Sagar Cements is engaged in the business of manufacture and sale of cement. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

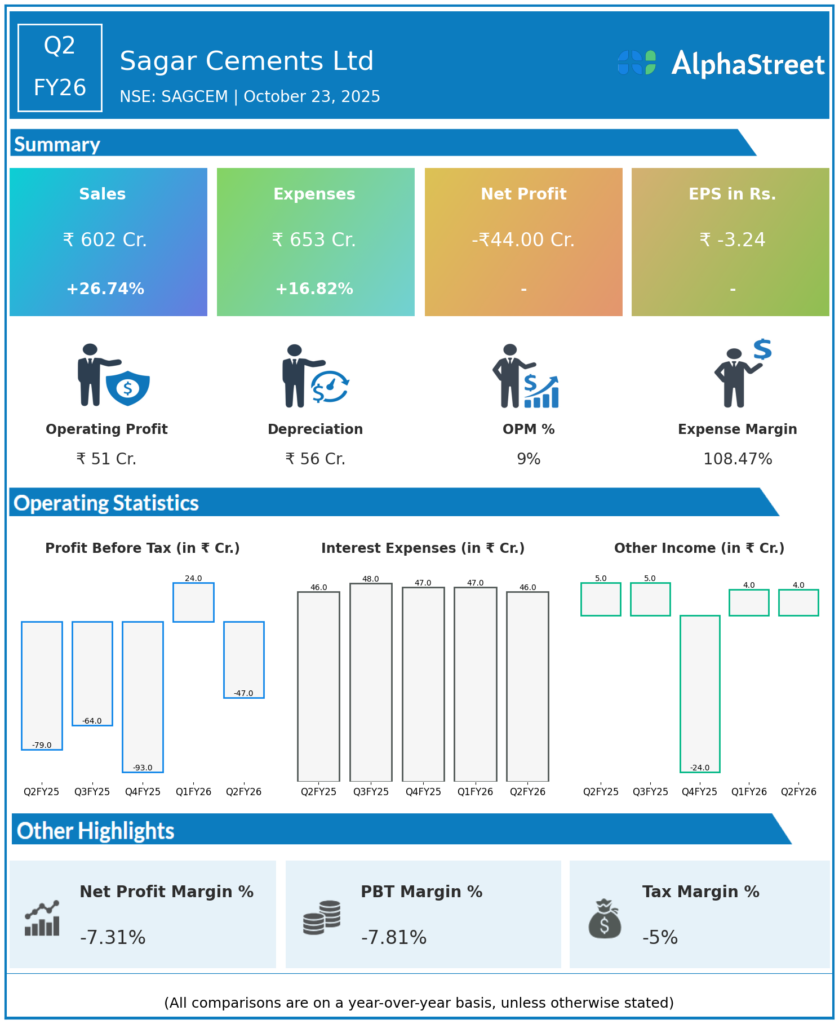

Consolidated Revenue from Operations: ₹601.86 crore, up 26.7% YoY from ₹475.12 crore in Q2 FY25, reflecting firm demand and improved operational scale.

-

Consolidated Net Loss: ₹44 crore, a significant downturn compared to a profit of ₹23.90 crore in Q2 FY25, primarily on account of elevated power, fuel, and freight costs.

-

H1 FY26 Revenue: Up 22.9% YoY, half-year results show narrowing losses compared to prior year.

-

Cost Pressures: Higher energy and freight costs ate into margins despite volume growth.

Operational Performance

-

Cement Dispatches: ₹ (approx.) 1.31 million tonnes in Q2 FY26 (up 18% YoY).

-

EBITDA: ₹60 crore, up 900% YoY with margins expanding to 10.22%, a healthy recovery from previous quarters.

-

Power & Fuel Costs: Reduced to ₹1,626 per tonne versus ₹1,935 a year earlier, reflecting efficiency gains.

-

Freight Costs: Stable at ₹850–860 per tonne.

-

Capex: Planned ₹360 crore focusing on capacity expansion and renewable energy.

Management Commentary & Strategic Outlook

-

The company highlighted strong cement dispatch growth and mix improvements as key revenue drivers.

-

Acknowledged margin pressure from increasing input costs but expects Q3/Q4 margins improvement driven by volume and cost optimization.

-

Approved ₹150 crore incentives from the Madhya Pradesh government to be disbursed over seven years, providing cash flow support.

-

Continued focus on expanding production capacity, operative efficiency, and logistical network to enable higher EBITDA per tonne in coming quarters.

Q1 FY26 Earnings Results

-

Consolidated Revenue: ₹540 crore.

-

EBITDA: ₹48 crore (margin 8.9%).

-

PAT: ₹11.3 crore.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.