SBI Life Insurance Company Ltd. (NSE: SBILIFE) on Wednesday reported a 5% rise in its third-quarter net profit, as a surge in premium collections and recent tax exemptions on individual policies offset a sharp increase in management expenses.

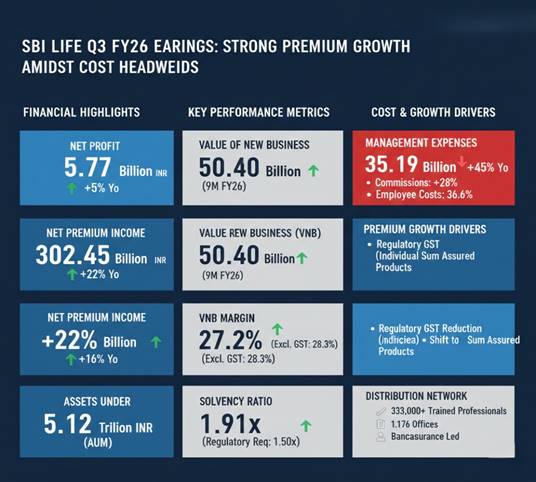

The Indian private life insurer posted a net profit of INR 5.77 billion ($62.87 million) for the quarter ended Dec. 31, 2025, compared with INR 5.51 billion in the same period a year earlier. While the bottom line showed steady growth, it narrowly missed some analyst estimates of INR 6.06 billion, according to LSEG data.

PREMIUM GROWTH SURGES

Net premium income for the quarter jumped 22% to INR 302.45 billion. This growth was underpinned by a 23% rise in first-year premiums and a 21% increase in renewal premiums, reflecting both strong new customer acquisition and steady retention of existing policyholders.

Analysts attributed the robust demand to a recent regulatory shift in India, where the Goods and Services Tax (GST) on individual life insurance policies was reduced from 18% to zero. This move significantly improved affordability, aiding volume growth during the October-December period.

“The life insurance industry witnessed improved momentum during the third quarter, supported by recent regulatory measures and a gradual shift in customer preference toward higher sum assured products,” Managing Director and CEO, Amit Jhingran said in a statement.

COST PRESSURES AND MARGINS

Despite the revenue momentum, SBI Life faced significant cost headwinds. Management expenses for the quarter escalated by more than 45% to INR 35.19 billion. This spike was driven by a 28% increase in commissions and a 36.6% rise in employee-related expenses. Additionally, the company recognized a one-time incremental charge of INR 1.35 billion due to the implementation of new labor codes in India.

Key profitability metrics remained resilient:

- Value of New Business (VNB): For the nine-month period ended Dec. 31, VNB rose 17% to INR 50.40 billion.

- VNB Margin: The margin stood at 27.2%, up from 26.9% a year ago. Management noted that excluding the impact of GST adjustments, the margin would have reached 28.3%.

- Solvency Ratio: The company maintained a healthy solvency ratio of 1.91, comfortably above the regulatory requirement of 1.50.

| Financial Metric (Q3 FY26) | Amount (INR) | YoY Change |

| Net Profit | 5.77 Billion | +5% |

| Net Premium Income | 302.45 Billion | +22% |

| Assets Under Management | 5,117.1 Billion | +16% |

| Management Expenses | 35.19 Billion | +45% |

DISTRIBUTION AND ASSETS

SBI Life continued to leverage its vast bancassurance network, which remains the largest contributor to its business. As of December 2025, the company had a distribution footprint of over 353,000 trained professionals and 1,176 offices.

The insurer’s Assets Under Management (AUM) grew 16% year-on-year to INR 5.12 trillion. Its investment portfolio remains conservatively positioned with a debt-equity mix of 59:41, with approximately 95% of debt investments held in AAA-rated or sovereign instruments.

“The growth was primarily volume-driven, supported by an increase in the number of individual policies sold,” Jhingran added, noting that the product mix remains balanced across ULIPs, participating, and non-participating savings products.

Shares of SBI Life ended 0.8% higher at INR 2,055 on the Bombay Stock Exchange following the results announcement.