Rossari Biotech was started in 2003. They are among the largest manufacturers of textile specialty chemicals in India. Presenting below are its Q1 FY26 earnings.

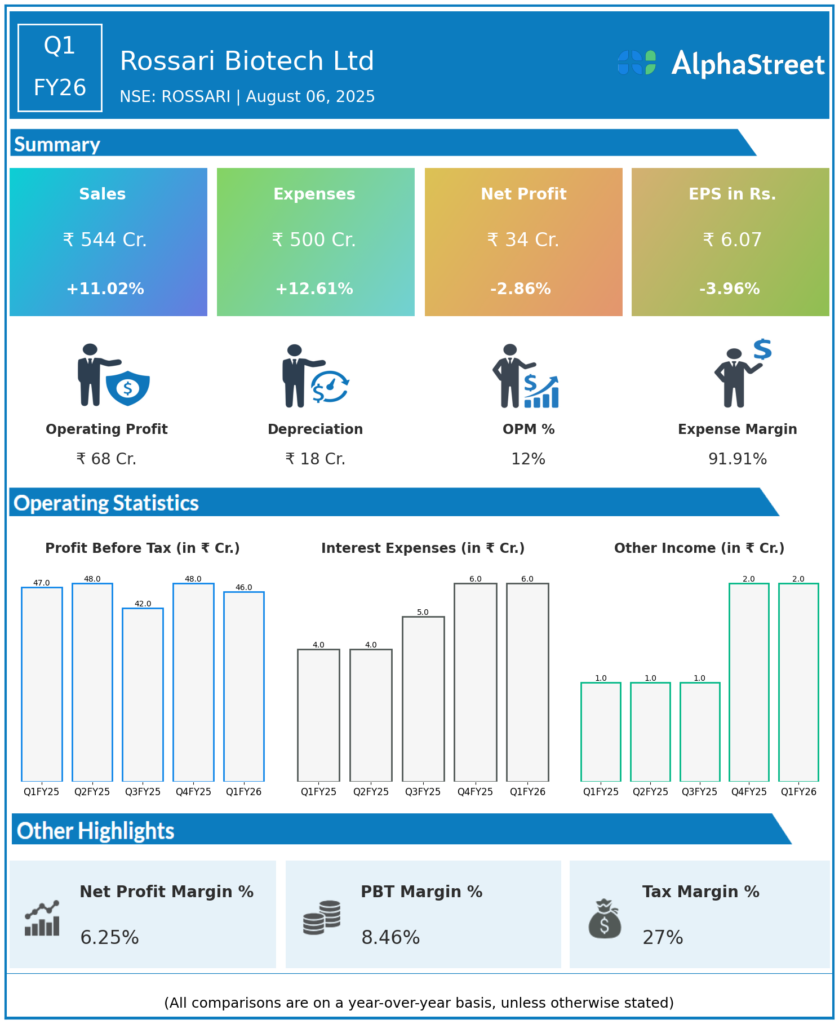

Q1 FY26 Earnings Summary

-

Consolidated Revenue from Operations: ₹543.7 crore, up 11% year-over-year (YoY) from ₹489.7 crore in Q1 FY25.

-

EBITDA: ₹67.9 crore, up 4.6% YoY; EBITDA margin at 12.5% (vs. 13.3% YoY).

-

Profit After Tax (PAT): ₹33.6 crore, down 3.7% YoY from ₹34.9 crore.

-

Earnings Per Share (EPS): ₹6.1 (not annualized).

-

Standalone Revenue: ₹365.8 crore, up 21.6% YoY.

-

Standalone PAT: ₹26.2 crore, up 7.8% YoY.

-

Segment Trends: Home, Personal Care & Performance Chemicals (HPPC) segment grew 16% and was a primary growth driver, while Animal Health & Nutrition (AHN) also showed 12% YoY growth. Export business showed a slight decline versus last quarter, but remained robust yearly.

-

Operational Notes: Margins softened slightly due to higher input, employee, and finance costs.

Key Management Commentary & Strategic Highlights

-

Management described Q1 FY26 as a quarter of “steady performance,” with growth led by strong momentum in HPPC and AHN despite a challenging and evolving operating environment.

-

Exports were lower sequentially but improved YoY; domestic market growth remained strong, supported by a resilient product mix and customer base expansion.

-

Efficiency initiatives and product-mix optimization remain a focus to drive growth over upcoming quarters.

-

Ongoing capacity expansion in personal care, agrochemicals, oil & gas, and pharma verticals is expected to improve manufacturing capabilities and supply chain agility.

-

Management is optimistic for H2 FY26, citing stronger recovery expected as new capacities ramp up and demand normalizes.

-

Leadership continues to target sustainable value creation, customer-led innovation, and operational excellence to support long-term growth.

Q4 FY25 Earnings Summary

-

Consolidated Revenue from Operations: ₹579.6 crore, up 22.6% YoY from ₹472.7 crore.

-

EBITDA: ₹69.5 crore, up 9.3% YoY; EBITDA margin at 12.0% (vs. 13.5% YoY).

-

PAT: ₹34.4 crore, up 0.9% YoY from ₹34.1 crore.

-

EPS: ₹6.21.

-

Full FY25: Revenue at ₹2,080.3 crore (+13.7%), PAT at ₹136.4 crore (+4.4%), with margins moderately below prior year due to input price headwinds.

To view the company’s previous earnings, click here