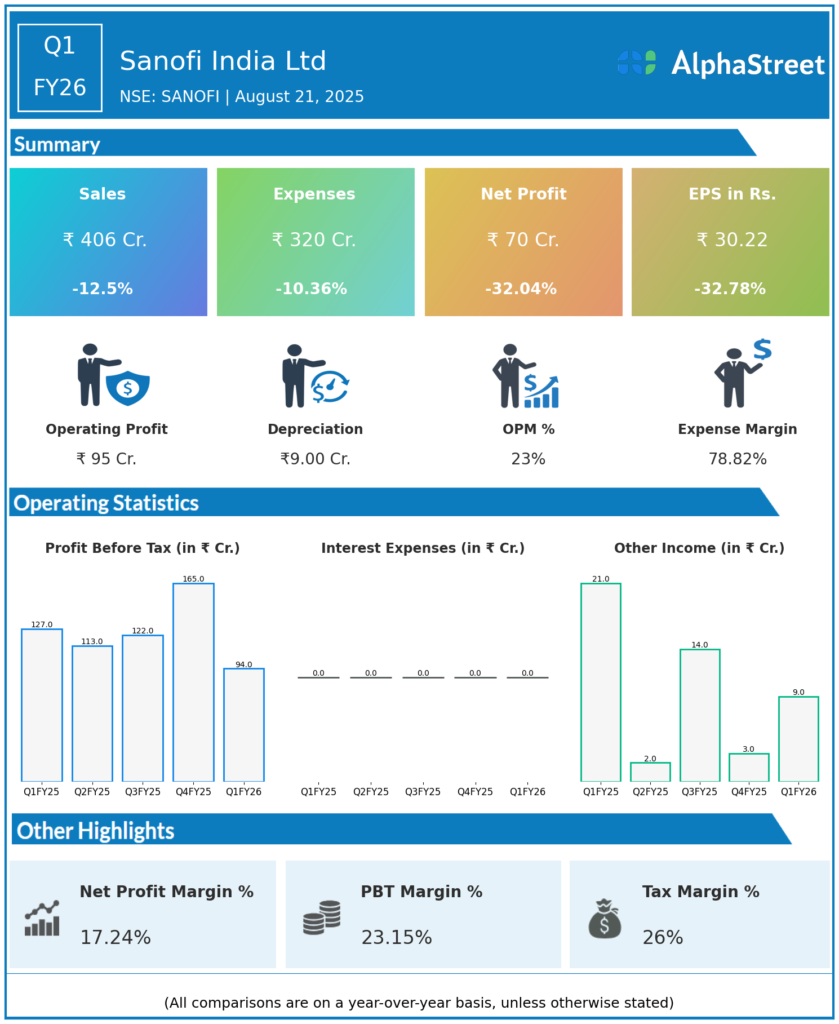

Sanofi India Limited is amongst the leading multinational companies in the Indian Pharmaceutical Market. It offers a wide array of medicines for therapy areas such as Diabetes, Cardiology, Thrombosis, Central Nervous System and Anti-histamines. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: ₹406.30 crores, down from ₹535.90 crores in previous quarter and also down by 12.5 percent on the YoY basis.

-

Total Expenses: ₹320.5 crores, down from ₹364 crores in previous quarter and also down by 10.3 percent from the same quarter, last year.

-

Profit Before Tax (PBT): ₹94.50 crores (down from ₹165.60 crores)

-

Profit After Tax (PAT): ₹69.50 crores, down from ₹172 crores in the previous quarter and also down by 32.4 percent on the YoY basis.

-

EBIT (Earnings Before Interest & Tax): ₹94.50 crores

-

EBIT Margin: Approximately 22.77%

-

Net Profit Margin: Approximately 17.24%

-

Basic EPS: ₹30.22, a decline of 32.7 percent on the YoY basis

Management Commentary & Strategic Highlights:

-

Sanofi India reported a 32% decline in profit for Q1 FY26 compared to Q1 FY25, mainly due to lower sales and higher input costs.

-

The company continues its focus on strengthening its product portfolio, especially in specialty care including diabetes and cardiovascular medicines.

-

Sanofi India’s strategic focus remains on innovation, expanding market share in niche segments, and improving operational efficiencies.

-

Emphasis on increasing footprint in emerging therapies and making investments in R&D and marketing.

-

Management highlighted navigating competitive pressures and economic headwinds while staying committed to growth and sustainable profitability.

Q4 FY25 Earnings Results

-

Total Income: ₹536 crores, up by 4.89 percent on the YoY basis.

-

Total Expenses: ₹364 crores, down by 2.6 percent on the YoY basis.

-

Profit After Tax (PAT): ₹120 crores, down by 12.4 percent from the same quarter, last year

-

EBIT: ₹165.60 crores

-

EBIT Margin: Approximately 30.71%

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.