Sapphire Foods is one of the largest franchisees of Yum! Brands Inc. in the subcontinent, and operates more than 400 KFC, Pizza Hut, and Taco Bell restaurants across India, Sri Lanka, and the Maldives. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

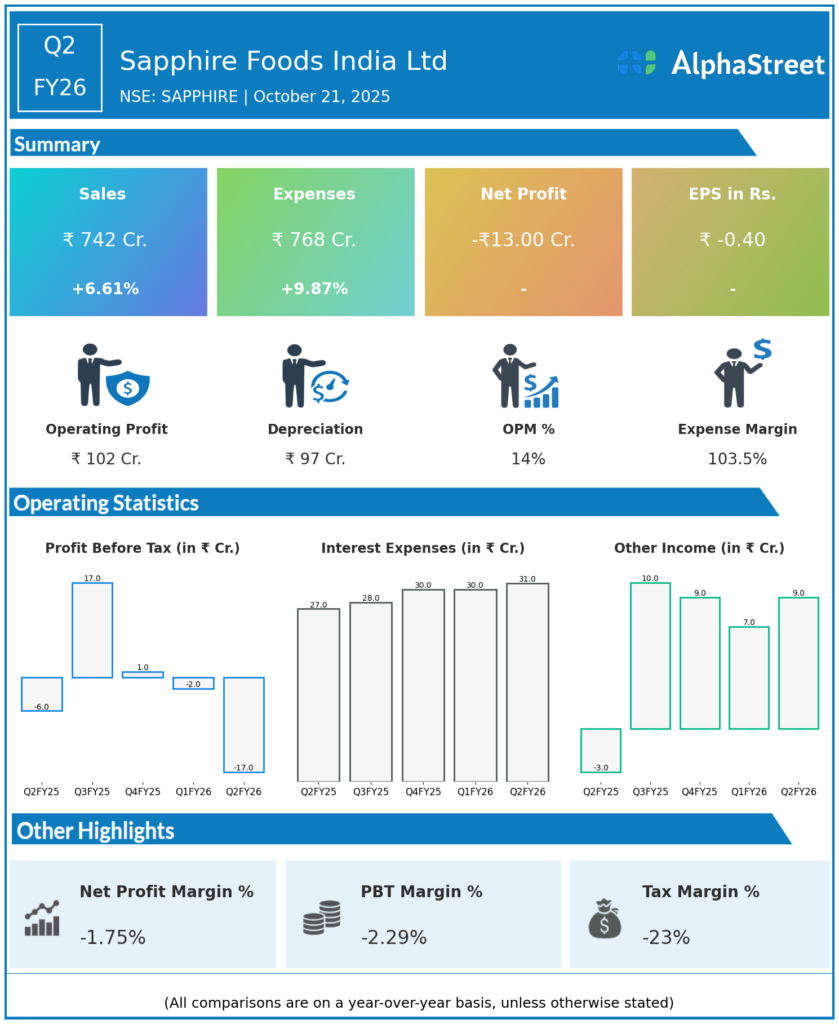

Total Income: ₹751.69 crore, up 6.75% YoY from ₹704.17 crore but down 4.07% QoQ from ₹783.61 crore in Q1 FY26.

-

Revenue from Restaurant Sales: ₹740.01 crore, up 6.6% YoY, driven by network expansion and KFC growth.

-

Net Loss: ₹12.78 crore, widening from a loss of ₹6.24 crore in Q2 FY25 and significantly higher than the ₹1.80 crore loss in Q1 FY26.

-

EBITDA: ₹106.16 crore, down 7.8% YoY from ₹115.2 crore; EBITDA margin compressed to 14.3% from 16.6% YoY.

-

Operating Profit: ₹102.10 crore, with operating margin at 13.75%, down 239 basis points YoY, representing the weakest margin since listing.

-

Pre-tax Loss: ₹16.58 crore vs ₹6.12 crore loss in Q2 FY25.

-

EPS: ₹-0.40 vs ₹-0.10 in Q2 FY25.

-

Employee Costs: ₹105.75 crore, increased from ₹102.33 crore in Q1 FY26.

-

Interest Expenses: ₹30.67 crore, impacting profitability.

-

Store Count: 997 total restaurants (529 KFC + 338 Pizza Hut in India; 119 Pizza Hut + 11 Taco Bell in Sri Lanka).

Operational Highlights

-

Store Expansion: Added 19 KFC restaurants, 2 Pizza Hut stores in India, and 1 Pizza Hut + 1 Taco Bell in Sri Lanka during Q2 FY26.

-

Same Store Sales Growth (SSSG): Trends remained similar to previous quarter for both KFC and Pizza Hut, except for negative impact on KFC due to Navratri festival shifting from Q3 FY25 to Q2 FY26.

-

Regional Performance: Sri Lanka business showed strong double-digit growth in local currency terms.

-

Market Position: Remains the largest international QSR chain in Sri Lanka by revenue and restaurant count.

Management Commentary & Challenges

-

The company faced operational stress due to rising employee costs, higher depreciation charges, and increased interest expenses.

-

Seasonal Impact: Navratri festival timing shift negatively affected KFC performance in Q2 FY26.

-

Margin Pressure: Operating margin compression reflects both revenue pressures and rising operational costs, creating severe profitability squeeze.

-

Focus Areas: Management continues to focus on store expansion, operational efficiency, and cost management to return to profitability.

Q1 FY26 Earnings Results

-

Total Income: ₹783.61 crore.

-

Net Loss: ₹1.80 crore.

-

EPS: ₹-0.06.

-

Sequential Improvement: Q1 showed better performance before Q2’s deterioration.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.