Route Mobile Limited is a cloud communications platform service provider catering to enterprises, OTT players, and mobile network operators (MNOs). RML’s portfolio comprises solutions in Business Messaging, Voice, Email, SMS filtering, analytics, and monetization. Route Mobile Became a part of Proximus Group in May’24.

Q2 FY26 Earnings Results:

-

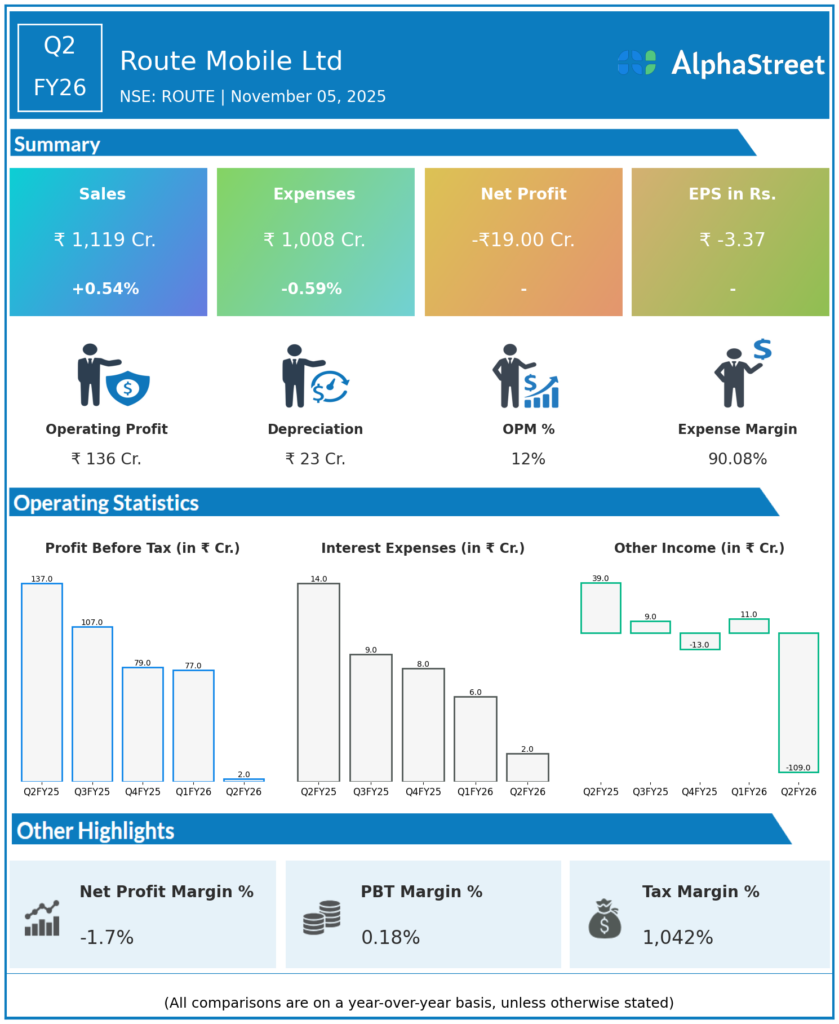

Revenue from Operations: ₹1,119.42 crore, up 0.5% YoY and 6.5% QoQ from ₹1,050.83 crore in Q1 FY26.

-

EBITDA: ₹135.95 crore, up 15.5% QoQ and 0.7% YoY; EBITDA margin improved to 12.14%.

-

Profit Before Exceptional Items and Tax: ₹137.87 crore, slightly up from ₹131.06 crore YoY.

-

Net Loss: ₹18.83 crore, compared to a profit of ₹107.03 crore in Q2 FY25 due to exceptional write-offs of ₹135.87 crore.

-

Employee benefits expenses: ₹71.66 crore, up 13.96% YoY.

-

Finance costs: ₹2.37 crore, down 83.56% YoY.

-

Gross profit margin expanded to 22.1%.

-

Declared interim dividend of ₹3 per share.

-

Processed 4.4 billion billable transactions in H1 FY26.

-

Operates in 20 global locations with 280 direct MNO connections and 2,500 active billable clients.

Management Commentary & Strategic Insights:

-

CEO Rajdipkumar Gupta highlighted strong execution on operational metrics despite challenging market dynamics.

-

Company is focusing on agility, responding to evolving carrier dynamics and market conditions.

-

Successfully using differentiated strategy to capture new opportunities and deliver sustained value globally.

-

Operational adjustments are taking effect as seen in sequential revenue and EBITDA growth.

-

Emphasis on expanding telecom API offerings, RCS solutions, and new-gen messaging channels.

Q1 FY26 Earnings Results:

-

Revenue from Operations: ₹1,050.83 crore, down 4.8% YoY.

-

EBITDA: ₹93.90 crore, margin contracted due to market challenges.

-

Profit After Tax (PAT): ₹58.78 crore, down 32.23% YoY.

-

Profit Before Tax (PBT): ₹76.57 crore.

-

The quarter saw strategic focus on expanding digital ecosystem partnerships and telecom API growth.

-

Transitional pressures impacted financials but groundwork laid for future recovery.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.