Business Overview:

Sarthak Metals Ltd. (SMLT), established in 1995 and part of the Desraj Bansal Group, has evolved into one of India’s premier manufacturers of cored wires, aluminum wire rods, flux-cored wires, and wire feeder machines. These products are critical inputs for steel plants and foundries, supporting metallurgical processes across the country’s rapidly expanding infrastructure and manufacturing sectors. SMLT’s strategic location near major steel hubs allows it to optimize logistics and maintain close relationships with its core clientele, which includes some of the largest steel producers in India. The company commands a 20–30% share of India’s consolidated cored wire market, and its focus on reliability and technological innovation has helped it consolidate its position as a preferred supplier. SMLT’s management has demonstrated agility by leveraging stable cash flows from its core business to fund diversification into new, high-growth segments such as welding consumables and industrial biotech, thereby building a reinvestment moat and derisking its business model from the inherent cyclicality of the steel sector.

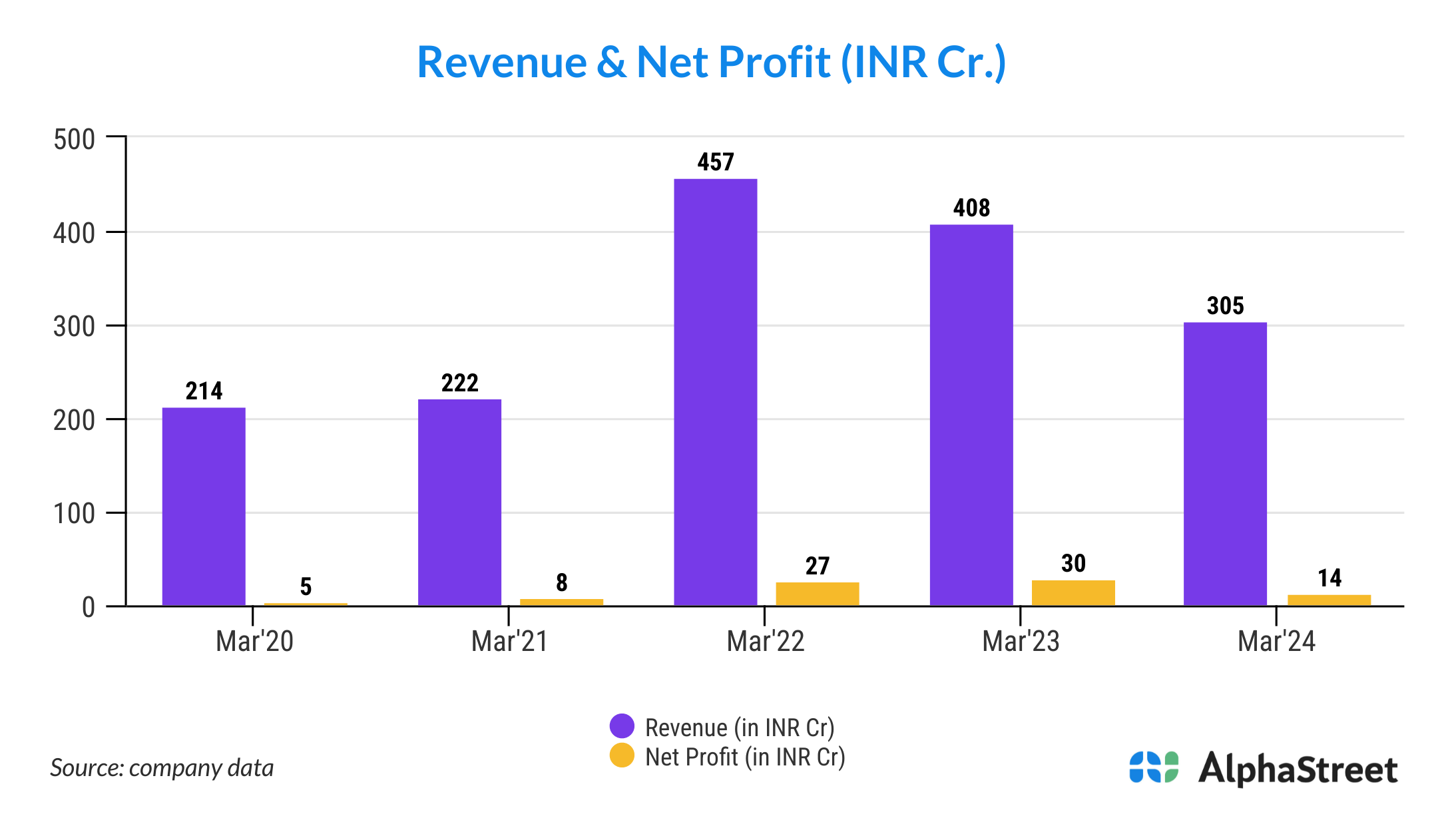

Financial Performance:

