Sagar Cements is engaged in the business of manufacture and sale of cement. Presenting below are its Q1 FY26 earnings.

Q1 FY26 Earnings Summary

-

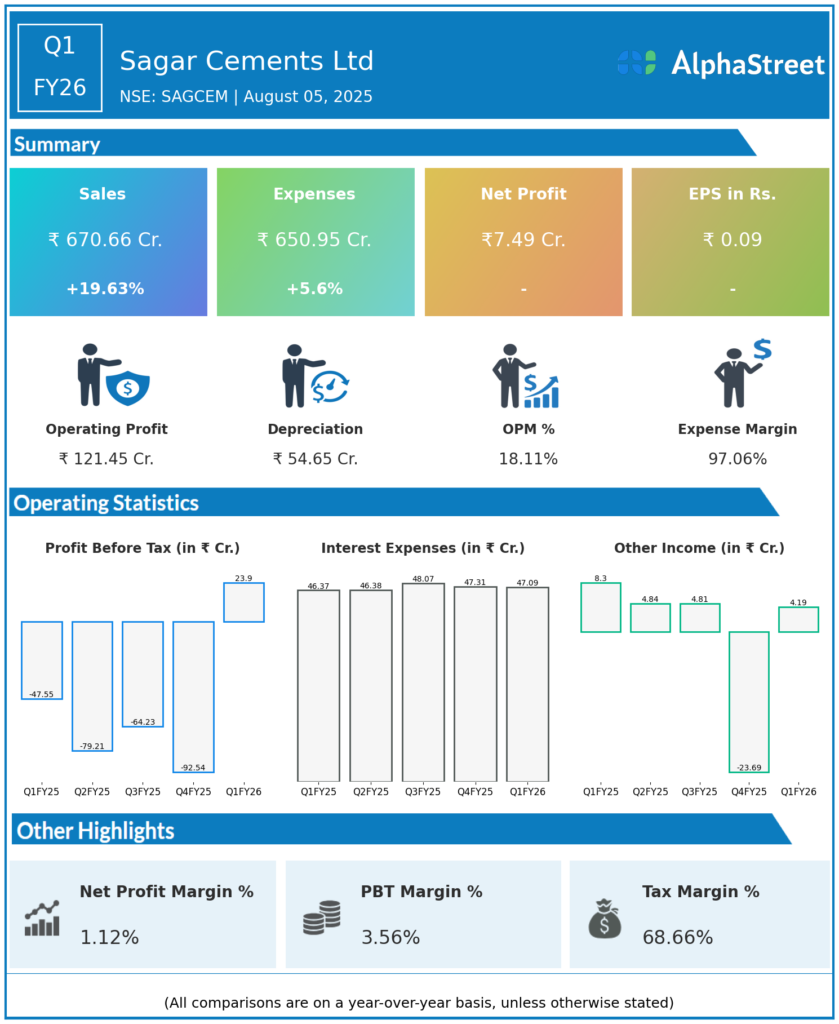

Consolidated Revenue: ₹671 crore, up 20% year-over-year (YoY) from ₹561 crore in Q1 FY25.

-

Net Profit (PAT): ₹7.49 crore, compared with a loss of ₹32.20 crore in Q1 FY25.

-

Volume: Increased 11% YoY, driven by higher government spending and growth in the construction and housing sectors.

-

EBITDA Margin: Expanded sharply to 18% from 8% YoY due to improved realizations and cost efficiencies.

-

Operating Profit: EBITDA per ton doubled YoY to ₹849 from ₹364 due to favorable price and operational performance.

-

Cost Efficiency: Raw material cost per ton declined 50.6% YoY; power and fuel cost per ton was stable; freight costs increased moderately but overall opex per ton fell 8.5% YoY.

-

Capacity Utilization: Approximately 55% during the quarter.

-

Debt to Equity Ratio: 0.86x, up slightly from 0.74x YoY.

-

Blended Cement Share: 52% of total sales.

-

Capex: ₹360 crore ongoing with expansion and installation of 6 MW solar plant at Jeerabad facility.

Key Management Commentary & Strategic Highlights

-

Joint Managing Director Reekan Reddy noted a robust start to the year encouraged by volume growth and better pricing environment.

-

The company focuses on cost reduction, operational efficiency, and enhanced use of renewable energy to drive sustainable margin expansion.

-

Sagar Cements is actively engaged in ramping up capacity and expects improved profitability and margins going forward as new plants come online.

-

Market positioning remains strong with well-distributed sales and a sizable share of blended cement.

-

Guidance remains positive with capacity and operational improvements expected to support long-term growth and returns.

Q4 FY25 Earnings Summary

-

Revenue: ₹658 crore (slightly lower QoQ but up YoY).

-

Profit: Net losses reported continuously prior quarters turned around in Q1 FY26.

-

Operational Metrics: Strengthening volume trends and price realizations, with increased focus on renewables and cost efficiencies.

-

Capex Activities: Significant investment in plant upgrades and renewable energy installations continued.

To view the company’s previous earnings, click here