Current Status Overview

SG Mart Ltd operates a B2B marketplace for construction materials.

The company supplies steel and allied products.

It serves EPC firms, developers, and traders.

Market capitalization is approximately ₹4,100 crore.

Operations are focused on the Indian market.

Share Price Performance

As of 23 January 2026, shares trade near ₹350.

The stock has shown recent volatility.

The 52-week range is approximately ₹290 to ₹436.

Short-term movement remains mixed.

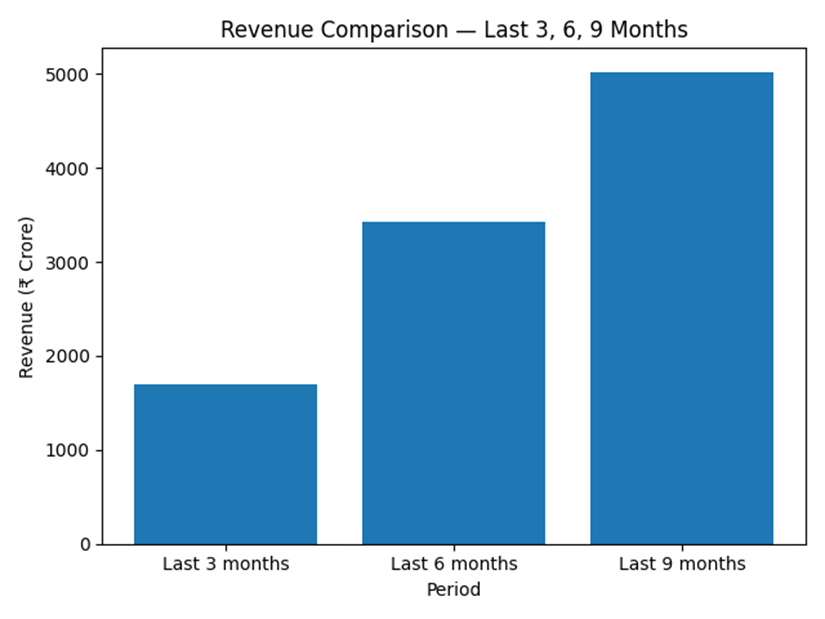

Revenue Performance

Revenue for the last 3 months totaled approximately ₹1,704 crore.

Revenue for the last 6 months totaled approximately ₹3,427 crore.

Revenue for the last 9 months totaled approximately ₹5,022 crore.

Market Analysis

SG Mart operates in the construction materials distribution sector.

Competition includes traditional distributors and B2B platforms.

Demand is linked to infrastructure and real estate activity.

Input price volatility remains a sector risk.

Analyst Commentary

No formal analyst coverage is currently available.

No consensus estimates have been published.

Mergers & Acquisitions

No completed mergers or acquisitions were reported.

No binding M&A announcements were disclosed.

Outlook

Business performance depends on construction demand trends.

Commodity price movements remain a key factor.

No official forward guidance has been issued.

Revenue Chart