Stock Data:

| Ticker | NSE: MANKIND |

| Exchange | NSE |

| Industry | PHARMACUTICALS |

Price Performance:

| Last 5 Days | +3.14 % |

| YTD | +25.85 % |

| Last 12 Months | +25.85 % |

Company Description:

Mankind Ltd. is a dynamic pharmaceutical and healthcare company headquartered in India. With a steadfast commitment to providing high-quality healthcare solutions, Mankind has achieved remarkable success in the industry. The company’s robust portfolio encompasses a wide range of pharmaceuticals and consumer healthcare products, backed by cutting-edge research and innovation. Mankind’s focus on domestic growth, expansion into profitable therapeutic areas, and market leadership exemplify its strategic prowess. The company’s stellar financial performance, strong market presence, and dedication to improving lives underscore its position as a trusted and influential player in the global healthcare landscape.

Critical Success Factors:

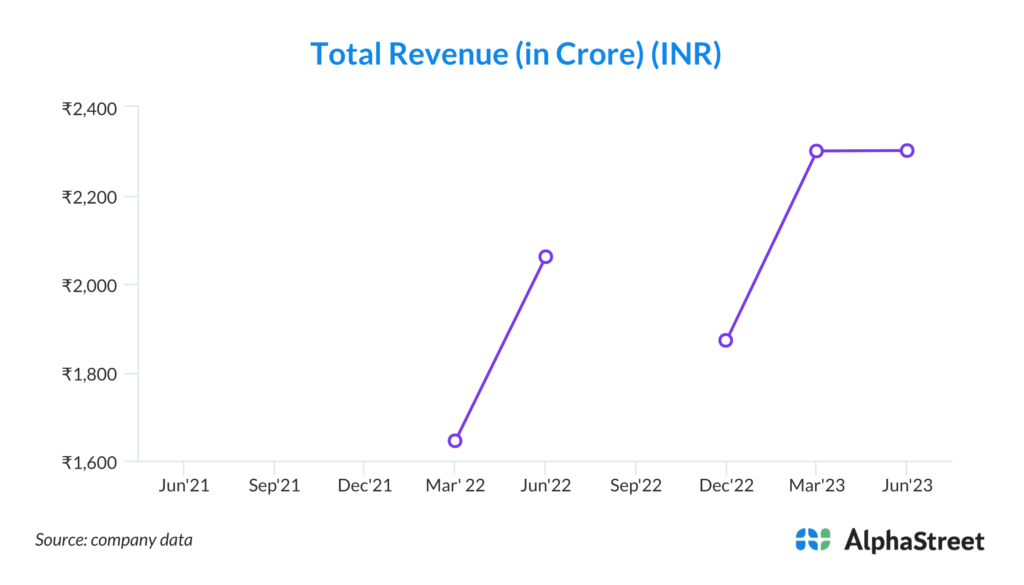

1. Strong Financial Performance: Mankind Ltd. has displayed a commendable financial performance in the first quarter of the fiscal year 2024. The company reported a significant 18% year-on-year growth in revenue, amounting to Rs. 2,579 Crore. This demonstrates the company’s ability to generate substantial income, which is a critical indicator of its financial health.

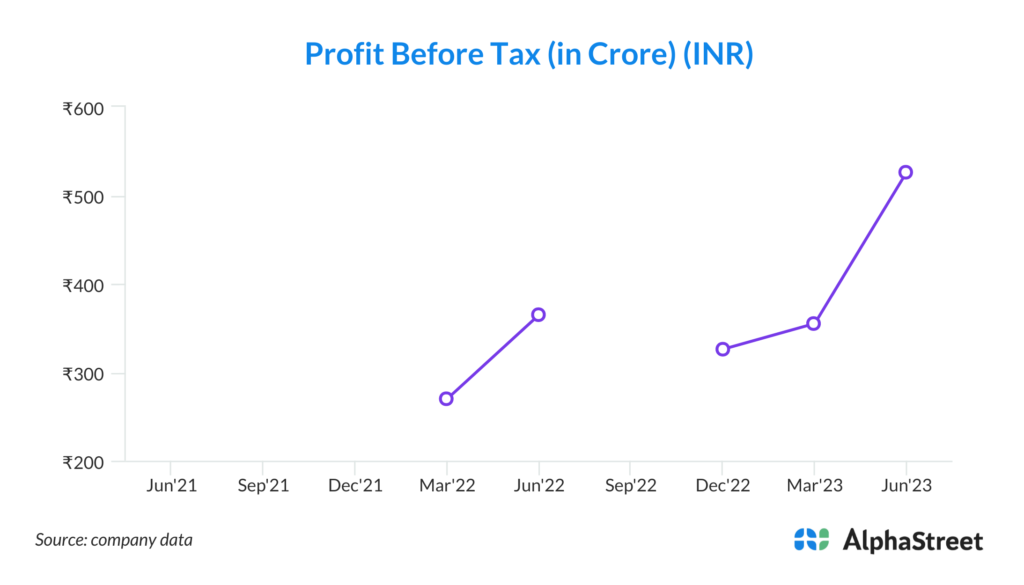

2. Profitability: The company’s profitability has seen remarkable growth, with EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) growing by an impressive 43% year-on-year, reaching Rs. 660 crores. Furthermore, Mankind Ltd. achieved an EBITDA margin of 25.6%, marking a substantial 4.5% increase compared to the previous year’s first quarter. This improvement in profitability showcases the company’s efficiency in managing its operations.

