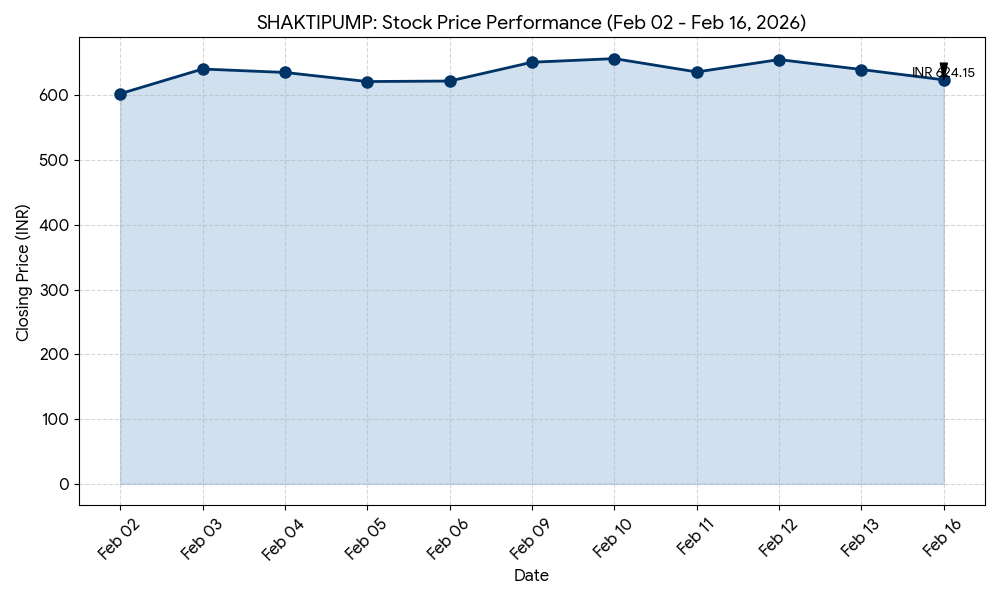

Shakti Pumps (India) Limited (NSE: SHAKTIPUMP, BSE: 531431) shares closed at INR 3,023.90 on Monday, representing an intraday decline of 3.80%. The stock opened the session at INR 3,100.00 and reached a high of INR 3,127.00 before settling lower following the release of its quarterly financial statements.

Market Capitalization

As of today’s market close, the market capitalization of Shakti Pumps (India) Limited stands at INR 7,902 crore.