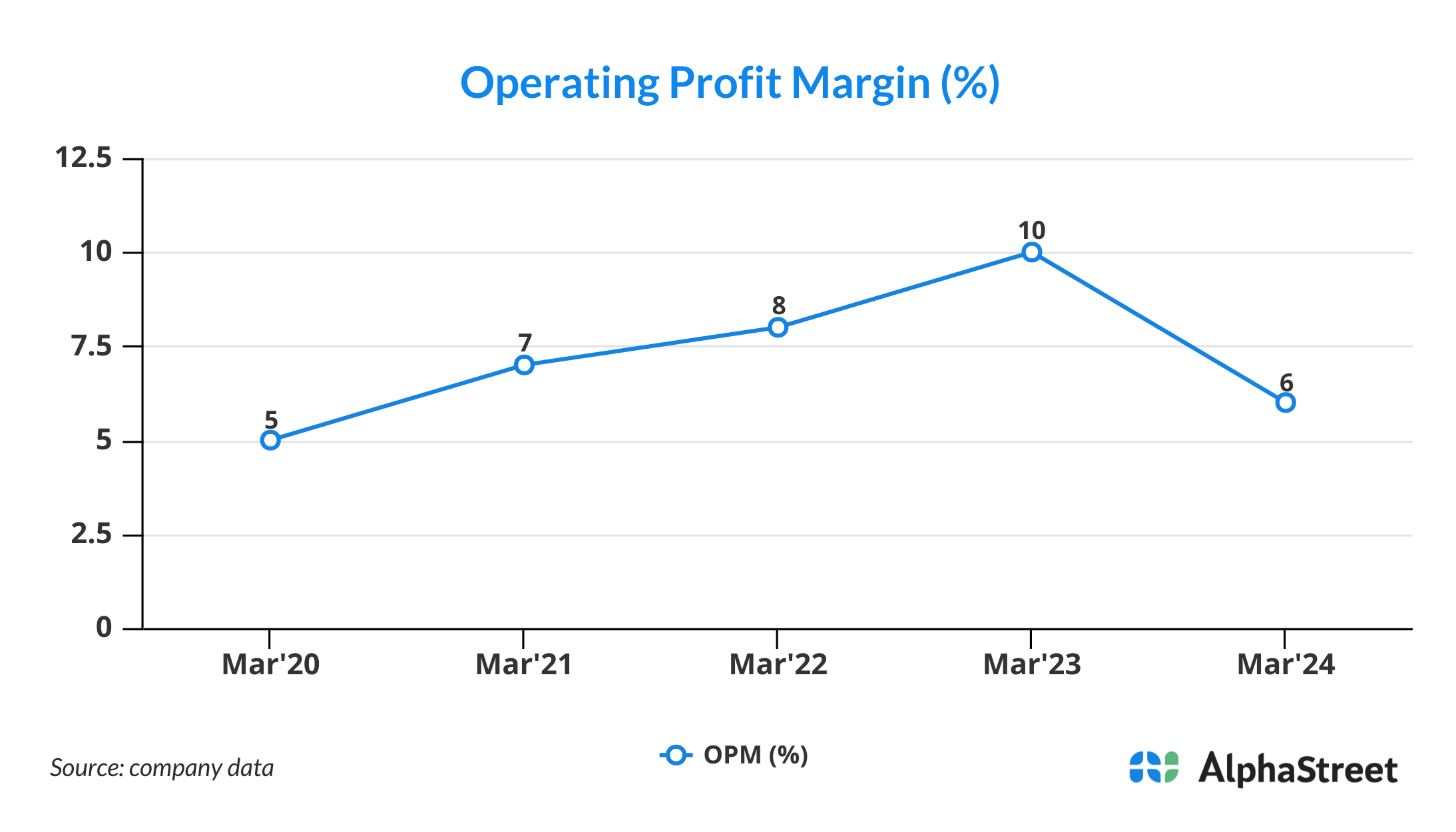

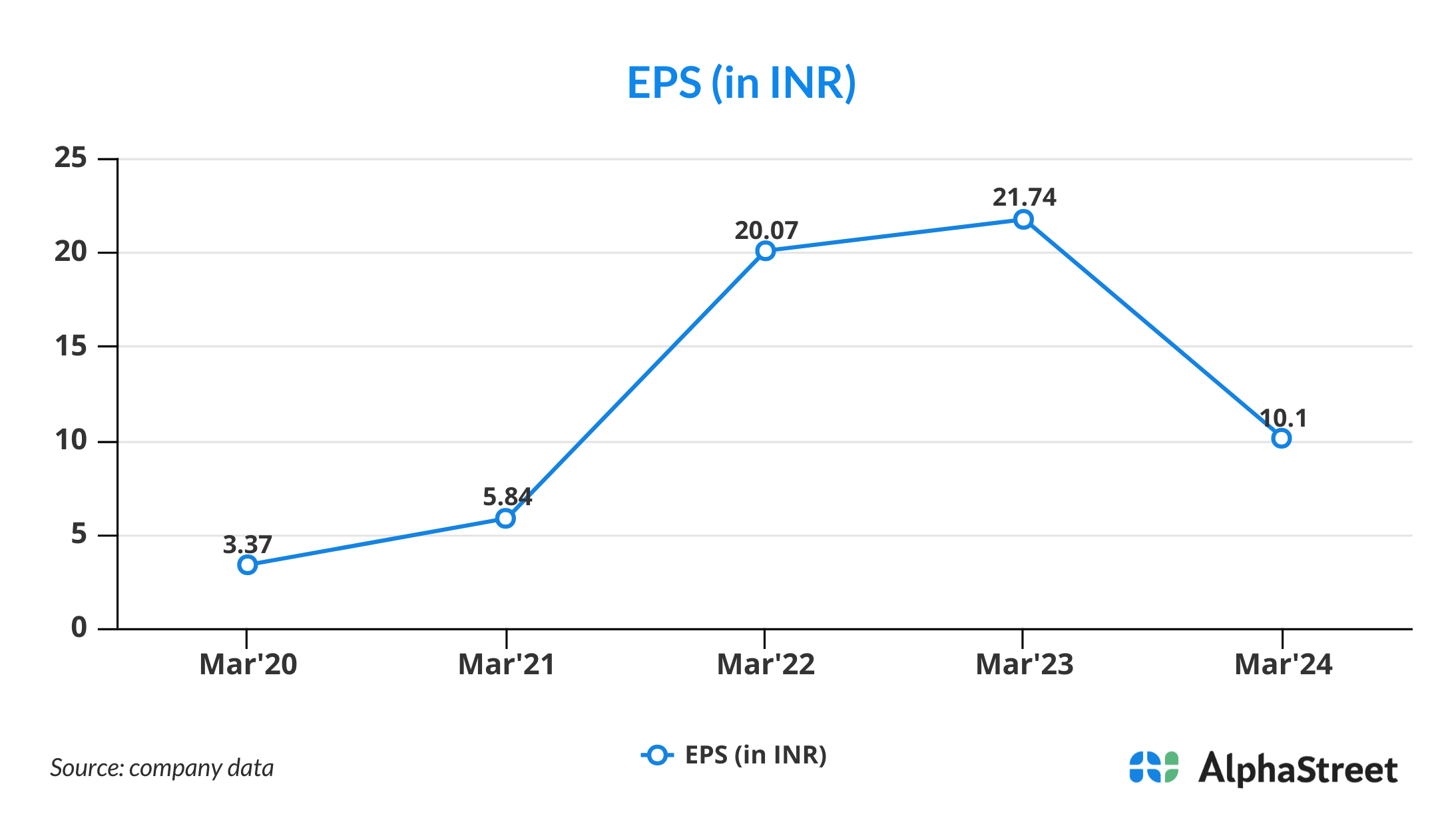

Sarthak Metals’ financial performance in Q3 FY25 reflects both the challenges of a cyclical steel industry and the company’s proactive restructuring efforts. The company reported revenue of ₹44.47 crore for the quarter, down 41.5% year-on-year and 4.3% sequentially, primarily due to the strategic exit from the unprofitable aluminum flipping coil business. Despite this revenue contraction, SMLT’s profitability metrics improved, with EBITDA rising 6% quarter-on-quarter to ₹2.06 crore and margins expanding to 4.67%, up from 4.24% in the previous quarter. Net profit (PAT) for Q3 FY25 was ₹1.22 crore, representing a 47% sequential increase, although it was 29% lower year-on-year due to the overall revenue decline. The company’s cost optimization initiatives, especially in material sourcing and