Sapphire Foods India Ltd (NSE: SAPPHIRE, BSE: 543397) shares closed at ₹213.00 on Friday, representing an intraday decline of 1.94%. The company, an operator of KFC and Pizza Hut restaurants, released its financial results for the quarter ended December 31, 2025, during market hours.

Market Capitalization

As of the market close on February 6, 2026, the market capitalization of Sapphire Foods India Ltd stood at ₹6,753.11 crore (approximately $814 million).

Latest Quarterly Results

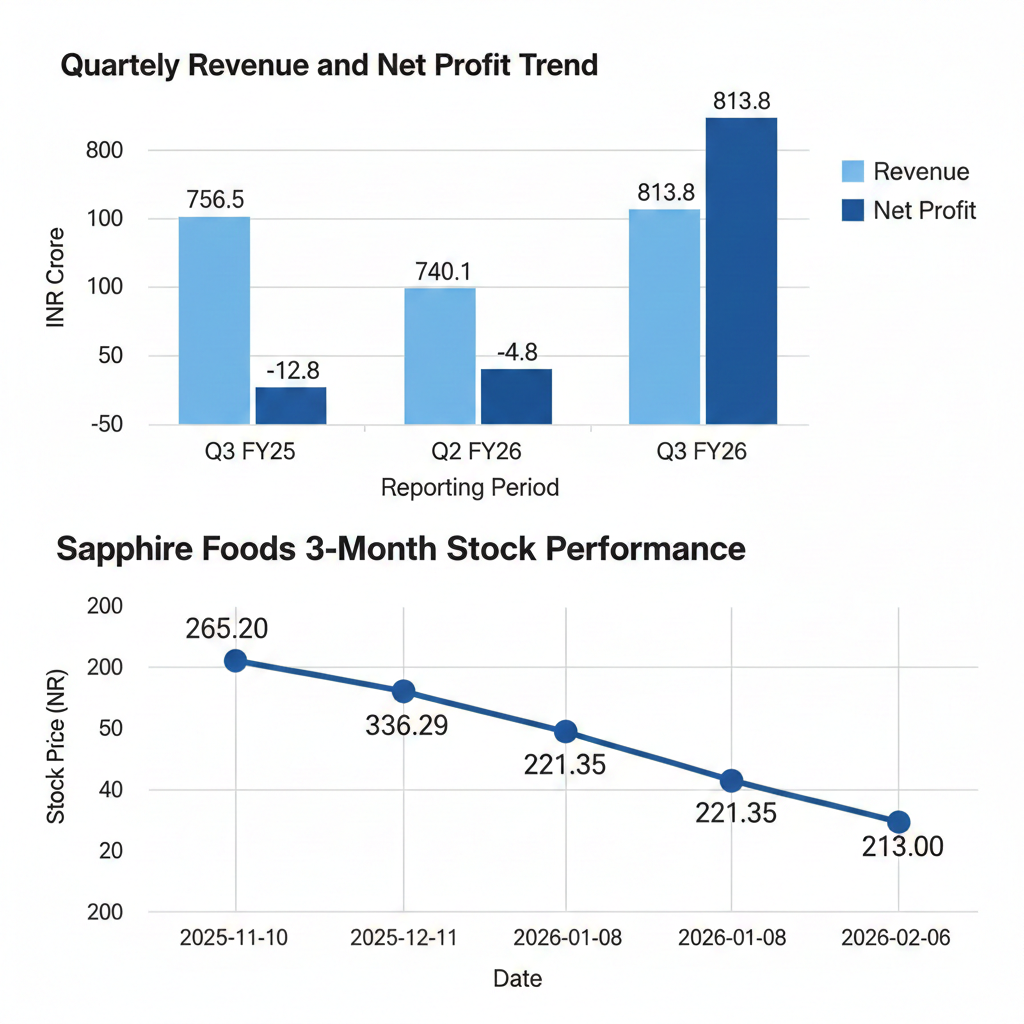

Sapphire Foods reported a consolidated net loss of ₹48.08 crore for the third quarter of fiscal year 2026. This compares to a net profit of ₹127.32 crore in the same period of the previous fiscal year. Consolidated revenue from operations increased 7.56% year-over-year to ₹8,138.29 crore, up from ₹7,565.37 crore.

Segment Highlights

- KFC India: Revenue grew 11% year-over-year. The segment recorded same-store sales growth (SSSG) of 1%. Restaurant EBITDA margin improved by 60 basis points to 18.8%.

- Pizza Hut India: Revenue declined 11% year-over-year, with a same-store sales decline of 12%. Restaurant EBITDA margins reached negative 3.1%.

- Sri Lanka: Revenue increased 15% in local currency terms, supported by an 11% SSSG. Restaurant EBITDA margins contracted by 110 basis points due to wage increases and weather-related disruptions.

Financial Trends

Nine-Year View

For the nine-month period ended December 31, 2025, consolidated revenue grew 7% to ₹23,330.94 crore. The company reported a nine-month net loss of ₹193.33 crore, compared to a profit of ₹146.80 crore in the prior-year period. Directional trends indicate sustained revenue growth alongside a contraction in net profitability.

Business & Operations Update

Sapphire Foods added 31 net new restaurants during the third quarter, including 27 KFC and one Pizza Hut outlet in India, and three Pizza Hut outlets in Sri Lanka. The total restaurant count reached 1,028 as of December 31, 2025. Profitability was impacted by exceptional items totaling ₹11.16 crore, which included employee benefit obligations related to new labor codes.

M&A or Strategic Moves

The Board of Directors approved a scheme of arrangement for the amalgamation of Sapphire Foods India Limited with Devyani International Limited. Under the proposed terms, Sapphire Foods shareholders will receive 177 equity shares of Devyani International for every 100 equity shares held in Sapphire Foods. The merger is subject to regulatory and statutory approvals, with a proposed effective date of April 1, 2026.

Equity Analyst Commentary

Institutional research from ICICI Direct and Emkay Global noted the divergence in brand performance, specifically the margin compression at Pizza Hut India compared to the relative stability of KFC India. Analysts attributed the quarterly loss to increased operating expenses and the one-time impact of labor code adjustments.

Guidance & Outlook

Management indicated that store expansion will continue with a focus on KFC, targeting 60-80 new stores annually. Monitoring points include the integration process with Devyani International and the impact of value-driven pricing strategies on Pizza Hut’s recovery.

Performance Summary

- Stock Move: Share price decreased 1.94% to close at ₹213.00.

- Financial Results: Revenue rose 7.56% while net profit swung to a ₹48.08 crore loss.

Segment Signals: KFC India maintained growth; Pizza Hut India reported revenue and margin declines.