The Indian cement market is drawing major players, such as Adani Group, which purchased a 63.1% stake in Ambuja Cements. This deal has made Adani group as India’s 2nd largest cement manufacturer. Similarly, as of March 2022, billionaire investor and founder of Dmart Radhakrishna Damani owned 8.14% of India Cement. While Premji Invest Opportunities Fund, Azim Premji’s investment company, has chosen to invest more than 10% of its capital in Hyderabad-based Sagar Cements. Why are these billionaires Showing interest in the cement sector? Read this report to find out more.

Background of Cement Sector

India produces over 7% of the world’s installed cement capacity, making it the second-largest cement producer in the world. India currently produces 298 Million Tonnes per Annum of cement at its installed capacity of 500 MTPA. According to Fortune Business Insights, the market value was increased to $340.61 billion in 2022 from $326.81 billion in 2021. It may shoot up to $481.73 billion by 2029.

Minerals like limestone (calcium), bauxite (aluminum), coal, and iron ore are commonly used in the production of cement. The majority of raw materials are readily available throughout India, so cement manufacturers incur zero or minimal import costs. In India, there are many different varieties of cement. However, the most popular type of cement, known as “Ordinary Portland Cement,” is appropriate for all general concrete construction.

Factors Affecting Cement Prices & Current Price Scenario

Cement is a commodity that is manufactured in large quantities. Therefore, cement transportation is challenging and adds significantly to the overall cost. As a result, any increase in fuel costs has a big impact on cement prices. Thermal energy from coal is used to run the cement factory. So, in addition to transportation, power also has a significant impact on the price of cement.

The war between Ukraine and Russia contributed to the ongoing upward trend in coal and fuel cost. To offset the inflationary headwinds from coal and petrol, companies have increased the price of cement. However, the margins for the majority of the companies were still impacted because the price increase was insufficient to offset the inflation. For the upcoming few quarters, we should continue to see cement prices rise.

Government Infra Push & Growth Forecast

The Indian government unveiled its “PM Gati Shakti – National Master Plan (NMP)” for multimodal connectivity in October 2021. It will include infrastructure initiatives from different Ministries and State Governments, such as UDAN, Bharatmala, Sagarmala, inland waterways, dry/land ports, and Sagarmala. To increase connectivity, economic zones such as fishing clusters, textile clusters, pharmaceutical clusters, defense corridors, electronic parks, industrial corridors, and agri zones will be covered. The Union Budget 2022-23 allocated $26.74 billion for road infrastructure and $ 18.84 billion for railways. Additionally, 8 million homes worth $6.44 billion will be constructed as part of the PM Awaj Yojna. Therefore, all of these initiatives will increase cement demand in the future.

By FY 2027, the demand for cement in India is anticipated to reach 419.92 Million Tonnes. According to the IMARC report, the CAGR for the cement market in India is predicted to be 4.8% from 2022 to 2027. Crisil Ratings predicts that by FY24, the Indian cement industry will likely add 80 MTA capacity, the most in ten years.

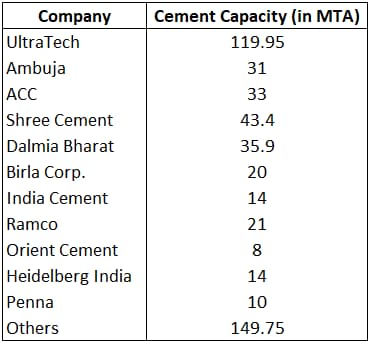

Between April 2000 and March 2022, FDI inflows into the sector, which is involved in the production of cement and gypsum products, totaled US$5.48 billion. The businesses are also reinvesting to boost capacities more quickly. For instance, UltraTech Cement approved a capital investment of $1.65 billion to add 22.6 MTA to its capacity. The eastern states of India are probably the cement industry’s newer and untapped markets, and they could help cement companies’ bottom lines in the future.

Read more: The Impact of National Logistics Policy on Cement Sector

Cement Sector in China

China is the world’s largest cement producer, with 2500 Million Tonnes of cement produced in 2021. However, according to China’s National Bureau of Statistics, the nation’s cement production decreased from 1.14 Billion Tonnes in the same period in 2021 to 979 Million Tonnes in the first half of 2022, a 14.5% year-over-year decline. The financial results for the first half of the year have also been released by the major cement producers in China, and the results are not promising. The situation has been attributed to numerous coronavirus outbreaks, volatility in the housing market, a lack of funding for infrastructure projects, and rising energy and raw material prices.

