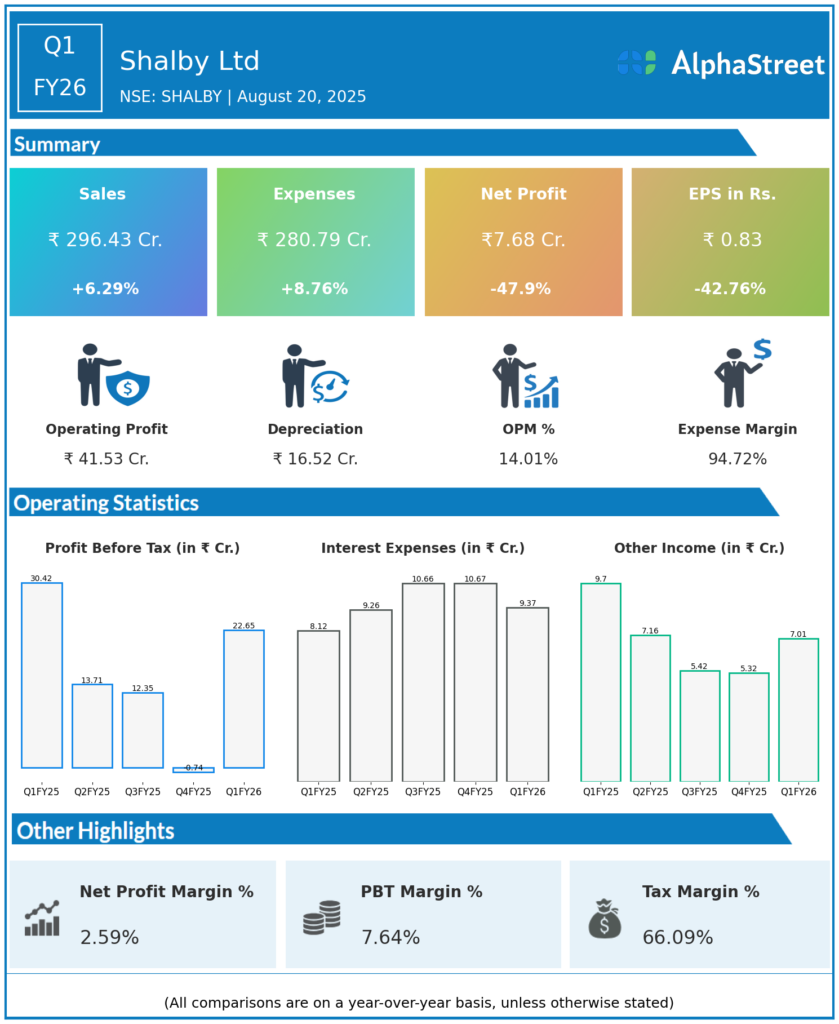

Total Income: ₹296.43 crore, up 6.2% year-over-year (YoY) and 11.9% quarter-on-quarter (QoQ).

-

Total Expenses: ₹280.79 crore, up 8.7% YoY and 4.4% QoQ.

-

Profit Before Tax (PBT): ₹22.65 crore, down 25.5% YoY but up 4.0% QoQ.

-

Profit After Tax (PAT): ₹7.68 crore, down 47.9% YoY and 52.1% QoQ.

-

Earnings Per Share (EPS): ₹0.83, down from -₹1.02 in Q1 FY25 and ₹1.45 in Q4 FY25.

-

EBITDA: ₹48.5 crore, down 11.6% YoY but up 85.6% QoQ; EBITDA margin at 16%.

-

Hospital Occupancy: Dropped to 45% (639 beds used vs. 669 last year), negatively impacting margins.

-

ARPOB (Average Revenue Per Occupied Bed): Increased 5.3% YoY.

-

Implant Business: Robust growth, with Shalby MedTech revenue up 74.2% YoY, driven by domestic volume.

Management & Strategic Highlights

-

Shalby continues to be a leading multi-specialty hospital group.

-

The quarter saw a record consolidated revenue but significant margin compression due to higher expenses and lower occupancy rates.

-

Implant business (MedTech) rapidly expanded, with strong domestic demand; Q1 FY26 MedTech revenue ₹30.8 crore, up from ₹17.4 crore YoY.

-

Strategic focus remains on expanding implant product offerings, operational efficiency, and geographic coverage.

-

Plans include new product launches globally, cost and manufacturing efficiency initiatives, and increased market share in India and abroad.

Q4 FY25 Earnings Results

-

Total Income: ₹264.8 crore, up by 8.4 percent on the YoY basis.

-

PAT: A loss of -₹12.19 crore as compared to a profit of ₹16.04 Crore during the same quarter last year.

-

EPS: -₹1.02 vs ₹1.54 in Q4 FY24.

-

On Yearly basis, Q1 showed top-line growth but a sharp profit drop due to tax and expense increases.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.