Being India’s largest company by sales, profits, and market value, Reliance Industries (NSE: RELIANCE) turned triumphant striking a balance between consumer business and energy. The company’s recent earnings report reflects strong profits and revenues in major segments such as digital services and retail, though the Oil-to-Chemicals business remained muted on energy market headwinds. Additionally, digital transformation, omnichannel retail strategy, and continuous customer additions bode well. Though macro uncertainties loom, the company is focused on long-term growth avenues and moving toward green energy business. Therefore, based on the company’s strong fundamentals, high returns, and long-term growth prospects, investors may build a position in the stock at the current level. Moreover, the company’s sound dividend policy makes it an attractive investment.

Overview

Headquartered in Mumbai, Reliance Industries Limited (RIL), an Indian multinational conglomerate company, is a Large Cap company that operates in the Diversified sector. It is a Fortune 500 company and the largest private sector corporation in India.

With a market capitalization of about Rs 16,661 billion, RIL operates diverse businesses such as energy, petrochemicals, natural gas, retail, telecommunications, mass media, and textiles. Being triumphant in all its segments, the company is listed both on the BSE (Bombay Stock Exchange) and the NSE (National Stock Exchange) in India.

Segment Details

Retail: The segment braved all COVID restrictions and continued to expand on both fronts offline and online. The company experienced superior revenues and EBITDA with steady improvement in profit margins in the retail business.

Digital Services: With best-in-class service quality and value, along with a rising subscriber base, Jio has turned triumphant being the market leader for consecutive past three fiscal years. It has also explored fiber-based wireline broadband connectivity with more than 5 million connected homes and is expanding in 5G, with its advanced technology.

Oil to Chemicals: Post-pandemic, with the recovery in the economy, the global demand for oil and transport fuels grew speedily, supporting the refining margins of the company. Though macroeconomic challenges such as global logistics and elevated freight persisted impacting demand, Reliance continued to innovate and improve its operations. Additionally, RIL’s superior O2C assets and strong backward integration are likely to continue to maximize output and returns for the segment. Interestingly, the company is working on plans to move towards a sustainable, carbon-neutral, circular economy business in the coming years.

Oil and Gas E&P: Despite the COVID pandemic, RIL has moved forward with its projects. Two of the three phases of the KG-D6 development project had been commissioned. Further, Reliance and bp completed the work on Satellite Cluster and R-Cluster fields to start production and moved forward during the 2022 fiscal year. Notably, KG-D6 is now producing about 20% of India’s gas production and is expected to reach 30%. Remarkably, with a recovery in domestic pricing of natural gas, this segment is performing well.

Recent Share Price Insights

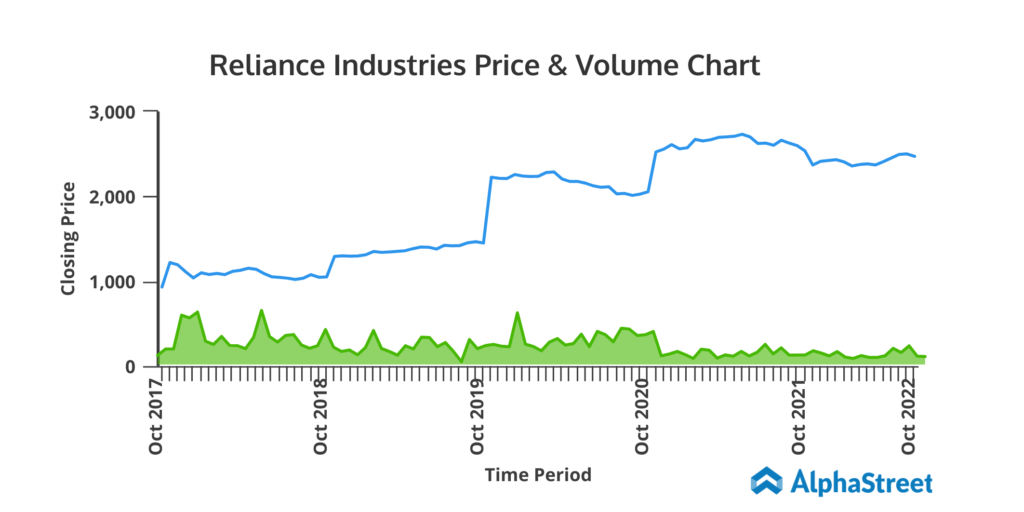

- With the current price of Rs 2,454 (as of October 25), RIL depicts an upside potential of more than 16% compared to the high of its 52-week range of Rs 2,180 – Rs 2,856.15.

- The stock recorded a 3-year return of 71.58% as compared to the Nifty 100 return of 52.65%.

