Sarthak Metals Ltd (NSE: SMLT) is set to release its financial results for the first quarter of FY25. This comes after a challenging Q4FY24, where the company reported a 13% decline in revenue year-on-year. Investors are keenly watching how the company will navigate through its diversified portfolio, especially with its recent expansion into the biotechnology sector.

Q4FY24 Recap:

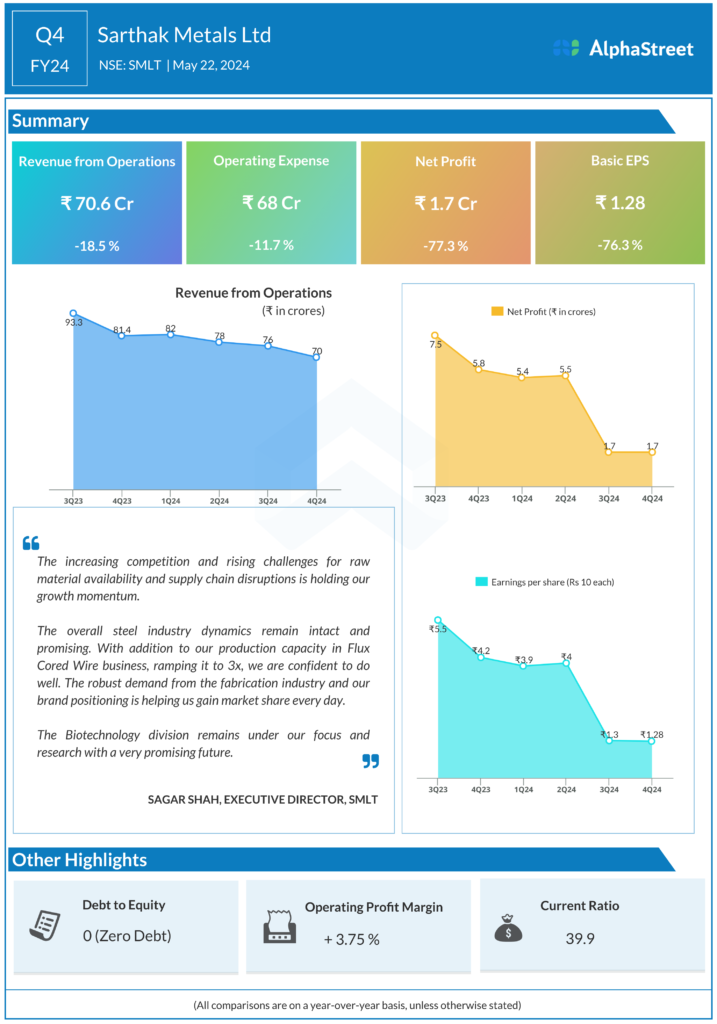

In the previous quarter, Sarthak Metals Ltd reported a significant decrease in revenue, falling from ₹80.82 Crore in Q4FY23 to ₹70.65 Crore in Q4FY24, marking a 12.58% year-on-year decline. The total expenses also saw a reduction, though not as steep, dropping by 6.44% from ₹73.62 Crores to ₹68.88 Crores. The most notable impact was on the company’s net profit, which plunged by 70.07%, down to ₹1.73 Crores from ₹5.78 Crores in the same quarter of the previous year. This resulted in a sharp decline in EPS, which fell to ₹1.26 from ₹4.22 same quarter of the previous year.

Key Factors for Q1FY25:

1. Revenue Trends: The Investors will be closely monitoring whether Sarthak Metals can reverse the revenue decline experienced in Q4FY24. The company’s ability to stabilize or grow its revenue will be crucial, especially considering the challenging macroeconomic environment and competitive pressures in the steel industry.

2. Profitability Metrics: With a significant drop in net profit last quarter, investors will focus on the company’s margins and cost-control measures. The extent to which Sarthak Metals can manage its expenses while maintaining operational efficiency will be a key determinant of its profitability in Q1FY25.

3. Biotechnology Venture: Sarthak Metals’ recent foray into the biotechnology sector, particularly in industrial enzymes, micronutrients, and prebiotics and probiotics, will be of particular interest. Any updates on the progress of this diversification strategy, including revenue contributions or advancements in research and development, could influence investor sentiment.

4. Steel Industry Dynamics: Given Sarthak Metals’ core business in manufacturing cored wires, aluminum wire rods, and wire feeder machines for steel plants, the overall health of the steel industry will play a critical role in its performance. Fluctuations in steel demand, raw material costs, and global trade dynamics could impact the company’s revenue and profitability in this segment.

5. Guidance and Outlook: Investors will be eager to hear the management’s outlook for the remainder of FY25. Any guidance on revenue expectations, margin trends, and capital expenditure plans, particularly in relation to the biotechnology venture, will be crucial in shaping market expectations.

Conclusion:

Sarthak Metals Ltd’s Q1FY25 earnings report is expected to provide valuable insights into the company’s ability to navigate through a challenging environment while capitalizing on its diversification into biotechnology. Investors will be watching closely to assess whether the company can stabilize its core business and leverage its new ventures to drive future growth.

Sarthak Metals Ltd is scheduled to announce its Q1 FY25 results on August 13, 2024.