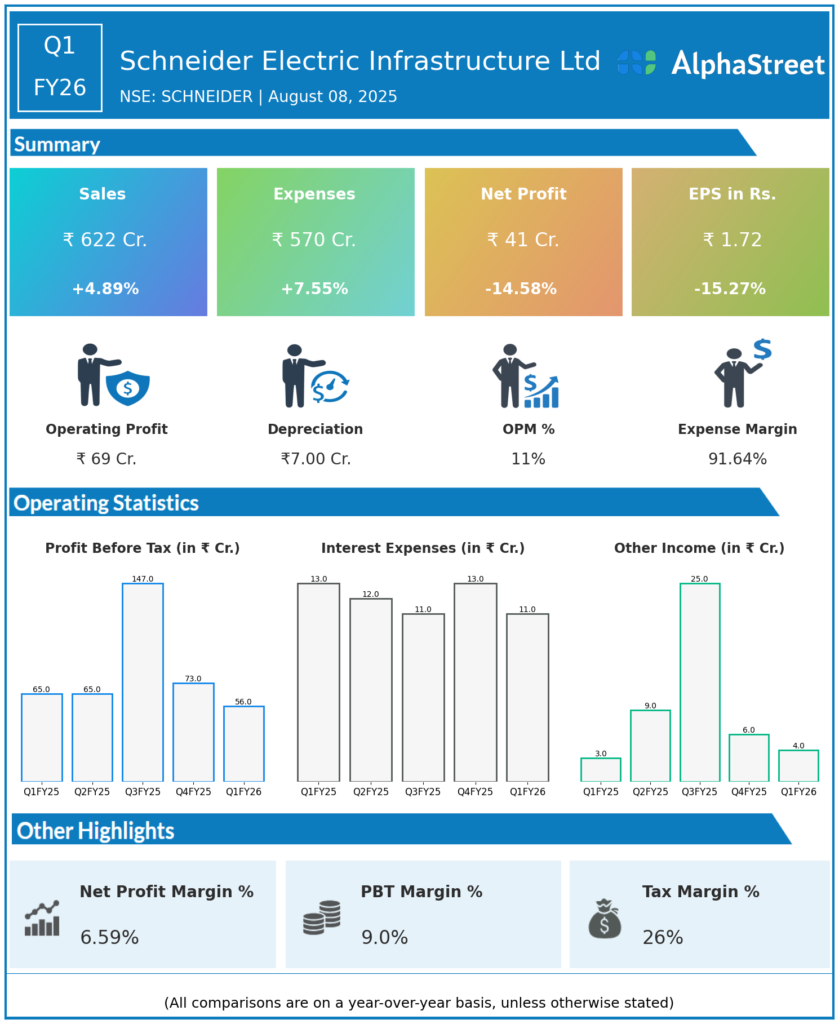

Schneider Electric Infrastructure Limited, incorporated in 2011, is engaged in the business of manufacturing, designing, building and servicing technologically advanced products and systems for the electricity network. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Net Profit (PAT): ₹41.24 crore, down 15% year-over-year (YoY) from ₹48.48 crore in Q1 FY25.

-

Total Revenue: ₹622 crore, up 5% YoY versus ₹595.5 crore last year.

-

EBITDA (Operating Profit): ₹69.3 crore, down 15% YoY (Q1 FY25: ₹81.7 crore). EBITDA margin dropped sharply to 11.2% from 13.8% YoY—its lowest in five quarters.

-

Earnings per Share (Basic EPS): ₹1.72 versus ₹2.03 in Q1 FY25.

-

Expenses: Rose 7.5% YoY to ₹570 crore as project costs and input prices increased, putting pressure on margins.

-

Order Book: Orders surged 42% to ₹910 crore in the quarter, with total backlog rising 26% YoY to about ₹1,635 crore, reflecting robust underlying demand in the infrastructure and energy sectors.

Key Management Commentary & Strategic Highlights

-

The company acknowledged the sharp profit decline and margin compression, attributing it to higher operating costs, delayed project execution, and elevated input prices.

-

Management noted strong order inflows, especially in its core verticals (electrification, grid modernization, energy management, and data centers), signaling recovery potential in coming quarters.

-

Focus areas include expanding capacity, investing in digitalization and green technology, and leveraging the large order book for multi-year revenue visibility.

-

Schneider Electric’s global parent reaffirmed the strategic focus on India, citing the region’s importance for innovation, supply chain, and R&D initiatives.

-

Despite regulatory and execution headwinds, the outlook remains positive, driven by growing investments in smart grids, renewables, AI, and digital energy.

Q4 FY25 Earnings Results

-

Net Profit (PAT): ₹54.6 crore, up by more than 1000% on the YoY basis.

-

Total Revenue: ₹587 crore, up by 24% as compared to the previous year.

-

EBITDA Margin: ~14.5% (higher than in Q1 FY26).

-

EPS: ₹2.28 vs 0.14 as compared to the previous year earnings during the same quarter,

-

The quarter was stronger sequentially, but Q1 FY26 saw a reversal in profitability due to cost-side challenges.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.