3. Market Share Growth: Mankind Ltd. has not only maintained its market position but also expanded it. The company’s market share increased from 4.2% in the first quarter of the previous fiscal year to 4.4% in the first quarter of 2024. This growth demonstrates the company’s ability to gain a larger share of the market, which is essential for long-term sustainability.

4. Volume-Led Growth: Mankind Ltd. has consistently outperformed the industry in terms of volume growth. In the first quarter, the company achieved a remarkable 4.3% volume growth, while the industry only managed 1.4%. This demonstrates Mankind Ltd.’s ability to capture market share through a strong distribution network and a significant presence among doctors. Volume-led growth is often considered more sustainable as it is driven by prescriptions.

5. Chronic Segment Expansion: Mankind Ltd. has made significant strides in expanding its presence in the chronic segment, achieving a record-high chronic share of 36%. This segment experienced exceptional growth of 17% in the first quarter, outperforming the industry’s growth rate of 10% by an impressive 1.7 times. This demonstrates the company’s ability to tap into profitable therapeutic areas with strong growth potential.

6. Consumer Healthcare Success: In the Consumer Healthcare segment, Mankind Ltd. achieved revenues of Rs. 208 crores in the first quarter of fiscal year 2024, representing an 8% year-on-year growth and a substantial 37% quarter-on-quarter growth. The growth of key brands such as Prega News, HealthOK, and Manforce condoms further highlights the company’s success in this segment.

7. Research and Development Focus: Mankind Ltd. has emphasized its commitment to being a science-based company and has invested in research and development. This focus on R&D is vital for product innovation, drug delivery systems, and strategic partnerships, all of which can provide a competitive edge in the pharmaceutical industry.

8. Financial Stability and Cash Flow: The company has demonstrated financial stability with a healthy net cash position of Rs. 1,727 crore. Additionally, cash flow from operations showed a significant increase from a negative Rs. 161 Crore in the first quarter of fiscal year 2023 to Rs. 488 crore in the first quarter of fiscal year 2024. This indicates efficient financial management and the ability to fund future growth.

9. Return on Capital: Mankind Ltd. has shown an increase in return on capital employed (ROCE) and return on equity (ROE) on a trailing 12-month basis, reaching 28% and 25%, respectively. This demonstrates the company’s ability to generate strong returns for its shareholders.

10. Strategic Priorities: The company has clear strategic priorities, including a focus on domestic growth, expanding in identified white spaces in key chronic therapies, and aggressive marketing efforts to maintain dominant brand leadership.

Key Challenges:

1. Market Dependency: Mankind Ltd. appears to be heavily dependent on the Indian market, as indicated by its commitment to domestic focus. Overreliance on a single market can leave the company vulnerable to economic, regulatory, or geopolitical changes that may negatively impact its operations and revenue.

2. Competition and Market Share: While the company has shown growth in market share, maintaining and increasing market share in a highly competitive pharmaceutical industry can be challenging. Rival companies may introduce new products or strategies that could erode Mankind’s market share.

3. Regulatory Environment: The pharmaceutical industry is subject to strict regulations, and changes in government policies or regulatory requirements could affect Mankind’s ability to operate, launch new products, or maintain pricing strategies. Compliance with evolving regulations is crucial and can be costly.

4. Healthcare Trends: Changes in healthcare trends, such as shifts in treatment protocols, the introduction of generic drugs, or changes in healthcare reimbursement policies, can impact the demand for pharmaceutical products. Mankind must stay adaptable to these shifts.

5. Dependency on Chronic Segment: While the company’s expansion into the chronic segment has been successful, this reliance on a specific therapeutic area exposes Mankind to risks associated with changing disease prevalence, treatment protocols, or competition within that segment.

6. R&D Challenges: While Mankind Ltd. has emphasized research and development, the success of R&D initiatives is not guaranteed. Developing new drugs and drug delivery systems can be costly and time-consuming, and there is a risk of failure in the development pipeline.

7. Global Expansion: If the company decides to expand beyond India, it may encounter challenges related to regulatory approvals, cultural differences, and market dynamics in other countries. International expansion involves unique risks.

8. Marketing and Branding Expenses: Mankind’s commitment to aggressive marketing may require substantial financial resources. Overspending on marketing without commensurate returns on investment could impact profitability.

9. Dependency on Key Brands: While the company has seen growth in key brands like Prega News, HealthOK, and Manforce condoms, dependence on a few brands for significant revenue can be risky. If these brands face challenges or lose market share, it could impact the overall financial performance.

10. Economic Factors: The pharmaceutical industry can be sensitive to economic downturns. Economic recessions or financial crises can lead to reduced healthcare spending, which may impact sales and revenue growth.