operational expenses, have contributed to this margin expansion. For the nine months ended December 2024, SMLT posted revenue of ₹130.34 crore and a PAT of ₹2.52 crore, both reflecting the impact of business rationalization. Importantly, SMLT remains debt-free with cash reserves of ₹27 crore, providing ample liquidity and financial flexibility to invest in new growth avenues and weather industry downturns.

| Metric | Q3 FY25 | Q2 FY25 | Q3 FY24 | YoY Change | QoQ Change |

| Revenue (₹ Cr) | 44.47 | 45.72 | 75.98 | -41.5% | -4.3% |

| EBITDA (₹ Cr) | 2.06 | 1.94 | 3.58 | -42.4% | +6.2% |

| EBITDA Margin (%) | 4.67 | 4.24 | 4.71 | -4 bps | +43 bps |

| PAT (₹ Cr) | 1.22 | 0.83 | 1.73 | -29.5% | +47% |

| PAT Margin (%) | 2.74 | 1.81 | 2.27 | +47 bps | +93 bps |

| EPS (₹) | 0.92 | 0.61 | 1.27 | -28% | +51% |

Sarthak Metals’ balance sheet is a testament to its prudent financial management and conservative capital structure. As of December 31, 2024, the company reported total assets of ₹127.6 crore and a net worth of ₹119.5 crore, reflecting consistent value creation for shareholders. The company’s liquidity position remains robust, with cash and equivalents totaling ₹27 crore and zero debt on the books, resulting in negligible finance costs. This strong cash position is particularly notable given the company’s ongoing investments in capacity expansion and diversification. During the quarter, SMLT invested ₹17.73 crore in property, plant, and equipment, primarily to enhance cored wire production capacity and support the welding consumables business. Working capital management remains a focus, with trade receivables at ₹46.6 crore and inventories at ₹28 crore, both higher than the previous year due to the transition in business mix.