Financial Snapshot

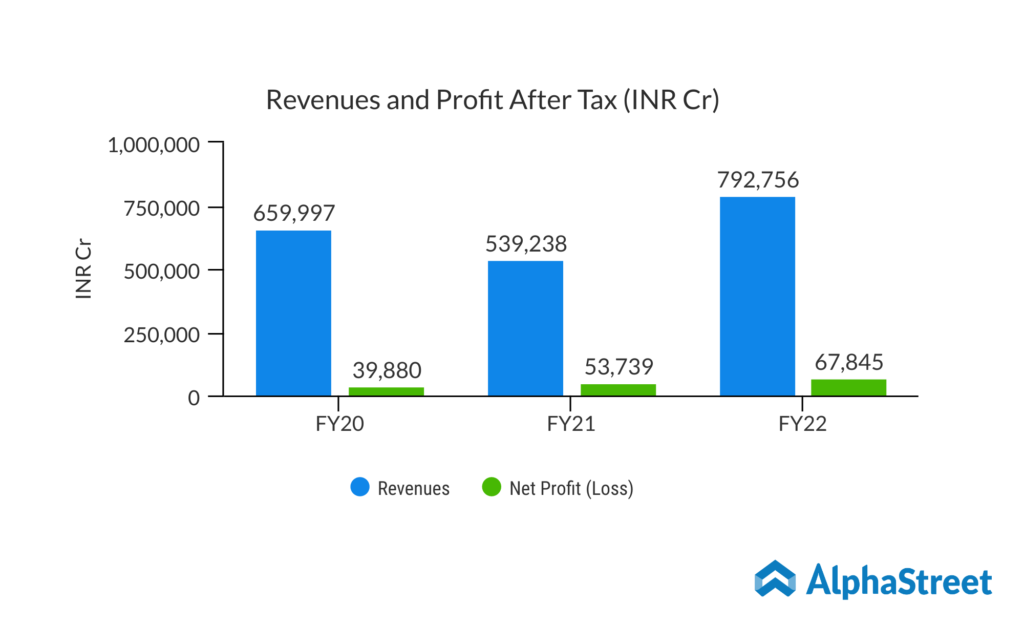

Recently, on a consolidated basis, RIL recorded gross revenues of Rs 2,53,497 crore, up 32.4% YoY riding on broad-based growth almost in all verticals. Revenues from operations grew 33.7% YoY to Rs 2,32,863 crore.

Net profit came in at Rs 15,512 crore, up marginally on a YoY basis. Results were impacted by subdued O2C business. Earnings per share (EPS) were Rs 20.20, down 3.3% from the prior-year quarter. EBITDA including certain charges stood at Rs 34,663 crore, up 14.5% YoY driven by consumer businesses and upstream.

Jio Platforms Limited recorded revenues of Rs 24,275 crore, up 22.7% YoY. As of September 30, 2022, the total subscriber base came in at 427.6 million.

Commenting on the strong quarterly results, Mukesh D. Ambani, Chairman and Managing Director of RIL said, “I am pleased with the record performance of our consumer businesses which continue to scale new milestones every quarter. We saw consistent net subscriber additions and higher engagement in Digital Services segment…Our Retail business delivered record performance with strong revival in footfalls, store additions and digital integration…Performance of our O2C business reflect subdued demand and weak margin environment across downstream chemical products…Our domestic Oil & Gas business continued to deliver robust performance maintaining production at 19 MMSCMD levels in the KG D6 block, significantly enhancing energy security for the country. We are confident of commissioning MJ Fields by year end.”

Factors to Consider

Revenue Growth: RIL recorded strong revenue growth over the past three years with a CAGR of 6.3% in FY2022. The uptrend continued in the first six months of FY2023, which is expected to trend higher on broad-based growth in all major units.

Earnings Growth: Earnings per share reflected an uptrend over the past three years with a CAGR of 13.39% in FY2022 riding on strong revenues. The rising trend continued in the first six months of FY2023. Continuation of such a trend will help the company to deal with economic downturns and macro uncertainties.

Increasing ARPU (Average Revenue Per User): With the strategy of aggressive pricing for Jio, RIL succeeded in gaining and retaining its market share in the telecom business. Notably, the industry has experienced elevated tariffs over the past few months. Will this price hike, ARPU per month of Rs 130.3 in FY20 rose to Rs 177.2 as of September 30, 2022. The continuation of this trend is expected to consistently improve the net margins of the telecom business.

Expenses: Though the company has experienced volatility in terms of costs due to global hues, it recorded decent margins over the past few quarters. As of September 30, 2022, the operating and net profit margins came in at 10.2% and 7%, respectively. Going forward, prudent cost management is expected to improve margins.