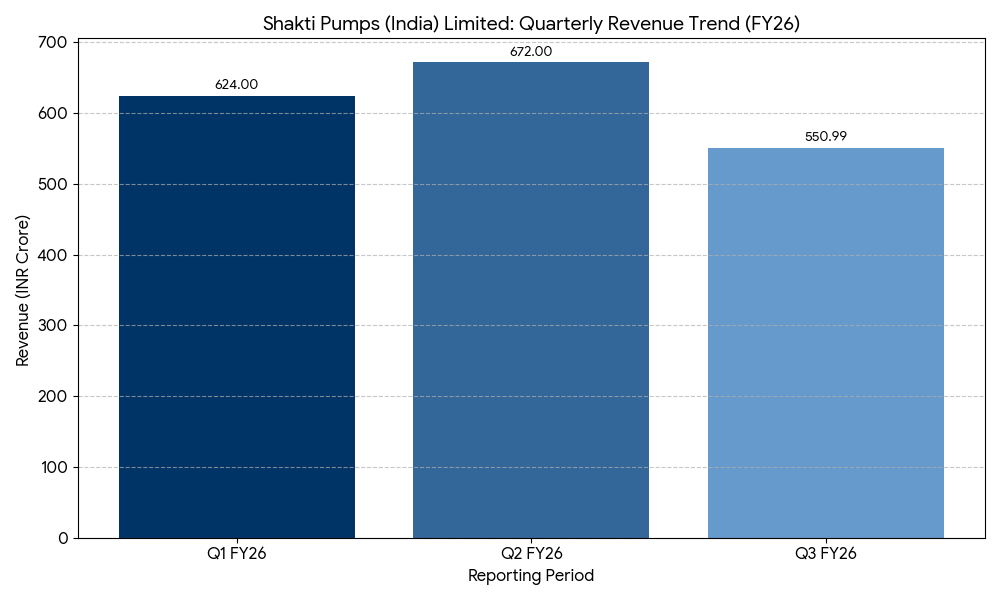

Latest Quarterly Results

For the quarter ended December 31, 2025 (Q3 FY26), Shakti Pumps reported a consolidated revenue from operations of INR 550.99 crore, a decrease of 15.07% compared to INR 648.77 crore in the same period last year. Consolidated net profit for the quarter stood at INR 31.70 crore, down 69.53% from INR 104.05 crore in Q3 FY25.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) was reported at INR 59 crore, a decline of 61.78% year-over-year. The EBITDA margin contracted to 10.7% from 23.8% in the previous year’s third quarter.

Segment Highlights:

- Domestic Operations: Revenue declined by 16.2% year-over-year, impacted by a calibrated slowdown in execution in Maharashtra to address receivable levels.

- Export Operations: Overseas subsidiaries recorded a growth of 40.5% in revenue during the quarter.

- Solar Solutions: The company maintained a focus on the PM-KUSUM scheme, though realization on certain state orders declined by 4%.

FINANCIAL TRENDS

Nine-Month Overview

For the nine-month period ended December 31, 2025, Shakti Pumps reported a directional trend of revenue growth compared to the corresponding period in FY25. However, the third quarter marked a period of contraction in profit margins and absolute net profit. Total nine-month net profit remains higher than the prior year’s nine-month total due to performance in the first half of the fiscal year.

Business & Operations Update

Shakti Pumps received several domestic work orders under the PM-KUSUM scheme during the quarter. This includes a contract from the Haryana Renewable Energy Department (HAREDA) for 792 solar water pumping systems valued at INR 23.54 crore. Additionally, the company secured orders from Madhya Pradesh Urja Vikas Nigam Limited totaling approximately INR 237 crore for over 6,700 solar pumping systems. The board also approved the appointment of a new independent director during the February 13 meeting.

M&A or Strategic Moves

On January 16, 2026, Shakti Pumps announced an investment of INR 75 crore in its wholly-owned subsidiary, Shakti Energy Solutions Limited. The capital is designated for the expansion of solar manufacturing capabilities, including solar structures and DCR cells. In January, the company also secured its maiden order from Karnataka Renewable Energy Development Limited (KREDL) valued at INR 654.03 crore for 16,780 solar pumping systems.

Q&A Focal Points

During the earnings conference call on February 14, management addressed the receivable management strategy in Maharashtra, confirming that execution was intentionally slowed to stabilize collections. Questions also focused on the 4% decline in realizations from the “Magel Tyala” orders and the impact of rising raw material costs, specifically copper and steel. Management detailed a one-time INR 4.4 crore impact on employee expenses related to the new labour code and confirmed that execution in Karnataka would be strictly aligned with payment timelines.

Guidance & Outlook

Management identified Q4 FY26 as a period to watch for potential record revenue volumes, citing fund releases from the Asian Infrastructure Investment Bank (AIIB) for Maharashtra projects. Market participants are monitoring the execution of the INR 2,100 crore order book and the stabilization of EBITDA margins, which remain pressured by cost inflation and lower realizations.

Performance Summary

Shakti Pumps stock fell 3.80% today to close at INR 3,023.90. The company reported a 69.53% decline in quarterly net profit and a 15.07% drop in revenue. While domestic execution slowed to manage balance sheet health, the export segment grew by 40.5%. The company continues to operate with a diversified order book exceeding INR 2,100 crore.