Segmental Analysis:

The core cored wire business remains the backbone of Sarthak Metals, accounting for approximately 70% of current revenues. In Q3 FY25, cored wire revenue grew 11% year-on-year to ₹31 crore, with volumes rising 15% to 1,216 tonnes, even as realizations dipped 4% to ₹2.55 lakh per metric tonne. This volume growth, despite a challenging market, underscores SMLT’s increasing market share and the resilience of its core operations. The aluminum flipping coil segment, once a significant contributor, saw revenues collapse by 75% to ₹9 crore and volumes drop 80% to 350 tonnes, as the company scaled back operations in response to global margin pressures and volatile scrap prices. However, price realizations in this segment improved by 25% year-on-year due to a shift to domestic sourcing. The welding consumables division, a recent addition, achieved revenues of ₹1.6 crore in Q3 FY25, with volumes up 15% quarter-on-quarter. With an annual production capacity of 2,500–3,000 tonnes and plans to reach ₹25 crore in annual sales within two years, this segment is poised to become a significant growth driver. The company’s foray into industrial biotech, though still in the pilot phase, represents a strategic bet on long-term, high-margin opportunities in the bioethanol and health supplement markets.

Industry Outlook:

The macroeconomic environment for Sarthak Metals remains challenging but not without opportunities. The steel sector, to which SMLT is closely linked, is experiencing a cyclical downturn, with India’s GDP growth projected at 6.4% for FY25-the lowest in four years. This slowdown, combined with a surge in Chinese steel imports (at a seven-year high), has reduced the market share of domestic steelmakers and pushed industry capacity utilization to a four-year low of 78%. However, the Indian government’s substantial capex allocation of ₹11.2 lakh crore in Budget 2025, representing a 10% increase over the previous year, is expected to stimulate infrastructure development and drive domestic steel demand. Additionally, industry consolidation and the closure of smaller players have strengthened the position of established companies like SMLT. The welding consumables and flux-cored wire markets are projected to grow rapidly, fueled by infrastructure, fabrication, and shipbuilding activity. SMLT’s entry into the industrial enzymes sector aligns with broader trends towards sustainability and biofuel adoption, offering a hedge against the cyclicality of its traditional markets and positioning the company for long-term growth.