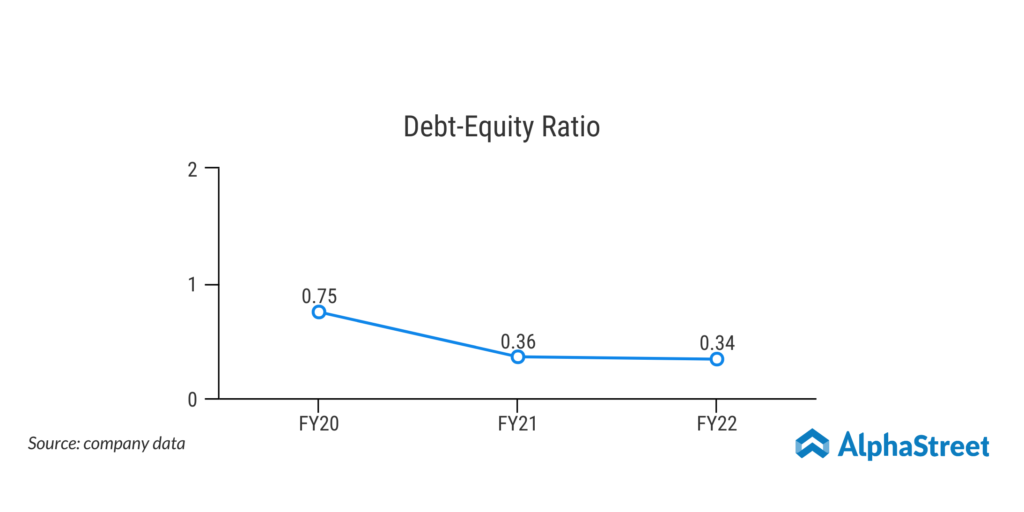

Dividend Policy: Over the last three years, the company has increased its dividend per share from Rs 6.5 to Rs 8 in FY22. Such efforts reflect the company’s commitment to return value to its shareholders, along with its strong cash generation capabilities. Also, with a reduced debt-equity ratio, capital-deployment activities seem sustainable for the long term.

Focus on ESG: With technological advancement, the Green Energy global industry is rapidly evolving. To take the initiative, last year, Reliance announced a $10 billion Capex over three years in this space. Though the return on new investments is likely to take time, in the medium term, it may improve the company’s ESG score. This will aid in getting funds globally and improving overall valuations. Interestingly, the recent acquisition in the clean energy space indicates the company’s target to establish its place in this green energy business.

Recent Highlights

Recently, Reliance Jio Infocomm Limited (Jio) introduced JioTrue5G-powered Wi-Fi services in the temple town of Nathdwara, Rajasthan. It will expand services in high-footfall areas such as Educational Institutes, Religious places, Railway Stations, Bus stands, Commercial Hubs, and many more.

The Board of Directors of RIL has approved a plan, according to which the financial services undertaking of the company will be demerged into Reliance Strategic Investments Limited (RSIL), the wholly-owned subsidiary of RIL. It will be renamed Jio Financial Services Limited (JFSL) and will be listed on the Indian stock exchanges. Notably, all shareholders of RIL will get one equity share of JFSL for every share held.

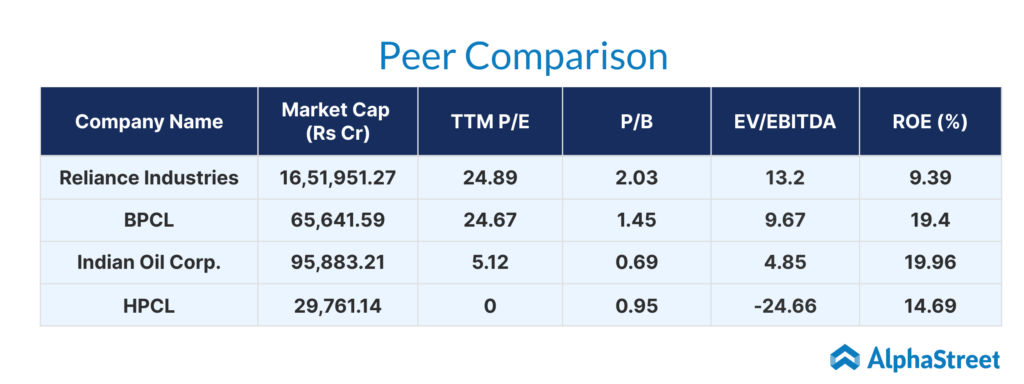

Peer Comparison

In terms of market capitalization, RIL ranks much higher than its peers. Based on decent ROE, long-term growth potential, and strong fundamentals, investors can consider RIL an attractive investment, despite it seeming overvalued at the current level compared to its industry peers.