Current Status Overview

SENCO Gold Ltd is a listed jewellery retailer in India. The company operates a multi-format showroom network across several states. Q3 FY26 results reported strong revenue growth. Operational margins improved sequentially. The company continues expansion of retail footprint and product diversification.

Share Price Performance

As of 13-02-26, shares trade in the ₹330–₹340 range on NSE. The stock has moderated from previous 52-week highs. Recent movement reflects sector-wide volatility. Trading volumes remain steady. Market capitalization remains aligned with mid-cap peers.

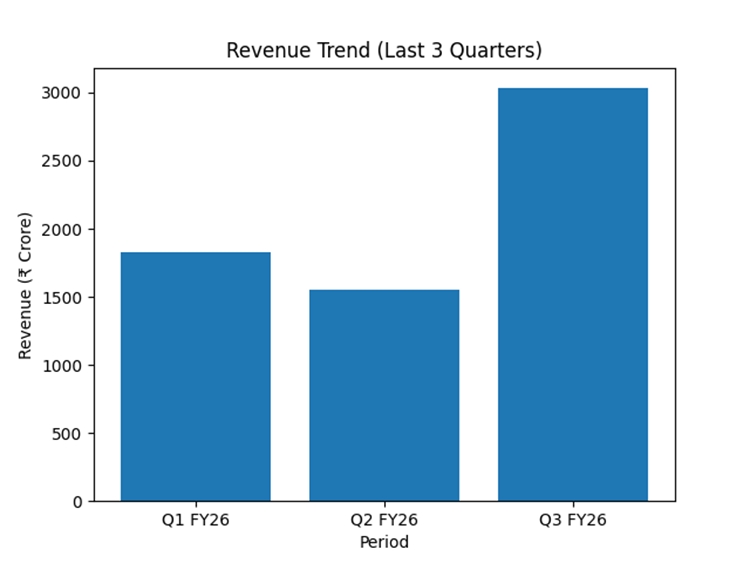

Revenue Performance

Q1 FY26 revenue: ₹1826 crore. Q2 FY26 revenue: ₹1554 crore. Q3 FY26 revenue: ₹3032 crore. Q3 reflects significant sequential growth. Nine-month performance shows seasonal variation.

Revenue Chart

Market Analysis

The company operates in India’s organised jewellery retail sector. Competition includes national and regional branded players. Demand is influenced by wedding and festive cycles. Gold price movements impact consumer purchasing patterns. Industry trend shows gradual shift toward branded retail.

Analyst Commentary

Recent coverage highlights revenue growth in Q3 FY26. Margin improvement noted sequentially. Formal consensus estimates not publicly disclosed. Coverage remains limited among brokerage houses.

Mergers & Acquisitions

None reported.

Outlook

Management indicates continued expansion in FY26. Performance remains linked to consumer demand trends. Retail footprint expansion continues as planned. Outlook remains aligned with sector growth trajectory.