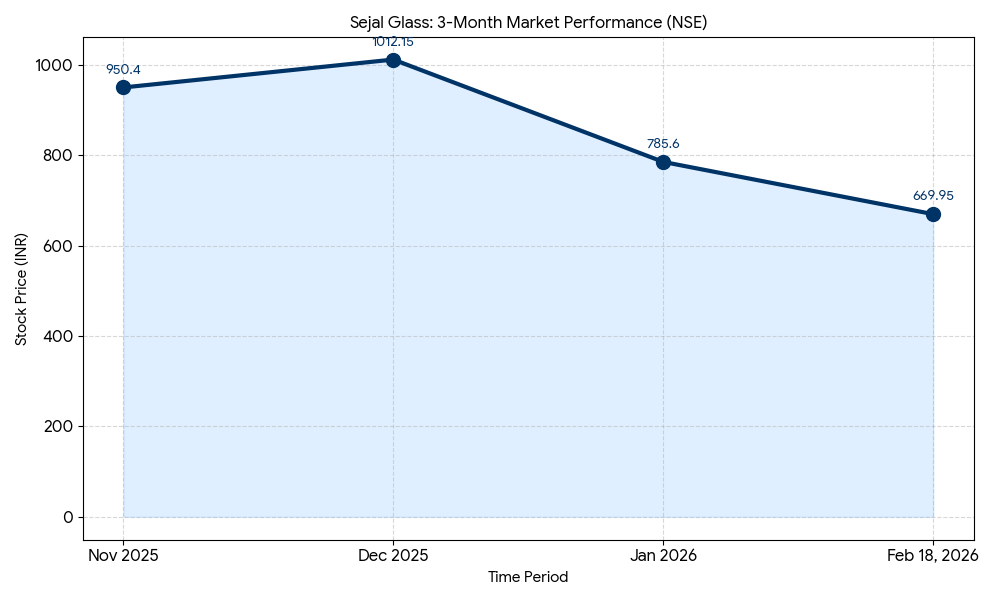

Sejal Glass Limited (NSE: SEJALLTD, BSE: 532993) shares closed at ₹669.95 today, marking an intraday decline of 3.78%. The stock fluctuated between a high of ₹695.70 and a low of ₹665.00 during the session.

Market Capitalization

As of today’s market close, the market capitalization of Sejal Glass Limited stands at ₹763.70 crore (approximately $91.8 million).

Latest Quarterly Results

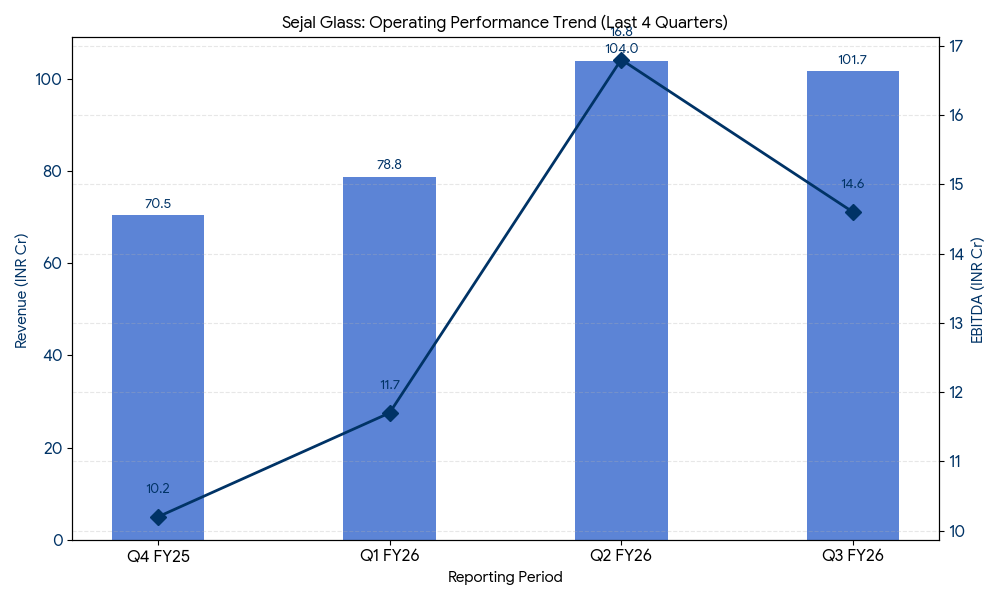

For the third quarter ended December 31, 2025 (Q3 FY26), Sejal Glass reported consolidated revenue from operations of ₹101.70 crore, representing a 63.9% increase from ₹62.04 crore in the corresponding quarter of the previous fiscal year. Consolidated net profit for the period rose to ₹5.08 crore, up 49.1% from ₹3.40 crore in Q3 FY25.

Operating performance highlights:

- EBITDA: ₹14.60 crore compared to ₹9.10 crore in the previous year.

- EBITDA Margin: 14.47%, a marginal contraction from 14.72% year-over-year.

Segment Highlights The company operates primarily in the glass processing and value-added architectural glass segments. No specific sub-segment revenue for Digital or Retail was reported, as the company’s core operations remain focused on industrial and architectural glass products.

FINANCIAL TRENDS

Nine-Month Overview

For the nine-month period ended December 31, 2025, consolidated revenue reached ₹284.51 crore, compared to ₹177.06 crore in the same period last year. Consolidated net profit for the nine months stood at ₹17.41 crore, up from ₹8.03 crore previously. These figures indicate a consistent growth trend in revenue and bottom-line performance for the current fiscal year.

Business & Operations Update

Sejal Glass has recently expanded its domestic manufacturing capacity through the integration of Glasstech Industries. The company has also appointed N R Doshi and Partners as the statutory auditor for its UAE material subsidiary, Sejal Glass and Glass Manufacturing Products LLC, effective January 13, 2026, to strengthen its international audit framework.

M&A or Strategic Moves

The Board of Directors, chaired by Surji D. Chheda, met on February 2, 2026, to discuss the issuance of equity shares on a preferential basis to a non-promoter group. While the strategic initiative aims to enhance the capital structure, a final decision on the preferential issuance was deferred during the session.

Q&A Focal Points & Management Response

During the investor interactions regarding the third-quarter results, corporate participants including Jiggar L. Savla, Whole-time Director, and Ashwin S. Shetty, Vice President and Company Secretary, addressed the following:

- Margin Pressures: Management attributed the 26 basis point contraction in EBITDA margins to higher employee costs, which rose 10.1% sequentially, and elevated interest expenses related to expansion debt.

- Geographic Expansion: Directors confirmed that the UAE subsidiary is being utilized as a hub for expanding market penetration into Africa and Europe.

- Capital Efficiency: Management highlighted an improvement in the half-yearly Return on Capital Employed (ROCE) to 14.12%, responding to queries regarding the effective use of capital following recent acquisitions.

- Inventory Disclosure: In response to a subsequent clarification on February 17, the company identified and corrected a ₹60.77 lakh inventory mismatch caused by a formula error in internal Excel workings.

Guidance & Outlook

What to watch for:

- Stabilization of operating margins in the architectural glass segment following the integration of Glasstech.

- Final regulatory approvals and member votes regarding the proposed preferential equity issuance.

- The impact of the New Labor Codes on manufacturing overheads.

Performance Summary

Sejal Glass Limited saw its stock move down 3.78% today. The company’s quarterly results showed a 63.9% revenue increase and a 49.1% rise in net profit. The nine-month trend remains positive with sustained top-line growth.