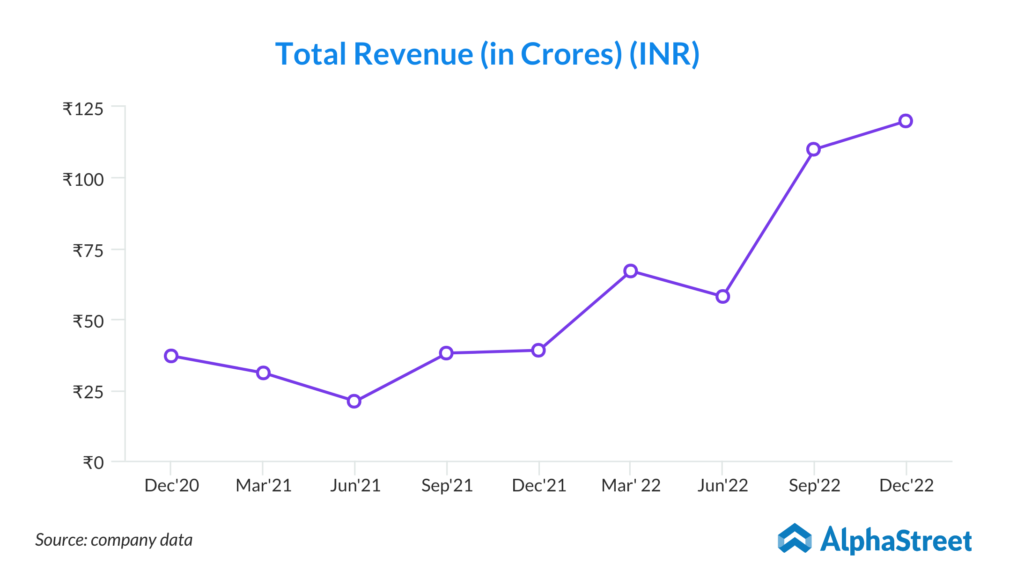

In Q3, we have delivered a good number of tests for them and that has also helped us make sure that we continue the delivery in the fourth quarter where the larger chunk of the order is going to be executed. And there also, a large part of it we have already executed and there is a significant chunk which will be executed in this month also. And overall, we are well on track to achieve the total order value that we disclosed that we will deliver in H2 of INR135 crores. We are well on track to achieve that number. – Saurabh Gada — Investor Relations, Aptech

Stock Data:

| Ticker | NSE: APTECHT & BSE: 532475 |

| Exchange | NSE & BSE |

| Industry | SOFTWARE & SERVICES |

Price Performance:

| Last 5 Days | +3.62% |

| YTD | +24.26% |

| Last 12 Months | +26.98% |

Company Description:

Aptech Ltd. is a well-established company with over 30 years of experience in providing vocational and non-formal academic curriculum-based training programs. The company has a global presence with over 800 centers worldwide and has successfully ventured into diverse sectors such as IT training, media & entertainment, retail & aviation, beauty & wellness, banking & finance, and pre-school segment. Aptech Ltd. offers two main streams of business – Individual Training and Enterprise Business Group – through its multi-brands such as Arena Animation, Maya Academy of Advanced Creativity, Lakmé Academy Powered by Aptech, Aptech Learning, Aptech Aviation Academy, and Aptech International Preschool. The company also offers online training in graphic design, animation, VFX, and game design through ProAlley.

Critical Success Factors:

