SAMHI is a prominent branded hotel ownership and asset management platform in India. SAMHI has long-term management arrangement with Marriott, IHG and Hyatt.

Q2 FY26 Earnings Results

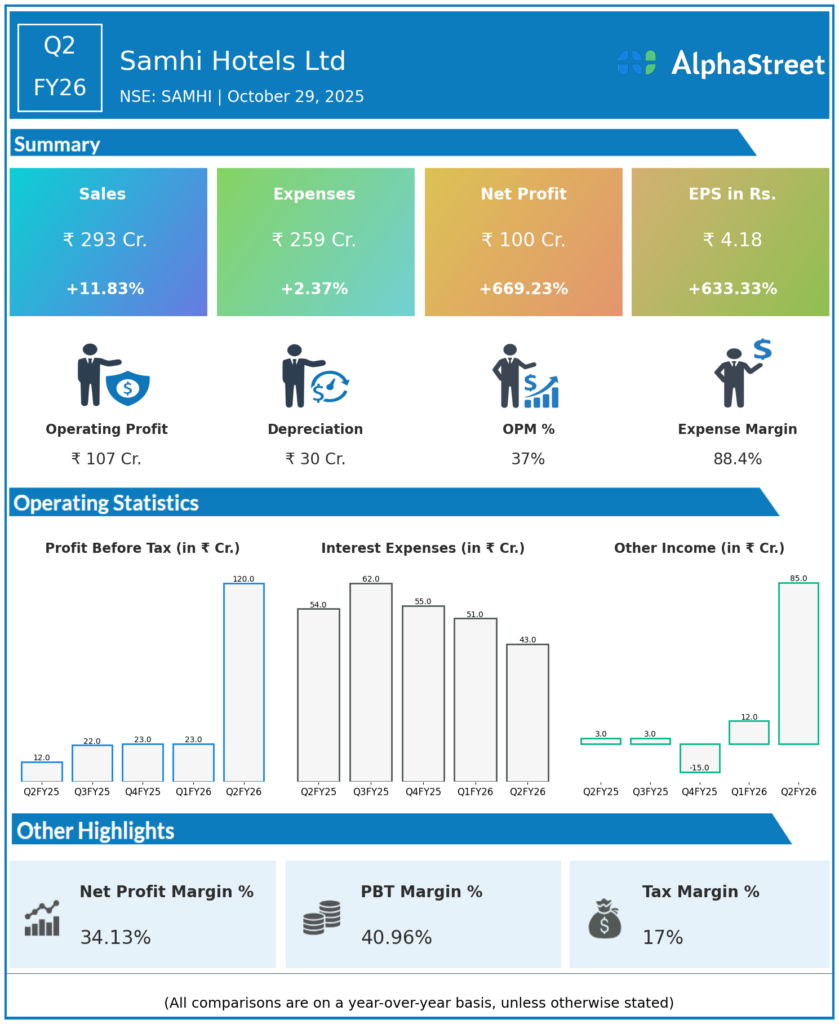

Total Revenue: ₹292.97 crore, up 11.8% YoY from ₹262.13 crore, and up 7.6% QoQ from ₹272.21 crore in Q1 FY26.

Consolidated EBITDA: ₹110.5 crore, up 14.2% YoY and margin improved to 37.3% (from 36.2% YoY).

Profit After Tax (PAT, Consolidated): ₹100 crore, up a remarkable 669% YoY from ₹12.62 crore and up 434.9% QoQ.

PAT Attributable to SAMHI: ₹92.4 crore.

Profit Before Tax (PBT, before exceptional items): ₹38.18 crore, up 179.3% YoY.

PAT Margin: 34.96%, sharply higher than 8.10% in Q1 FY26.

Operating Margin: 36.57%.

Exceptional Items: Exceptional gain of ₹84.1 crore (including a ₹57.1 crore net benefit from Navi Mumbai land impairment reversal).

Average Room Rate (ARR): ₹5,026, up 11.2% YoY.

Occupancy Rate: 75% (Q2 FY26).

RevPAR: Grew 11.2% YoY.

Net debt / trailing 12M EBITDA: 2.9x, credit rating upgraded to A+ (stable).

Key Growth Projects: Announced 700-room dual-brand project near Navi Mumbai Int’l Airport and a 260-room hotel in Hyderabad Financial District.

Management Commentary & Strategic Direction

-

Chairman & MD Ashish Jakhanwala highlighted robust operational performance and record profitability, reflecting sustained RevPAR expansion, cost discipline, and deleveraging.

-

Management attributed profit surge to operational improvement and a one-off exceptional item (impairment reversal), emphasizing the underlying strength of core hotel operations.

-

Major expansion projects in Navi Mumbai (adjacent to the new international airport) and Hyderabad are set to drive 8% inventory growth and an estimated 9-11% CAGR in RevPAR over the next cycle.

-

SAMHI continues to innovate on asset-light platforms, leverage digitalization for pricing/yield management, and control employee costs (kept at 16.7% of revenue).

-

The group remains optimistic about sustained demand in Indian hospitality, with expectations of higher domestic and international travel boosting occupancy and rates through H2 FY26.

Q1 FY26 Earnings Results

Total Revenue: ₹272.21 crore, up 6.0% YoY from ₹256.81 crore.

Consolidated EBITDA: ₹105.6 crore, up 18.6% YoY; margin at 38.8%.

PAT (Consolidated): ₹17.28 crore, up 308% YoY from ₹4.23 crore (Q1 FY25).

PAT Attributable to SAMHI: ₹19.2 crore.

EPS: ₹0.90 (up from ₹0.20 YoY).

RevPAR: ₹4,760, up 10.3% YoY.

Occupancy Rate: ~74%.

Operational Notes: Q1 temporarily impacted by geopolitical events but rebounded strongly in June; overall, same-store growth was healthy and project pipeline robust.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.