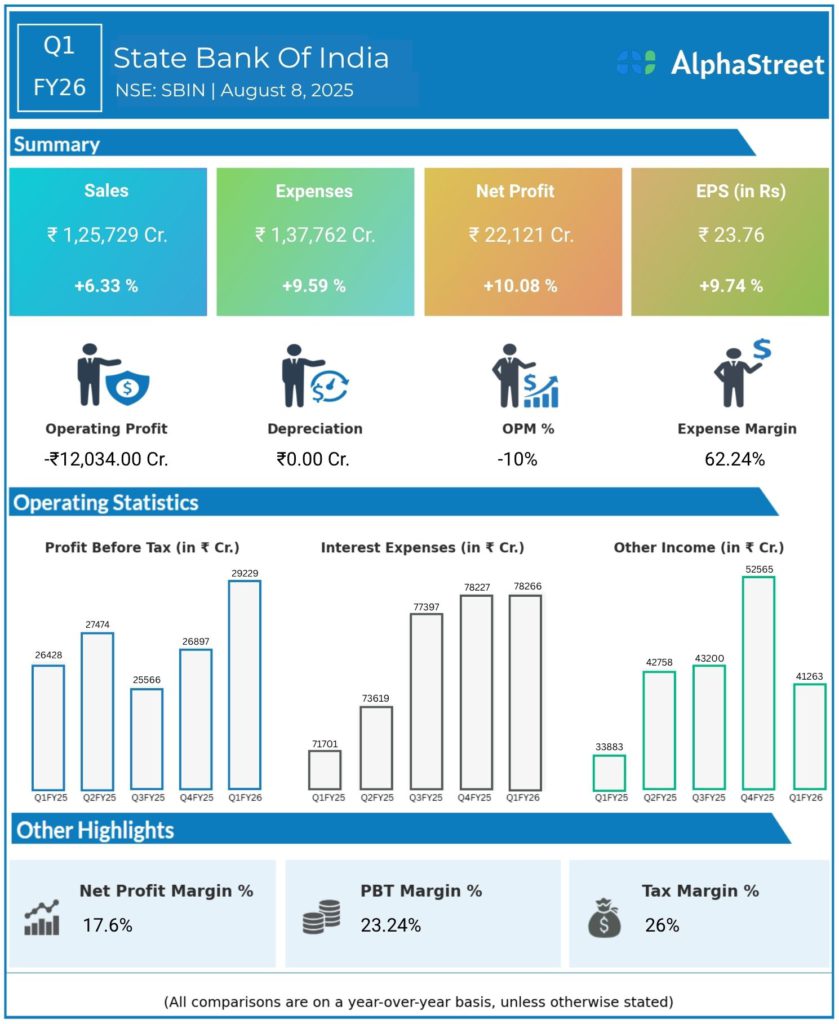

State Bank of India is a Fortune 500 company. It is an Indian Multinational, Public Sector banking and financial services statutory body headquartered in Mumbai. It is the largest and oldest bank in India with over 200 years of history. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Net Profit (PAT): ₹22,121 crore, up 10% year-over-year (YoY) from ₹20,094 crore in Q1 FY25.

-

Interest Income: ₹1,25,729 crore, up 6.33% YoY.

-

Net Interest Income (NII): ₹41,072 crore, marginally down 0.13% YoY amid higher interest expenses.

-

Net Interest Margin (NIM): 2.90% for the whole bank (down 32–33 basis points YoY); domestic NIM at 3.02%.

-

Operating Profit: ₹30,544 crore, up 15.5% YoY.

-

Return on Assets (ROA): 1.14%; Return on Equity (ROE): 19.7% for the quarter.

-

Gross Advances: ₹42.54 lakh crore (up 11.6% YoY); whole bank credit growth robust, led by retail, SME (up 19%), and agriculture.

-

Deposit Growth: Not explicitly stated, but CASA ratio at 39.36% (down 134 bps YoY).

-

Asset Quality:

-

Gross NPA Ratio: 1.83% (improved by 38 bps YoY, stable QoQ)

-

Net NPA Ratio: 0.47% (improved 10 bps YoY)

-

Provision Coverage Ratio: 74.5%

-

Slippage Ratio: 0.75%

-

-

Capital Adequacy Ratio (CAR): 14.63% (up 77 bps YoY).

Segment Growth Highlights

-

Retail Personal Advances: Up 12.6%; SME: Up 19%; Corporate Book: Up 5.7%; Agriculture: Up 12.7% YoY.

-

Asset quality improved with NPAs at their lowest ever levels.

Key Management Commentary & Strategic Highlights

-

Management highlighted another quarter of double-digit profit growth, controlled expenses, and strong asset quality improvement even as NII and margins declined marginally due to higher cost of liabilities.

-

Chairman and CEO committed to maintaining ROA above 1% and ROE above 15% for FY26, despite ongoing margin compression from possible rate cycle changes and higher deposit costs.

-

Business Focus: Management is prioritizing risk-adjusted growth, operating efficiency, robust retail and SME lending, and more tech-driven product offerings.

-

Resilient Fundamentals: Capital buffers remain strong; the bank continues to optimize cost-to-income ratio, improve underwriting, and strengthen collections.

-

Outlook: SBI expects profitability momentum to sustain, aided by healthier advances growth, focus on digital and granular deposits, and ongoing cost discipline.

Q4 FY25 Earnings Results

-

Net Profit (PAT): ₹18,643 crore, down 10% YoY (due to higher base, one-offs in previous year).

-

Net Interest Income (NII): ₹42,775 crore, up 2.7% YoY.

-

Operating Profit (Q4): ₹31,286 crore (+8.8% YoY).

-

Gross NPA Ratio: 1.82%; Net NPA: 0.47%.

-

Dividend: ₹15.90 per share declared for FY25.

-

ROA: 1.10%; ROE: 19.87% for full FY25.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.