Mumbai-based Indian multinational conglomerate company Reliance Industries Limited (NSE: RELIANCE) will release its financial results for the second quarter of Fiscal 2023 on October 21, after the market close. It has diverse businesses including hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, retail, and digital services.

Segment Expectations

India’s largest private sector company is expected to report strong second-quarter earnings driven by robust retail sales on store additions, Reliance Jio telecom’s profits, and a modest increase in ARPU (Average Revenue Per User).

However, the company’s oil-to-chemicals (O2C) business is expected to have mar results sequentially to some extent. The business has been impacted by several headwinds in the energy sector during the September quarter. Closure of refineries, windfall taxes on fuel exports, and reduced product cracks are expected to act as negatives. Also, subdued demand for petrochemicals in China is likely to have added fuel to the fire.

Notably, the company’s EBITDA might experience the pressure of reduced gross refining margins and windfall tax.

Last Quarter Earnings

In the June quarter, Reliance Industries posted record quarterly earnings backed by robust O2C earnings, record retail revenues, and a strong rebound in Jio net subscriber addition. Additionally, increased production in KGD6 and improved realizations benefited Oil and Gas business.

Overall, total revenues came in at Rs 242,982 cr, up 53% YoY. Also, EBITDA and net profit jumped 45.8% and 40.8%, respectively, on a year-over-year basis.

Concluding Remarks

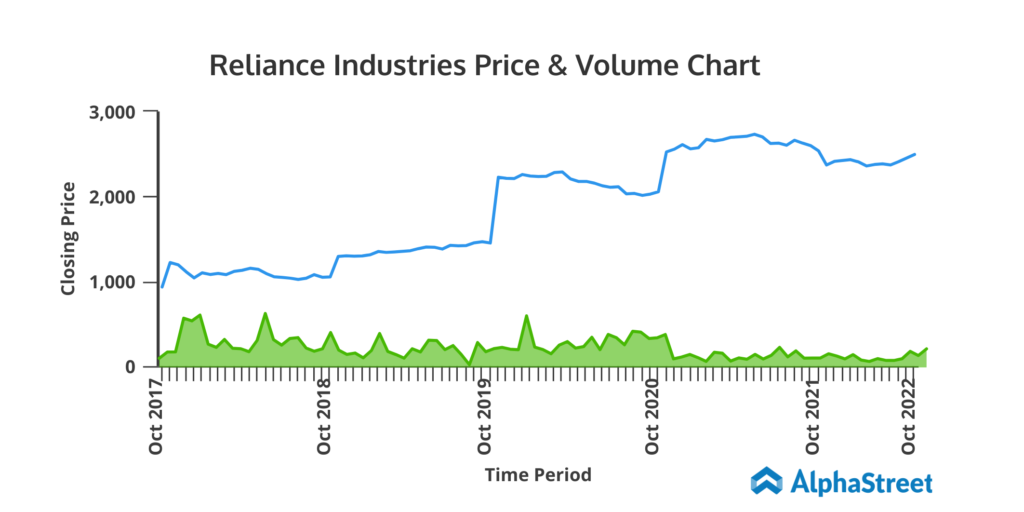

With a market capitalization of about Rs 16.92 trillion and strong business momentum, Reliance Industries has emerged triumphant in the industry. Moreover, the company’s move towards the green energy business is expected to reap benefits in the future. Currently, shares are trading 12% down from the 52-week high figure. As a result, based on the company’s positive earnings expectations, strong returns, and robust fundamentals, investors can consider the stock an attractive investment.