Sapphire Foods is one of the largest franchisees of Yum! Brands Inc. in the subcontinent, and operates more than 400 KFC, Pizza Hut, and Taco Bell restaurants across India, Sri Lanka, and the Maldives. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

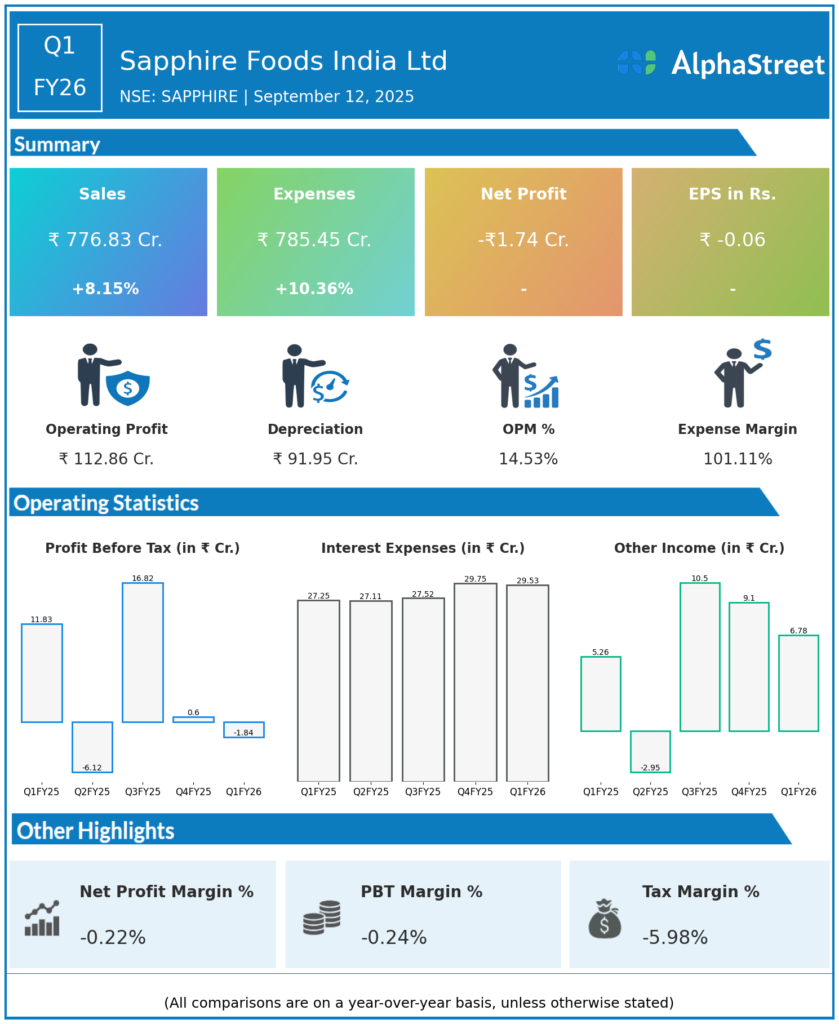

Total Income: ₹777 crores, up 21.7% QoQ and 8.1% YoY (Q4 FY25: ₹644.11 crores; Q1 FY25: ₹723.55 crores).

-

Total Expenses: ₹785.45 crores, up 22.1% QoQ and 10.3% YoY.

-

Profit Before Tax (PBT): Loss of ₹1.84 crores, compared to ₹0.84 crores profit in Q4 FY25 and ₹11.83 crores in Q1 FY25.

-

Profit After Tax (PAT): Loss of ₹1.74 crores, compared to profit of ₹2.04 crores in Q4 FY25 and ₹8.19 crores in Q1 FY25.

-

Earnings Per Share (EPS): ₹-0.06, down from ₹0.40 QoQ and ₹1.30 YoY.

-

Restaurant Sales: ₹774.8 crores, up 8% YoY; total restaurant count at 974 outlets.

-

Same Store Sales Growth (SSSG): KFC flat; Pizza Hut declined 5% YoY; Sri Lanka operations showed strong double-digit growth.

-

New Openings: Added 8 KFC, 2 Pizza Hut in India; 1 Pizza Hut in Sri Lanka this quarter.

-

EBITDA: ₹113.4 crores, down 9% YoY; EBITDA margin at approximately 14.6%.

Key Management Commentary & Strategic Highlights

-

Management highlighted improving revenue on the back of new restaurant openings and robust Sri Lanka market performance despite Q1 loss.

-

Challenges in Pizza Hut segment due to continued soft demand and competitive pressures have weighed on margins.

-

KFC segment showed steady sales and operational stability with flat SSSG, supported by higher value offerings.

-

Continued focus on cost management, brand strengthening, and digital transformation initiatives to enhance customer engagement and operational efficiency.

-

Management remains optimistic about volume and margin recovery as demand environment stabilizes and new initiatives yield results.

Q4 FY25 Earnings Results

-

Revenue: ₹711 crores

-

Net Profit: ₹2.02 crores

- EPS: ₹0.06 crores

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.