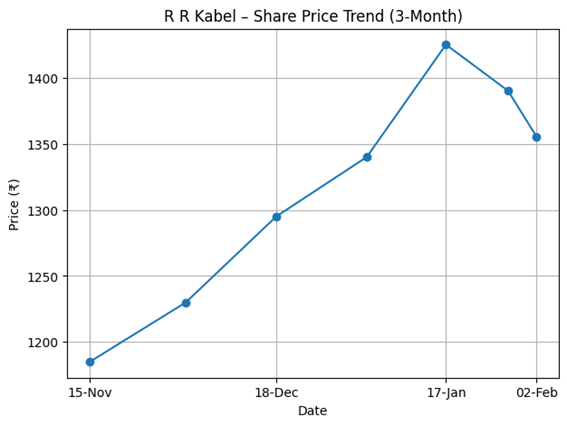

R R Kabel Ltd (BSE/NSE: RRKABEL) shares closed at ₹1,355.50 on February 2, 2026, down approximately 1.55% on the day. The stock price movement follows the company’s release of unaudited Q3 and nine-month fiscal 2026 results.

Market Capitalization

At today’s closing price, R R Kabel’s market capitalization stood around ₹15,400 crore on Indian exchanges.

Latest Quarterly Results

For the quarter ended December 31, 2025, R R Kabel reported consolidated revenue from operations of ₹2,535.9 crore, up 42.3% from ₹1,782.2 crore in Q3 FY25. Consolidated net profit for Q3 FY26 was ₹118.2 crore, a 72.4% increase from ₹68.6 crore in the prior-year quarter.

Financial Trends – Operating Performance

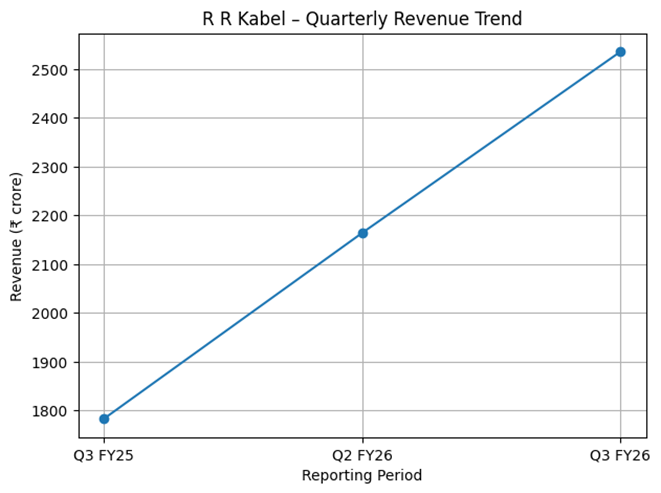

Quarterly Revenue Trend (₹ crore)

- Q3 FY25: 1,782.2

- Q2 FY26: 2,163.8

- Q3 FY26: 2,535.9

(Bar chart showing quarterly revenue on the Y-axis and reporting periods on the X-axis)

Market Performance – Stock Price Trend

RR Kabel Share Price Trend

Business & Operations Update

R R Kabel operates primarily in wires & cables and fast-moving electrical goods (FMEG). In the latest quarterly results, the wires & cables segment continued to lead growth, supported by domestic and export demand. The company highlighted improvements in operating EBITDA and profit before tax for Q3 FY 26.

M&A or Strategic Moves

There were no new merger, acquisition, or divestment announcements disclosed in the most recent earnings release or regulatory filings.

Equity Analyst Commentary

Institutional research notes from recent months have underscored R R Kabel’s performance trends. Reports highlight consolidated revenue and profit growth in the latest quarter and reference competitive dynamics in the wires and cables sector. Analysts also pointed to historical earnings momentum in preceding quarters as context for the company’s financial trajectory.

Guidance & Outlook

The company highlighted operational performance metrics but did not provide formal forward earnings forecasts in the press release. Investors will monitor commentary from the call for insights into demand, margin trends, and segment performance.

Performance Summary

R R Kabel shares closed lower today. Q3 FY 26 revenue increased over 40% year-over-year to ₹2,535.9 crore. Net profit rose over 70% to ₹118.2 crore. Annual figures showed year-over-year expansion in revenue and profit. Market capitalization remained in the ₹15,000 crore range at latest close.