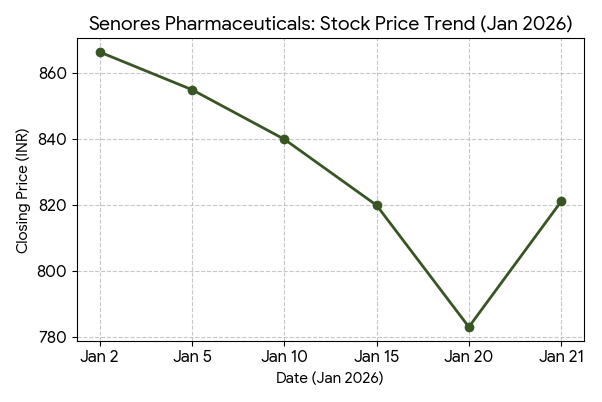

Senores Pharmaceuticals Ltd. (NSE: SENORES; BSE: 544319) shares closed 4.85% higher on the National Stock Exchange and Bombay Stock Exchange today, following the release of the company’s third-quarter financial results. The stock recovery follows a period of volatility in the pharmaceutical sector.

Market Capitalization

The total market capitalization of Senores Pharmaceuticals Ltd stood at ₹3,778.50 crores at the close of trading on Wednesday.

Latest Quarterly Results

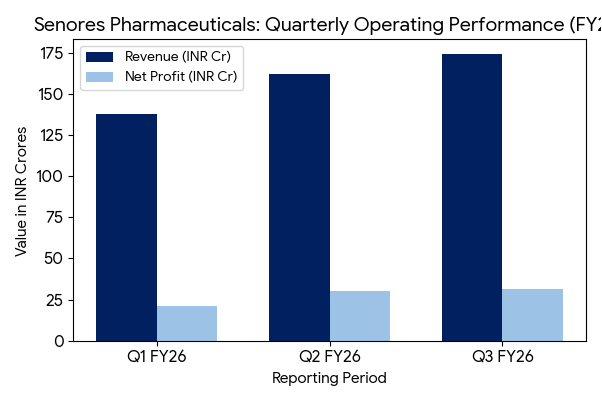

For the third quarter ended December 31, 2025 (Q3 FY26), Senores Pharmaceuticals reported a consolidated revenue of ₹174.56 crore, representing a year-over-year increase of 69.44% from ₹103.02 crore in the corresponding period last year. Consolidated net profit for the quarter rose 84.28% to ₹31.66 crore, compared to ₹17.18 crore in Q3 FY25.

The company reported the following segment performance:

- The company reported the following segment performance:

- Regulated Markets: This segment contributed ₹112.7 crore to quarterly revenue, representing 64.5% of total sales. The segment reported an EBITDA margin of 40%.

- Emerging Markets: Revenue from emerging markets reached ₹38.4 crore, a 48% increase year-over-year. The segment’s EBITDA margin improved to 13% from 1% in the previous year. Other Segments: Revenue from other operations accounted for ₹23.4 crore.

CHART — FINANCIAL TRENDS

Full-Year Results Context

In the previous full fiscal year (FY25), Senores Pharmaceuticals reported annual consolidated revenue of ₹458.2 crore and a net profit of ₹82.4 crore. This compared to revenue of ₹312.1 crore in FY24, indicating a directional trend of growth in both top-line and bottom-line metrics over the 12-month period.

Business & Operations Update

The company reported the completion of the first phase of its manufacturing facility expansion in Chhatral. As of December 2025, Senores Pharmaceuticals holds 46 approved Abbreviated New Drug Applications (ANDAs) covering 137 strengths. The company disclosed that 22 additional ANDAs are currently under development. The board also approved the issuance of warrants on a preferential basis to raise ₹950.04 crores to fund research and development and capital expenditure.

M&A or Strategic Moves

Senores Pharmaceuticals confirmed the acquisition of a 75% stake in Apnar Pharmaceuticals, a U.S.-based specialty pharmaceutical company. The transaction, executed in multiple phases, is intended to expand the company’s direct distribution presence in the North American market. The integration of Apnar’s commercial platform is currently underway.

Equity Analyst Commentary

Institutional research reports noted the company’s increasing contribution from regulated markets and the impact of the Apnar acquisition on margin profiles. Analysts from regional brokerage firms highlighted the transition from a research-focused entity to a commercial-scale pharmaceutical player. Reports attributed the recent quarterly performance to improved product mix and operational efficiencies in the emerging markets segment.

Guidance & Outlook

Management indicated a focus on the U.S. specialty generic market and the commercialization of its current ANDA pipeline. Regulatory filings for new product launches in European and Canadian markets are identified as key factors to watch in the coming quarters. The company remains subject to global regulatory inspections and price volatility in raw material procurement.

Performance Summary

Senores Pharmaceuticals shares closed with a 4.85% gain today. The company reported a 69.44% increase in quarterly revenue and an 84.28% rise in net profit. Growth was led by the regulated markets segment, supported by the ongoing integration of international acquisitions.