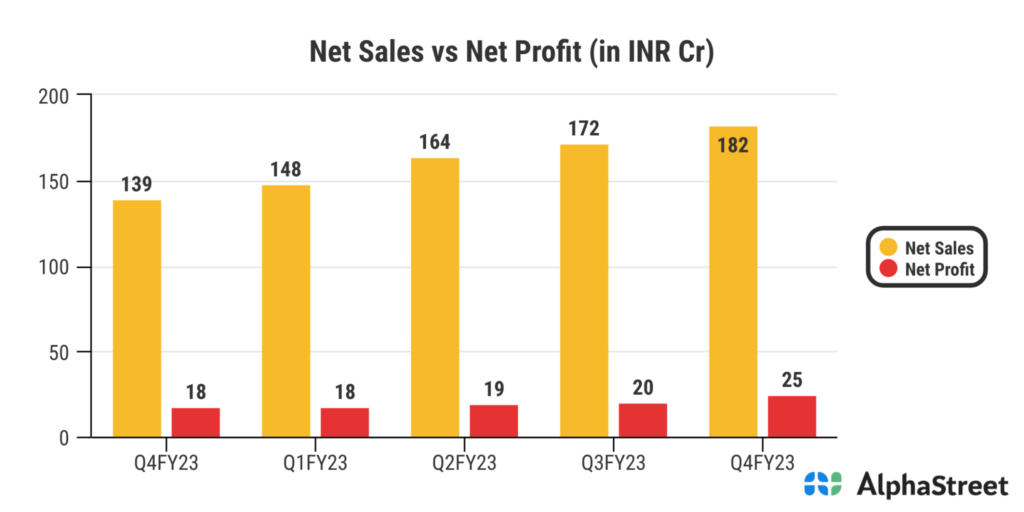

In FY 22 -23 we continued our “inch wide, mile deep” strategy for growing the company. This focus helped us grow revenues by 39%, Operating EBITDA by 37% and PAT by 30% for the full year. While we are optimistically cautious about the global macroeconomic environment, we will continue to focus on creating market niches for ourselves in an increasing competitive industry. We are looking forward to the journey ahead towards our goal of USD 500 million in revenues by 2030

Aditya Krishna, Managing Director

Stock data

| Ticker | SAKSOFT |

| Exchange | BSE and NSE |

| Industry | IT- Software |

Price Performance:

| Last 5 days | +18.84% |

| YTD | +130.15% |

| Last 1 year | +206.5% |

Company description:

Established in 1999 by Autar Krishna and his son Mr Aditya Krishna, Saksoft Ltd is engaged in providing business intelligence and information management solutions predominantly to mid-tier companies based out of the USA and UK.

Service Offerings:

The company is a leading Digital Transformation Solution Partner for clients across various countries. It provides services like application development, testing & quality control and solutions based on cloud, mobility and Internet of Things (IoT) along with Information Management (IM) and Business Intelligence (BI) solutions.

User Industries:

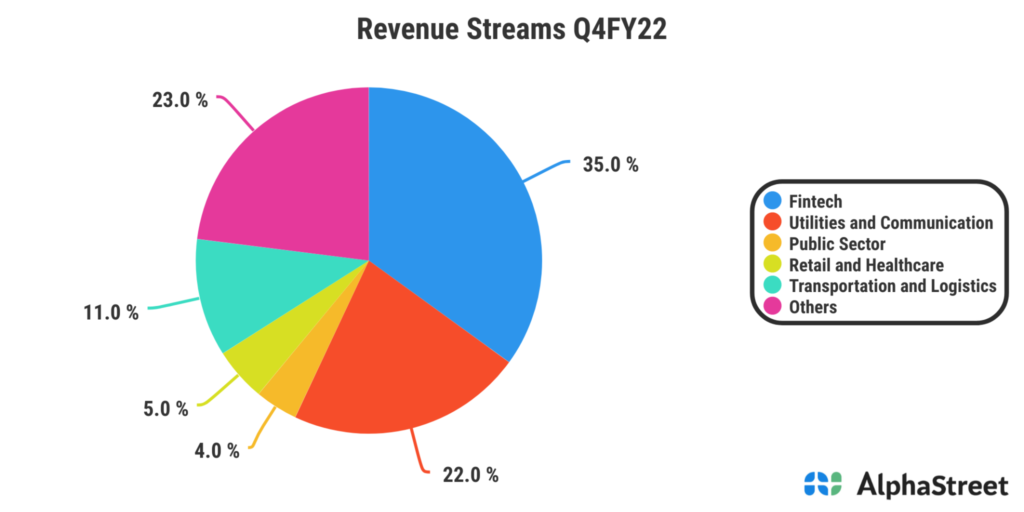

The company provides domain specific services in the verticals of :-

- Fintech: Mobile Cash Disbursement Solution, API Integration, Mobile/Web Development, Big data analytics, etc.