Climate Actions on Cement Production

Cement is one of the most widely used products, and it emits a significant amount of CO2 each year. Additionally, the cement factories significantly pollute the environment with carbon monoxide, nitrogen oxide, and Sulphur dioxide. One of the biggest sources of air pollution is this industry. Health risks from the emissions include headaches, eye irritation, cardiovascular conditions, and more.

As a result, the global cement industry is taking more and more climate action, which is encouraged by advancements in technology, policy, and new business opportunities that can be realized by lowering greenhouse gas emissions and increasing profits. The Indian cement industry has responded extremely well to climate action. Dalmia Bharat has taken steps to replace natural resources with eco-friendly raw materials and waste products from other industries. By 2040, the company plans to become a carbon-positive enterprise. UltraTech has filed four patents for products that use fewer natural resources, such as fossil fuels and limestone, than conventional products. These products will eventually contribute to water conservation and reduced environmental impact.

Many companies are performing research to reduce the clinker factor in cement to make it more eco-friendly. Every 1% decrease in clinker factor can cut CO2 emissions by 8–9 kg/cement. Clinker, however, is in charge of giving cement strength. Therefore, its percentage cannot be significantly reduced. Clinker, an intermediate product, is created by heating limestone to 1400 degrees Celsius. Cement is made by grinding a clinker and gypsum mixture.

In general, cement companies are switching from coal-generated energy to green energy sources like solar and wind energy. Companies are also implementing waste recovery systems that generate electricity by utilizing hot gases produced during the manufacturing process. This system lowers the cost of electricity generation for cement companies while also limiting carbon emissions in the sector.

Investment Opportunities In Cement Sector

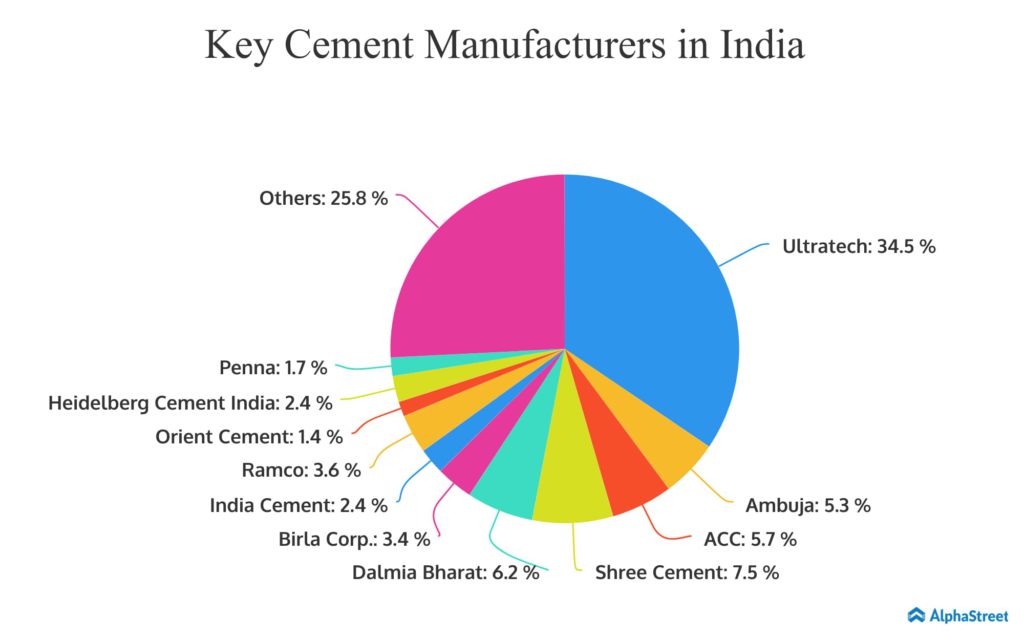

On Indian stock exchanges, there are more than 25 companies that are engaged in the production of cement. The increased demand for cement in India will benefit big players like Ultratech, Ambuja, and Shree Cements and may give a good return. However, there are a few small-cap companies that can outperform the market.