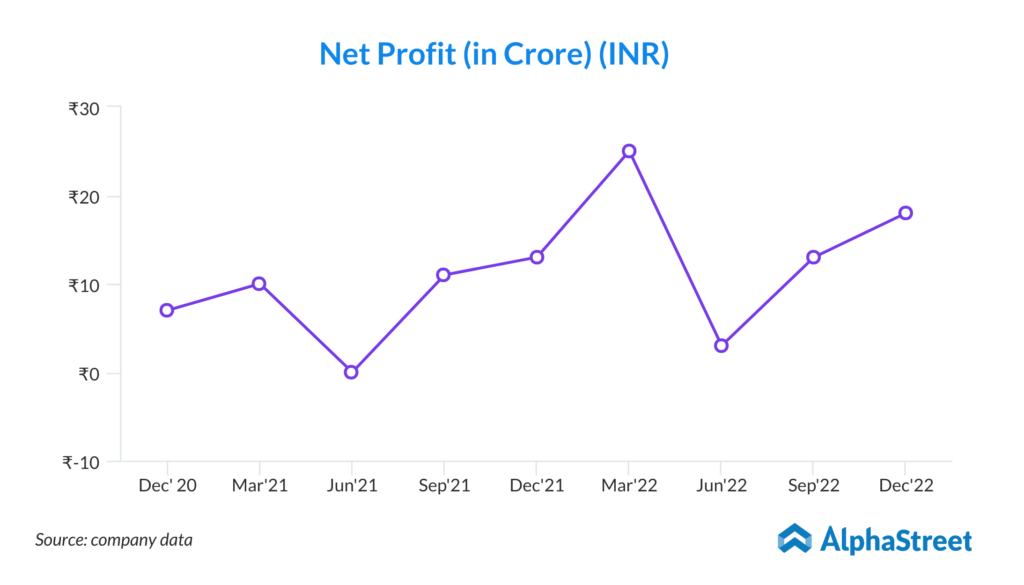

- Strong financial performance: Aptech Ltd. has shown exceptional performance in its Global Retail division, with a 36% increase in PBT levels over the previous year. This is a clear indication of the company’s strong financial position, and its ability to generate significant revenue and profits. In addition, the company has achieved a CAGR of 18% on the PBT level for the quarter, and 16% on a 9-month period basis, which is impressive, considering the fact that one year was lost to COVID. These strong financial results are a clear indication of the company’s financial stability and growth potential.

- Diversified revenue streams: Aptech Ltd. has a diversified revenue stream, with businesses in various areas, including the Education and Training Business Group (EBG) and the AVGC brands (MAAC and ARENA), among others. This diversification allows the company to reduce risk and maximize revenue potential, as it is not solely dependent on one area of business. This is evidenced by the fact that the company has shown strong growth in its EBG business, with exceptional margins and the winning of a significant order from an autonomous education body associated with the Central Government.

- Operational excellence: Aptech Ltd. has shown operational excellence in its delivery capabilities, with the company continuously expanding its delivery capabilities, crossing the milestone of one lakh exams per shift in the last quarter. This is a clear indication of the company’s ability to deliver higher stake, higher volume exams flawlessly across the country. Furthermore, the company has shown positive signs in the market with its new vertical in the AVGC brands, which is already contributing handsomely to the company’s booking in this area.

- Strong brand recognition: Aptech Ltd. has received recognition from The Economic Times as one of the best brands of 2022, which is a clear indication of the company’s strong brand recognition in the market. This recognition further strengthens the company’s position as a market leader, and its ability to attract new customers and retain existing ones. This is a clear advantage in a competitive market, and is a testament to the company’s commitment to providing quality education and training services.

- Robust cash flow: Aptech Ltd. has demonstrated robust cash flow, with a free cash flow of INR48 crores for the YTD period, which is a significant growth over last year. This indicates that the company has strong cash flow management and financial discipline, which is crucial for its long-term sustainability and growth. Furthermore, the company has shown strong return ratios, indicating that it is effectively utilizing its resources to generate profits and create value for its stakeholders.

Key Challenges:

- Aptech Ltd. faces several risks and concerns that could impact its financial performance and reputation. The first risk is the reliance on a limited number of clients, which represents a concentration risk. Aptech’s top five clients accounted for 63% of its revenue in 2020. If any of these clients were to reduce or terminate their business with the company, it could have a significant negative impact on Aptech’s financial results. To mitigate this risk, Aptech needs to diversify its customer base and reduce its dependence on a few clients.

- Another risk for Aptech is its exposure to foreign currency fluctuations. The company generates a significant portion of its revenue from overseas operations, which means it is subject to currency exchange rate risk. Changes in exchange rates could result in foreign currency translation losses or gains, which could negatively impact Aptech’s financial performance. Aptech needs to implement a hedging strategy to manage this risk and reduce the impact of currency fluctuations.

- Thirdly, the rapid pace of technological change represents a risk for Aptech. The company operates in a highly competitive industry, where technological advancements occur frequently. If Aptech fails to keep up with these changes, it could lose market share to its competitors. To mitigate this risk, Aptech needs to invest in research and development to ensure that its products and services remain relevant and competitive.

- Another concern for Aptech is the regulatory environment. The company operates in several countries and is subject to various regulations and laws. Any changes in regulations could impact Aptech’s business operations and increase compliance costs. Therefore, Aptech needs to monitor the regulatory environment and ensure that it complies with all applicable laws and regulations.

- Finally, Aptech faces the risk of cybersecurity threats. The company holds sensitive information about its clients, which could make it a target for cyberattacks. A data breach could lead to reputational damage, financial losses, and legal liabilities. Aptech needs to implement robust cybersecurity measures to prevent cyber threats and ensure that its clients’ data is protected.

- In conclusion, Aptech Ltd. faces several risks and concerns that could impact its financial performance and reputation. The company needs to diversify its customer base, implement a hedging strategy to manage currency risk, invest in research and development, monitor the regulatory environment, and implement robust cybersecurity measures to mitigate these risks and concerns. By addressing these issues, Aptech can improve its financial performance, ensure compliance with regulations, and protect its clients’ data.