Rossari Biotech was started in 2003. They are among the largest manufacturers of textile specialty chemicals in India. Their 3 main product categories are:

– Home, personal care, and performance chemicals

– Textile specialty chemical

– Animal health and nutrition

The company has two R&D facilities, one at Silvassa manufacturing facility and a research lab at IIT Bombay.

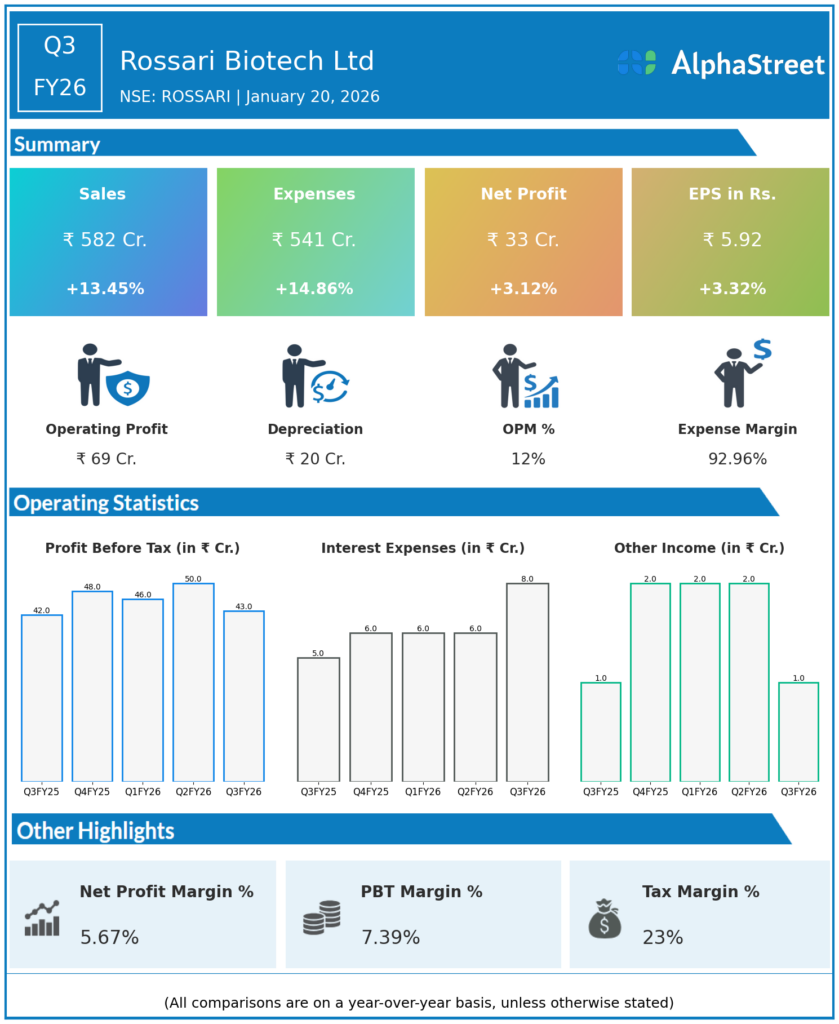

Q3 FY26 Earnings Results

- Revenue from Operations: ₹581.7 crore, up 13% YoY from ₹512.7 crore; broadly flat to slightly down QoQ vs ~₹586.1 crore in Q2 FY26 (seasonally softer domestic demand, stronger exports base.

- EBITDA: ₹68.9–69.4 crore, up 6% YoY from ₹64.8 crore; EBITDA margin 11.8%, down ~80 bps YoY from 12.6%.

- Profit Before Tax (PBT): ~₹42.5 crore, broadly flat YoY (₹42.4 crore) as margin compression offset revenue growth.

- Profit After Tax (PAT): ₹32.8 crore, up 3.2% YoY from ₹31.7 crore; PAT margin about 5.6%.

- EPS (diluted): ₹5.92 vs ₹5.70–5.73 in Q3 FY25.

- 9M FY26:

- Revenue from Operations: ₹1,711.5 crore vs ₹1,500.7 crore in 9M FY25, up 14%.

- EBITDA: ₹208.7 crore vs ₹195.6 crore, up 7%; EBITDA margin 12.2% vs 13.0% (‑80 bps).

- PAT: ₹103.2–103.24 crore vs ₹101.9–101.93 crore, up ~1%.

Segment Performance – Q3 FY26

- HPPC (Home, Personal Care & Performance Chemicals): Revenue up 11% YoY.

- TSC (Textile Specialty Chemicals): Revenue up 18% YoY.

- AHN (Animal Health & Nutrition): Revenue up 39% YoY, fastest‑growing segment.

- Exports: Continued strong, building on 36% YoY growth in Q2; exports contribute about 28% of revenue (latest hard percentage is Q2).

Management Commentary & Strategic Decisions – Q3 FY26

- Management stated that Rossari delivered “healthy YoY growth” despite a softer domestic demand environment, with consolidated revenue up 13% and growth broad‑based across HPPC, TSC and AHN.

- Margin compression (‑80 bps YoY) was attributed to competitive pricing, input‑cost environment and mix, though absolute EBITDA and PAT still grew.

- Strategic moves and plans:

- Board granted in‑principle approval for setting up greenfield manufacturing facilities in Saudi Arabia (KSA) through a wholly owned subsidiary, aimed at strengthening on‑ground presence and supply chain in the Middle East.

- Continued capacity expansion and debottlenecking at Dahej and integration of ethoxylation capacities (including Unitop) to support volume growth and more specialty, green‑chemistry products.

- Focus on improving working‑capital efficiency after an increase to ~102 days in H1 due to stretched receivables and strategic inventory stocking; management reiterated its target EBITDA‑margin band of 14–16% over the medium term as mix improves.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹586.1 crore, up 17.6% YoY from ₹498.4 crore in Q2 FY25 and up 7.8% QoQ from ~₹543.7 crore in Q1 FY26.

- EBITDA: ₹71.9 crore, EBITDA margin 12.3%, down from 13.2% in Q2 FY25 but up slightly QoQ.

- PBT (operating): ~₹49.7 crore (PBT/Revenue margin ~8.5%).

- Profit After Tax (PAT): ₹36.9 crore, up 4.4% YoY; PAT margin ~6.3%.

- H1 FY26:

- Revenue: ₹1,129.8 crore vs ₹988.0 crore in H1 FY25, up ~14%.

- PAT: ₹70.4 crore vs ₹70.2 crore, broadly flat with slight improvement.

Management Commentary & Strategic Directions – Q2 FY26

- Management highlighted that Q2 FY26 showed robust 18% YoY revenue growth driven by volume expansion across HPPC (+16%), TSC (+21%) and AHN (+29%), with exports up 36% YoY and contributing 28% of revenue.

- Despite pricing pressure and one‑time expenses, profitability remained steady, supported by operating leverage and new‑product development in green chemistry and advanced formulations.

- Strategic priorities emphasised:

- Scaling exports and specialty formulations while defending margins in the 14–16% targeted band through mix upgrade and operational efficiencies.

- Leveraging new capacities at Dahej and ethoxylation additions to capture incremental demand and support higher‑value chemistries.

- Tightening working‑capital management (receivables and inventories) after a step‑up to 102 days, to support sustainable growth and returns.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.