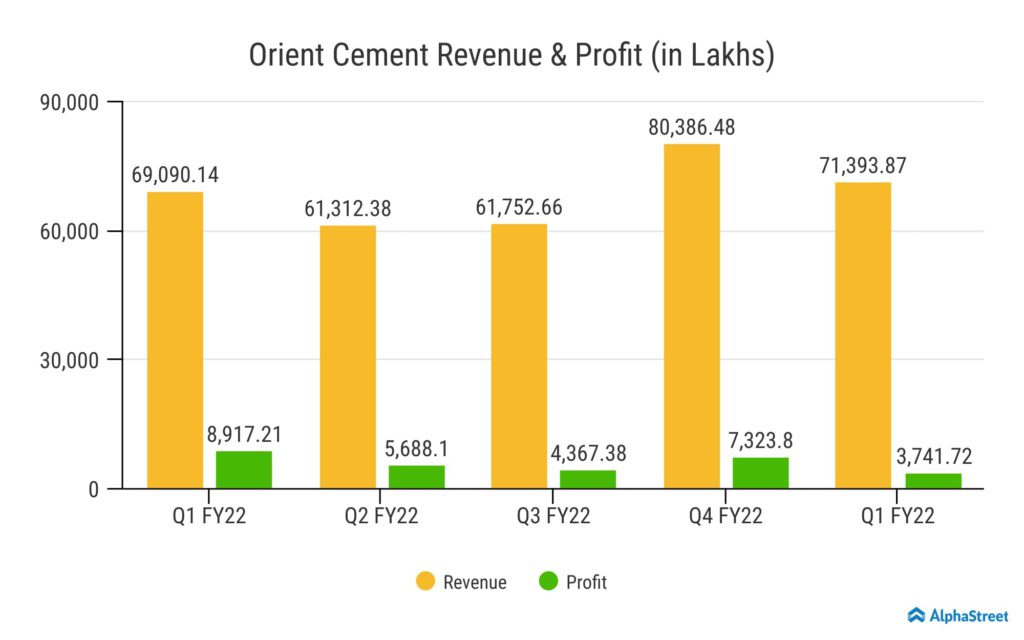

Orient Cement

Orient Cement (NSE: ORIENTCEM) produces two different types of cements: Portland Pozzolana Cement (PPC) and Ordinary Portland Cement (OPC). In the previous five years, the company’s profits improved by 59%. Furthermore, with a Debt-to-Equity ratio of 0.2, Orient Cement has significantly reduced its debt by 429.72 Crore. The stock has elevated by 3% over the past week. While it moved by almost 5% over the course of a month to ₹125.15 from ₹115.7.

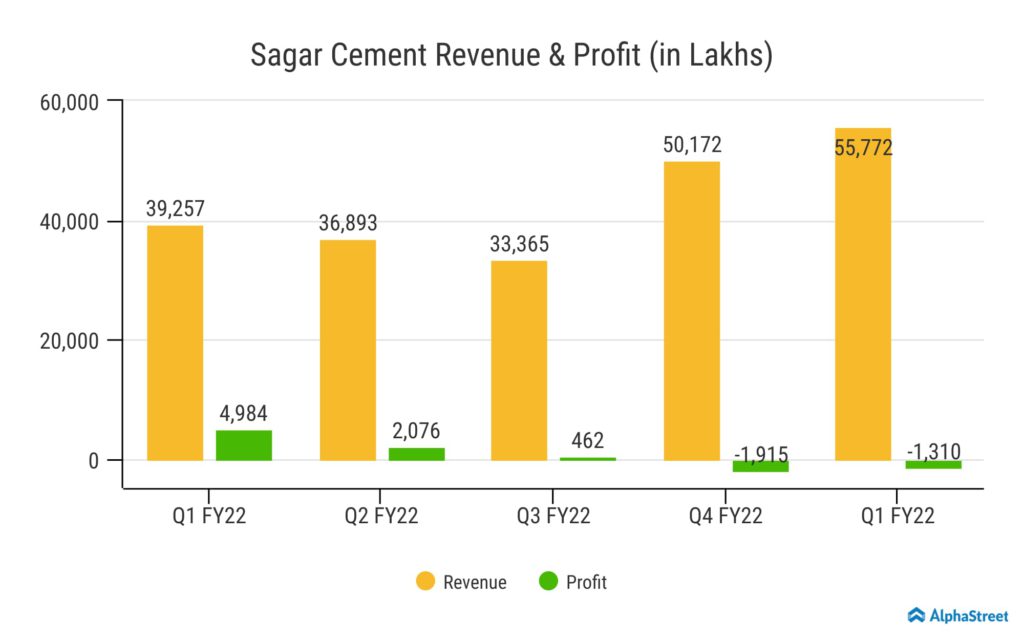

Sagar Cement

Sagar Cement Ltd. (NSE: SAGCEM) produces a variety of cement types, including Ground Granulated Blast-furnace Slag (GGBS), Ordinary Portland Cement (OPC) of grades 53 and 43, Portland Pozzolana Cement (PPC), Sulphate Resistant Portland Cement (SRPC), and Portland Slag Cement (PSC) (GGBS). In the last five years, the company has shown excellent profit growth of 76%. By 2025, the management aims to boost the installed production capacity to 10 MTA from 8.5 MTA. In last 30 days, the share price was increased to 209.15 from ₹190.85. The company’s share price was elevated by approximately 10% and touched ₹211.20 on 19th August.