- Retail/E-Commerce: Multi Store eCommerce Solutions, Customer Engagement Solutions, Order Inventory Management, etc.

- Telecommunication: SharePoint development, Advanced analytics to reduce customer churn, Oracle Support, Testing CoE.

- Healthcare: Telehealth, EHR integration, Imaging analytics, etc.

- Transportation & Logistics: IoT Solutions, Freight Management Software, Supply & Warehouse Management.

- Public Sector: Machine learning & facial recognition from IoT data feeds, Predictive Analytics & BI, People identity management,

International Presence:

Presently, the company is operating through 2000+ employees and 16+ strategic locations across the world. In FY23, Americas accounted for ~47% of revenues, followed by Europe (25%) and Asia-Pacific and others (28%).

Client Concentration:

The company has significant client concentration with top 5 customers accounting for ~45% revenues and top 20 customers accounting for ~71% of revenues in FY23.

Past Acquisitions

Since the company’s incorporation, it has acquired various companies/ startups such as EDP, DreamOrbit, 360 Logica, Faichi Solutions, and acuma solutions.

Financials:

What we like:

- Focus on high-growth interconnected verticals:

Saksoft has identified 4 key verticals viz healthcare, transport and logistics, fintech, and retail/ ecommerce wherein it possesses i) technological capabilities ii) domain acumen, and iii) execution experience and intends to focus on these niche verticals to aid growth under its ‘inch wide mile deep’ strategy which differentiates it from the pantheon of bigger ‘can do it all’ companies. This helps Saksoft demarcate its target market and position itself as domain expert with an established track record in these industries.

- Leveraging growth with acquisitions:

Saksoft’s acquisitions have predominantly been for capabilities and it acquired 5 niche companies over the last decade or so, allowing it to add newer service verticals and increase penetration in US and UK. Saksoft refers to this as the ‘String of pearls’ strategy whereby it acquires capabilities in industries it envisages growth and/or complements existing capabilities. Bundling acquired with existing capabilities enabled Saksoft to offer a bouquet of complementing services under one roof which are scalable and relevant across long-term. DreamOrbit has been a key acquisition registering 42.9% CAGR revenue growth during FY17-21.

| Particulars | Acuma | EDP | Three Sixty Logica | DreamOrbit | Faichi |

| Acquisition in | 2006 | 2013 | 2015 | 2016 | 2018 |

| Location | USA | UK | Noida | Bangalore | USA |

| Specialization | Public Sector | Business Intelligence | Testing | Transportation and logistics | Healthcare |

| Geographies served | Europe | USA | All | USA and APAC | USA |

- The company has a robust growth strategy:

The company is using the ‘Network Effect’ coupled with its sales front end to drive growth and believes this creates familiarity and leads to deal conversion. Also, 80% of revenues through existing accounts and references to Invest in creating digital assets and framework such as unite and stack to enable customers faster go to market and help their digitization journey.

- The company is virtually debt free and has increased its topline by a good margin over the past couple of years.

Factors to consider:

- The company is a relatively small player in the IT services industry which is dominated by large multinationals and thus remains highly exposed to intense competition.

- Saksoft’s top 5 clients contribute approximately 50% thereby losing a a top client could significantly impact revenues. However, this is a challenge in most small caps and the possible solution is the addition of more clients.

- The impact of recession might affect the financial result of the company.

Industry Analysis:

As per Gartner’s April 2022 release, worldwide IT spending is expected to touch USD 4.4 trillion in 2022, witnessing a growth of 4% from 2021. This year is shaping up to be one of the most eventful years on record for CIOs. Geopolitical disruption, inflation, currency fluctuations and supply chain challenges are major factors vying for their time and attention, yet contrary to what the beginning of 2020 witnessed, CIOs are accelerating IT investments as they recognize the importance of flexibility and agility in retorting to disruption. Organizations are adapting to futuristic technologies faster than ever. As a result, purchasing and investing preferences will be prioritized in 2022 in the areas including Cloud computing, Seamless Customer experiences, Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML), Blockchain, Big Data Analytics, Robotics Process Automation (RPA), Data Security & Cyber Protection and many more.

IT spending across segments is projected to grow in 2022 and beyond. Inflation effects on IT hardware from the past two years are finally diminishing and spilling over into software and services. With the current shortage of IT talent prompting more competitive salaries, technology service providers are raising their prices, which is helping to boost spending growth in these segments through 2022 and 2023.