Shares of RITES Limited (NSE: RITES) fell 1.29% to ₹222.67 on Thursday, despite reporting a rise in third-quarter consolidated net profit. While the state-owned engineering firm saw a recovery in export sales and maintained robust consultancy margins, the stock continues to trade near its 52-week lows as investors weigh premium valuations against a long-term decline in turnkey revenue.

Company Description

RITES Limited is a Navratna Public Sector Enterprise and a leading multidisciplinary engineering and consultancy firm in India. The company provides a comprehensive range of services from concept to commissioning in transport infrastructure, including railways, highways, airports, and urban transport. Its business model spans consultancy, turnkey construction projects, and the leasing and export of rolling stock, serving domestic government entities and international clients across more than 55 countries.

Market Performance and Valuation

- Current Stock Price: ₹222.67 (As of Feb 5, 2026)

- Market Capitalization: Approximately ₹10,707.85 crore

- 52-Week Context: Shares have traded between a high of ₹316.00 and a low of ₹192.40. The stock has declined roughly 8.5% over the past month, reflecting sustained selling pressure despite recent international order wins.

- Valuation: RITES trades at a trailing P/E ratio of 26.08x. While this is below the capital goods sector average of approximately 39x, the company’s price-to-book (P/B) ratio of 4.12x represents a significant premium over its historical average, suggesting a high growth expectation that remains unfulfilled by current earnings trends.

Third Quarter and YTD Fiscal 2026 Results

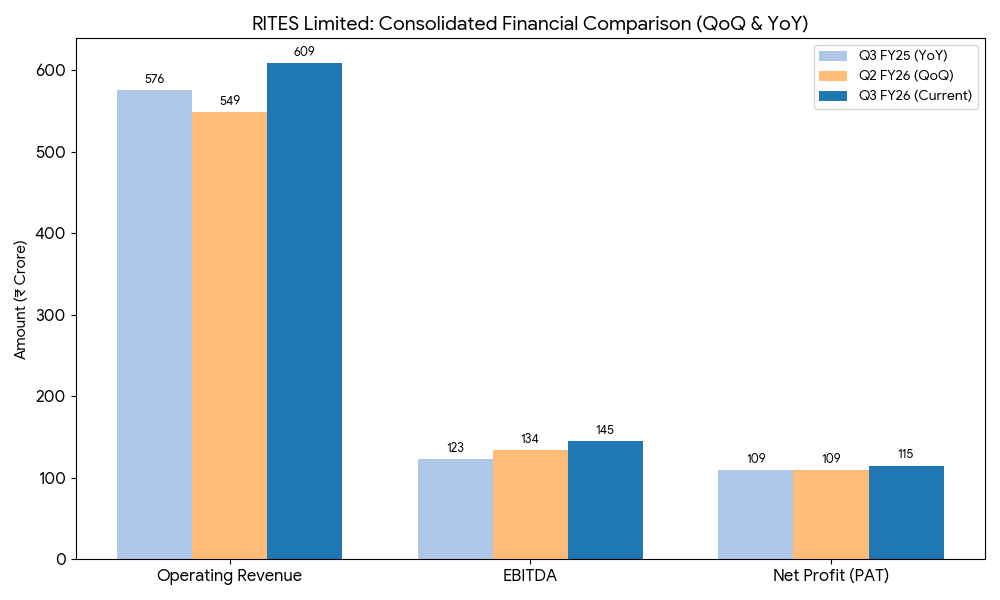

RITES reported consolidated results for the quarter ended December 31, 2025:

- Q3 Revenue from Operations: ₹608.59 crore, an increase of 5.7% year-over-year.

- Q3 Consolidated PAT: ₹115.10 crore, up 5.2% (some sources report up to 21% based on normalized adjustments) compared to ₹109.4 crore in Q3 FY25.

- Profitability Metrics:

- EBITDA: Rose 18.6% to ₹145 crore.

- EBITDA Margin: Expanded to 23.9% from 21.3% in the prior-year period, driven by a higher-margin project mix.

- 9M FY2026 Performance: For the nine-month period, consolidated revenue reached ₹1,726 crore (up 2.4% YoY), while PAT rose 11.6% to ₹315 crore.

- Interim Dividend: The Board declared a third interim dividend of ₹1.90 per share (19% of face value), with a record date of February 10, 2026.

Segmental and Order Book Highlights

- Consultancy: Remained the primary profit driver with revenue of ₹292 crore (up 4.1%) and healthy margins of 35.4%.

- Exports: Witnessed an extraordinary surge to ₹62 crore from just ₹1 crore in Q3 FY25, following the supply of locomotives to Mozambique.

- Turnkey: Continued to struggle, with revenue falling 22.8% to ₹172 crore as older projects wind down.

- Order Book: Reached a record high of ₹9,262 crore, including over ₹1,100 crore in new orders secured during the quarter.

Analyst Forecasts and Macro Pressures

Analyst consensus remains divided, with a target price of approximately ₹283, implying a 27% potential upside. However, technical indicators remain neutral-to-bearish.

- Macro Pressures: The Indian railway sector faces increased competition and a shift toward larger integrated turnkey contracts, which often carry lower margins compared to RITES’ core consultancy business.

- Company-Specific Challenge: Execution delays in international rolling stock orders and the voluntary liquidation of joint ventures like IRSDC (Indian Railway Stations Development Corporation) remain overhangs on the company’s non-core asset valuations.

Geopolitical Risk and Trade Exposure

RITES has significant exposure to Sub-Saharan Africa and Southeast Asia. While recent orders from Mozambique ($20.6 million) and Zimbabwe ($3.6 million) bolster the export pipeline, they expose the company to regional geopolitical stability and counterparty credit risks. The company noted no material impact from domestic labour code changes but remains sensitive to global supply chain disruptions affecting the delivery of locomotives.

SWOT Analysis

| Strengths | Weaknesses |

| Debt-free balance sheet with robust cash reserves. | Continued decline in the high-volume Turnkey segment. |

| Dominant position in domestic rail consultancy. | High dependency on government-funded infrastructure. |

| Opportunities | Threats |

| Record-high order book of ₹9,262 crore. | Competitive pressure from private engineering firms. |

| Expansion into renewable energy via REMC Ltd JV. | Geopolitical risks in key export markets (Mozambique). |