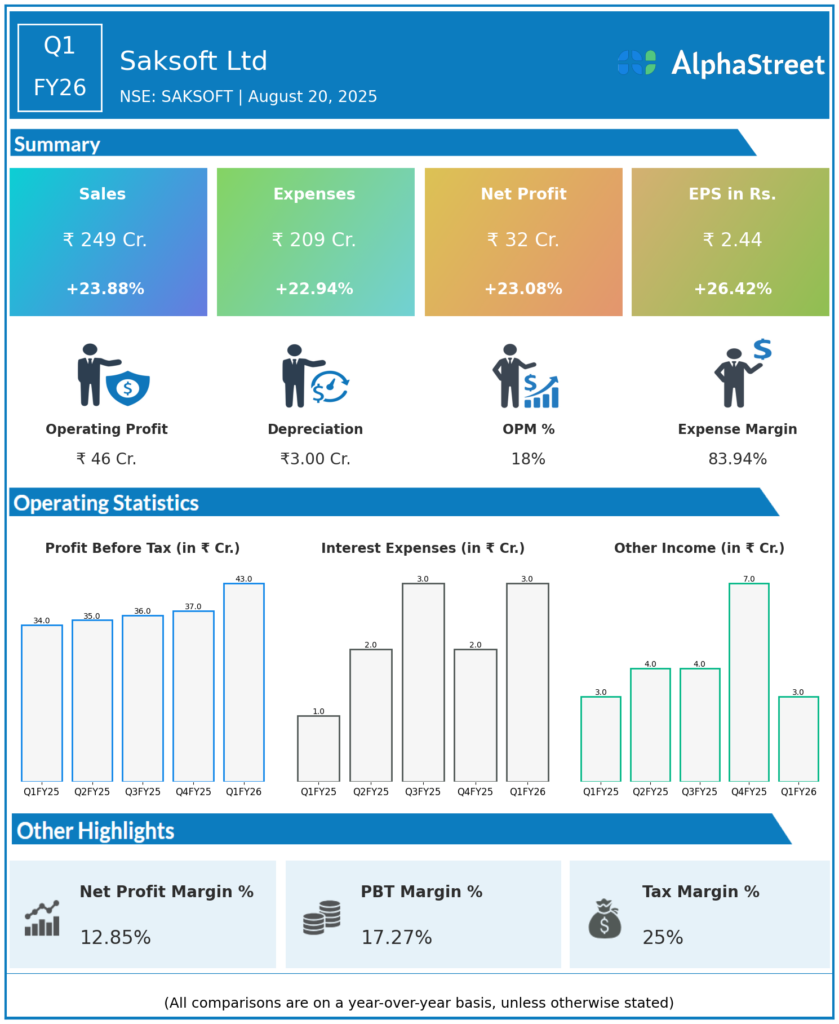

Saksoft Ltd is engaged in providing business intelligence and information management solutions predominantly to mid-tier companies based out of USA and UK. It was established in 1999 by Autar Krishna and his son Mr Aditya Krishna. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: ₹249 crore, up 3.7% quarter-on-quarter (QoQ) and 23.8% year-over-year (YoY) from ₹203.78 crore in Q1 FY25.

-

Total Expenses: ₹209.34 crore, up 26.0% QoQ and 23.0% YoY.

-

Profit Before Tax (PBT): ₹43.03 crore, up 37.6% QoQ and 28.1% YoY.

-

Tax Expense: ₹10.69 crore, up 32.5% QoQ and 33.6% YoY.

-

Profit After Tax (PAT): ₹32.35 crore, up 6.6% QoQ and 23.08% YoY.

-

EBITDA: ₹46 crore, up 31% YoY and 26% QoQ.

-

EBITDA Margin: 18.4%, expanded by approx. 320 bps QoQ and 97 bps YoY.

-

EPS: ₹2.4, up 7.4% QoQ and 26.4% YoY.

-

Operating Efficiency: Employee utilization increased to 86%; no major headcount increase, reflecting operational leverage.

-

Geography: Americas contributed 44%, Europe 21%, Asia Pacific and others 35%.

-

Verticals: BFS (Banking & Financial Services) 31%, Emerging verticals 47%, Logistics 14%, Commerce 8%.

-

Strategy: Focus on AI-led product engineering, domain-based accelerators, and profitable acquisitions.

Management Commentary

-

CEO Aditya Krishna highlighted strong quarter with good revenue and profit growth.

-

Investments in AI platform ongoing, with expected acceleration in AI-led deal wins.

-

Conservative FY26 revenue guidance of INR 1,000–1,100 crores and EBITDA margins forecast at 16.5–17.5%.

-

Strong cash position (~INR 190–200 crore).

-

Recent acquisitions integrated smoothly; focus on profitable growth.

Q4 FY25 Earnings Results

-

Total Income: ₹240 crore, up by 23 percent on the YoY basis

-

PAT: ₹30 crore, depicting a growth of 30.4 percent during the same quarter, last year.

-

Showing solid sequential improvement into Q1 FY26.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.