Strategic Initiatives and Growth Drivers

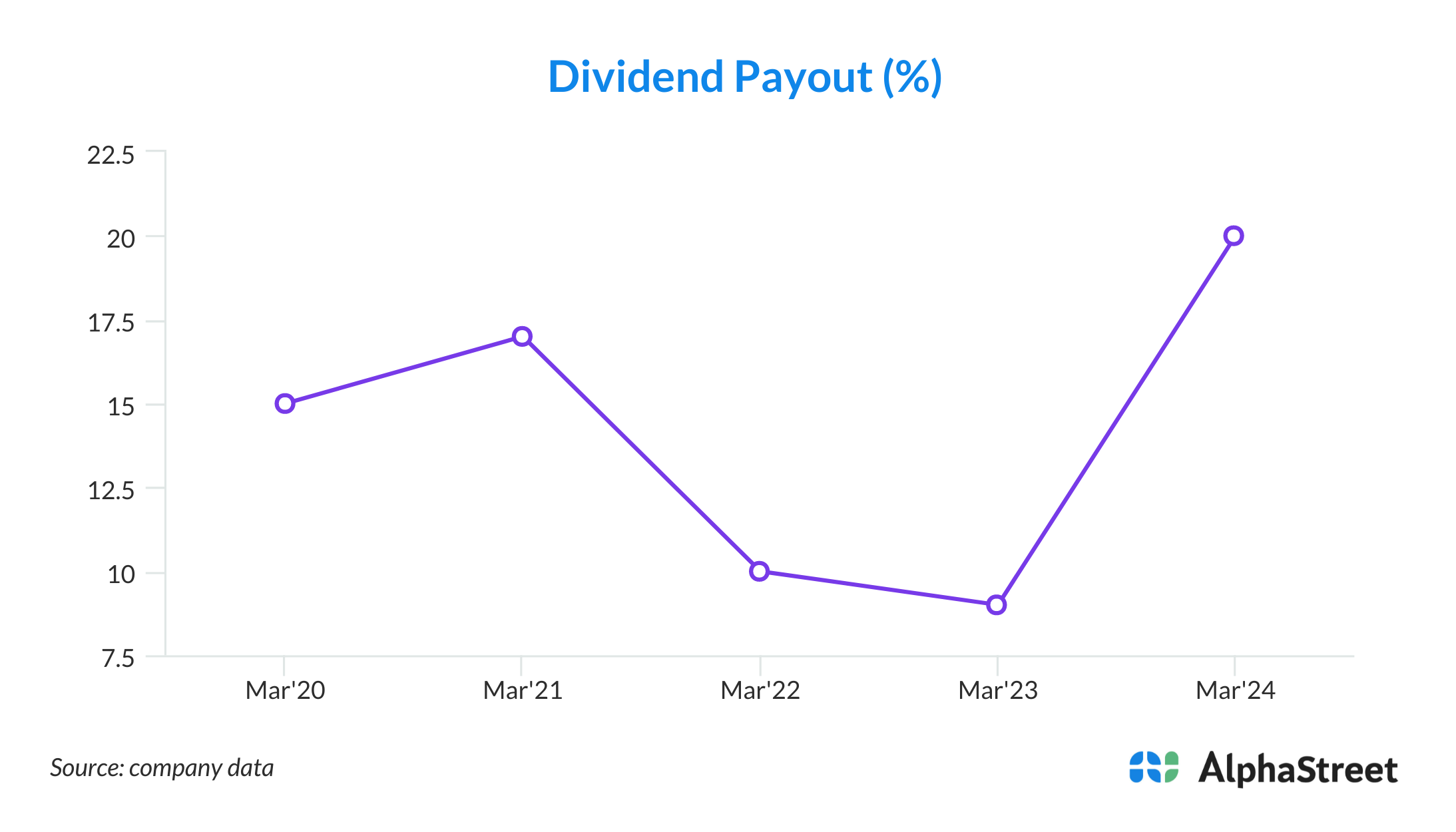

Sarthak Metals’ management has articulated a clear and multi-pronged growth strategy aimed at mitigating the risks of its cyclical core business and unlocking new opportunities. The company’s decision to exit the unprofitable aluminum flipping coil segment and focus resources on higher-margin cored wires and welding consumables reflects a disciplined approach to capital allocation. SMLT has invested heavily in expanding its cored wire and welding consumables capacity, with in-house design and fabrication capabilities providing a sustainable competitive advantage. The company is also aggressively building its distribution network for welding products and has achieved BIS certification for its flux-cored wires, enhancing its credibility in the market. On the diversification front, SMLT’s partnership with CSIR for industrial enzyme development gives it access to cutting-edge microbial cultures and R&D expertise, positioning it at the forefront of the bioethanol and biogas sectors. The company’s state-of-the-art fermentation facility, currently in the pilot phase, is designed to support both proprietary product development and contract manufacturing (CDMO) opportunities. This dual focus on investment-driven and consumption-driven sectors is expected to deliver sustained growth and stability to the business.

Risks, Challenges, and Mitigation Strategies

Despite its strengths, Sarthak Metals faces several risks that warrant close monitoring. The company’s core business remains exposed to the cyclicality of the steel sector, with demand and pricing sensitive to macroeconomic trends, global trade policies, and commodity price volatility-particularly in aluminum and steel. The recent spike in aluminum scrap prices and disruptions in global supply chains have compressed margins across the industry, prompting SMLT to scale down operations rather than engage in unprofitable price competition. Execution risk is another concern, especially as the company scales up its welding consumables and biotech businesses, both of which require significant investment in distribution, R&D, and regulatory compliance. Export competition, particularly from Chinese manufacturers, remains a persistent threat, although SMLT’s focus on quality, reliability, and technological differentiation provides some insulation. Working capital management is also critical, given the increase in receivables and inventories during the business transition. The company’s strong cash reserves, debt-free status, and disciplined approach to capital allocation are key mitigants, providing a buffer against short-term shocks and enabling continued investment in growth initiatives.