Schaeffler India Ltd is engaged in the development, manufacturing and distribution of high-precision roller and ball bearings, engine systems and transmission components, chassis applications, clutch systems and related machine building manufacturing activities.

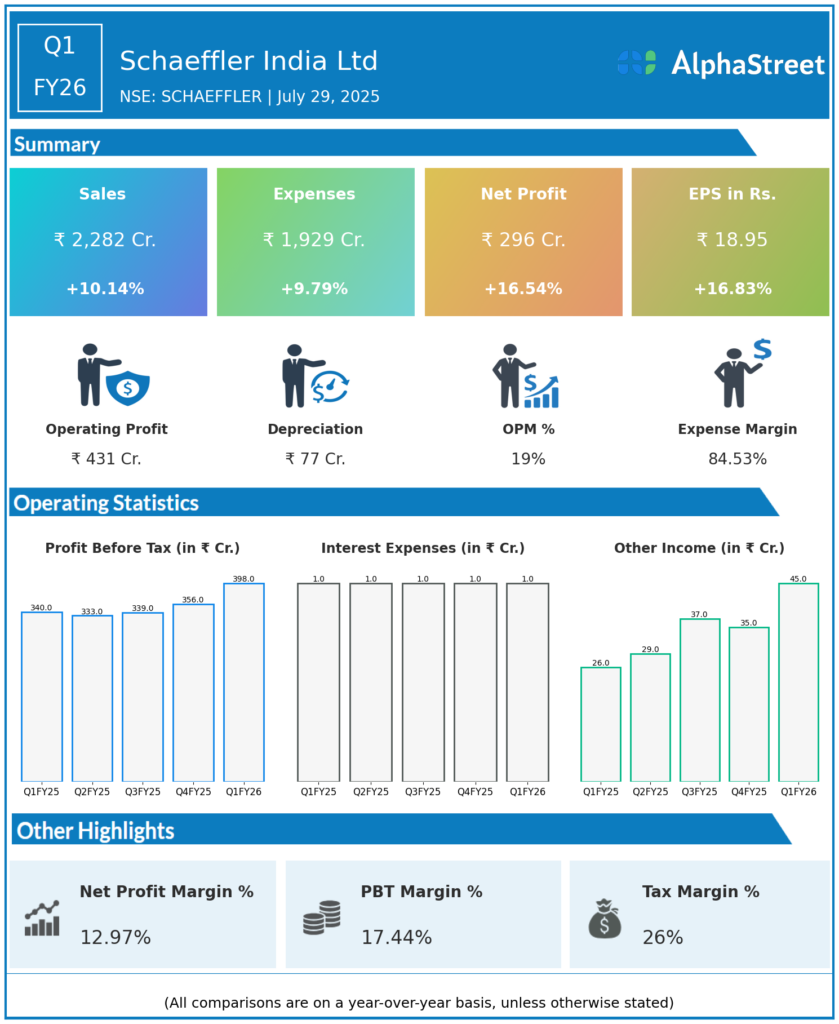

Q1 FY26 Earnings Summary (Jan–Mar 2025)

-

Revenue from Operations: ₹2,282 crore, up 10.1% YoY and 1.3% QoQ.

-

Net Profit (PAT): ₹296 crore, up 17% YoY from ₹254 crore in Q1 FY25.

-

EBITDA: ₹429 crore, up around 14% YoY.

-

EBITDA Margin: Improved to 18.25% from 17.8%.

-

PBT (before exceptional items): ₹356 crore, 16.4% higher YoY with a margin at 16.9% versus 16.5% YoY.

-

Strong revenue growth across all businesses with sustained double-digit growth for five consecutive quarters.

-

Quality of earnings improved owing to efficiency measures and strategic focus on localization.

Key Management & Strategic Decisions

-

Focus on volume expansion, operational efficiencies, and increased localization to improve profitability.

-

Continued investment in capacity, R&D, and operational excellence to sustain growth momentum.

-

Management highlighted improving financial and operating metrics, reinforcing their growth trajectory.

-

Sustained double-digit revenue growth with margin enhancement reflects execution on strategic priorities.

-

Ongoing efforts to enhance value creation through cost control and market expansion in automotive and industrial segments.

Q4 FY25 Earnings Summary (Oct–Dec 2024)

-

Revenue from Operations: ₹2,110 crore, slightly up about 1.3% QoQ.

-

Net Profit (PAT): Around ₹252 crore, up approximately 14.5% YoY from ₹220 crore.

-

EBITDA: ₹393 crore, up 19.1% YoY.

-

EBITDA Margin: Improved to 18.15% from 17.6% YoY.

-

PBT Margin: Around 16.3%.

-

The quarter saw continued double-digit growth momentum with improved earnings quality, driven by operational efficiency and volume growth of localized products.