Company Overview:

Sarthak Metals Ltd (NSE: SMLT) is set to release its Q2FY25 financial results. This follows a challenging Q1FY25, where the company reported a substantial year-on-year decline in both revenue and profitability. Investors are closely watching to see how Sarthak Metals navigates a difficult steel market while continuing its strategic initiatives.

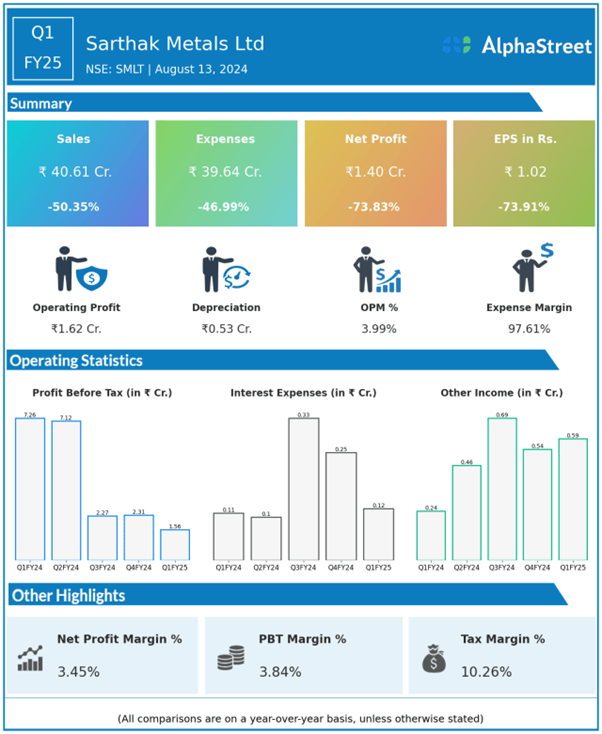

Q1FY25 Recap:

In Q1FY25, Sarthak Metals Ltd experienced a drop in revenue, decreasing from ₹81.80 Crore in Q1FY24 to ₹40.61 Crores, marking a 50.35% year-on-year decline. This decline reflects the challenges facing the steel industry, where reduced demand has impacted the company’s core business of cored wires and related products. Total expenses also saw a reduction, decreasing by 46.99% to ₹39.64 Crore from ₹74.78 Crore in Q1FY24, as the company implemented cost-saving measures. However, the decline in expenses was not enough to offset the revenue drop, leading to a significant impact on profitability, with net profit falling by 73.83% to ₹1.40 Crore, down from ₹5.35 Crore in Q1FY24. EPS also declined sharply to ₹1.02 from ₹3.91 in the same quarter previous year.

Key Factors for Q2FY25:

- Sectoral Performance in Steel:

Given that Sarthak Metals’ primary business caters to the steel industry, sector health will play a critical role in this quarter’s performance. Any shifts in steel demand, fluctuations in raw material costs, or changes in the regulatory environment could influence the company’s performance and prospects. - Update on Strategic Initiatives:

While the company’s core business remains its primary revenue driver, any updates on diversification or operational efficiencies will be of interest to investors. Signals of new projects or partnerships could positively influence investor sentiment, especially as the company navigates the fluctuating steel market. - Outlook and Guidance:

The management’s outlook for H2FY25, including revenue targets, margin expectations, and capital expenditure plans, will be essential in shaping investor expectations. Insights into the company’s strategic priorities will be crucial for understanding Sarthak Metals’ plans to navigate current challenges and prepare for future growth.

Result Day:

Sarthak Metals Ltd is scheduled to announce its Q2FY25 results on November 13, 2024.