Reliance was founded by Dhirubhai Ambani and is now promoted and managed by his elder son, Mukesh Dhirubhai Ambani. Ambani’s family has about 50% shareholding in the conglomerate. Presenting below are its Q1 FY26 earnings.

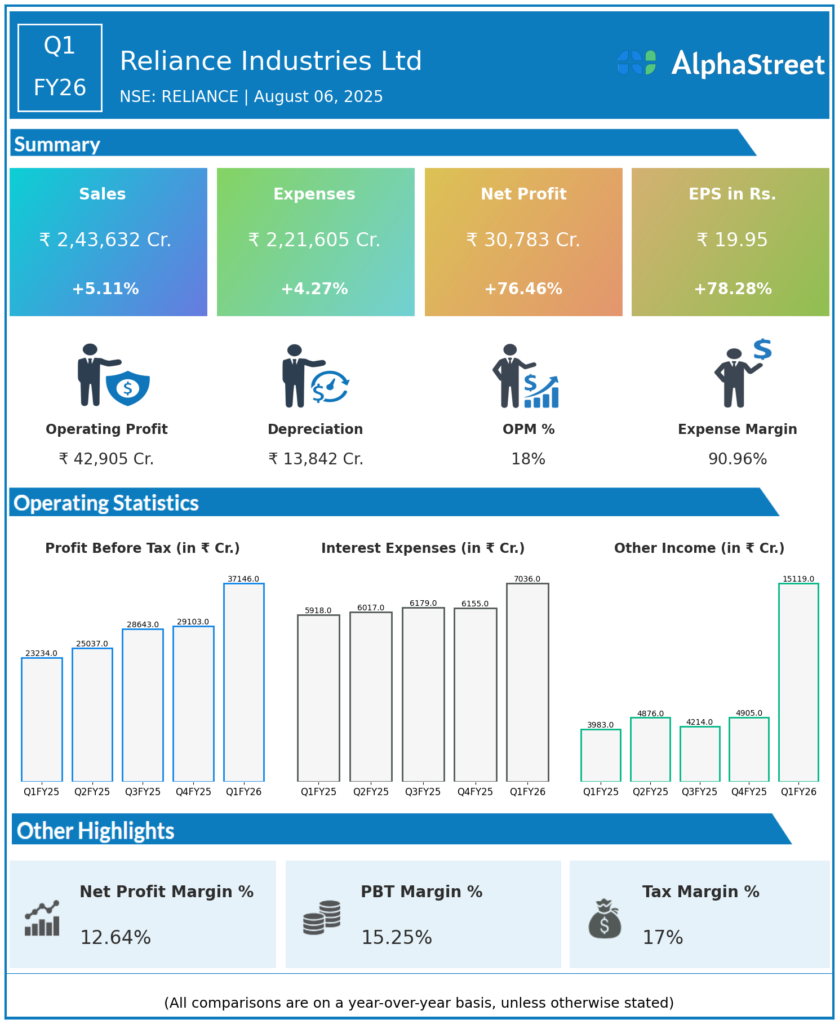

Q1 FY26 Earnings Summary

-

Consolidated Revenue: ₹2,73,252 crore, up 6% year-over-year (YoY).

-

Revenue from Operations: ₹2,43,632 crore, up 5.1% YoY from ₹2,36,217 crore.

-

Net Profit (PAT): ₹30,783 crore, up 76% YoY from ₹15,138 crore; profit includes a one-time gain of ₹8,924 crore from the Asian Paints stake sale. Excluding one-offs, recurring profit rose 25%.

-

EBITDA: ₹58,024 crore, up 36% YoY, with margin expanding by 460 basis points to 21.2% (Q1 FY25: 16.6%).

-

EPS: ₹19.95, up 78% on the YoY basis.

-

Segment Highlights:

-

Jio Platforms: Profit +25% YoY to ₹7,110 crore; robust 24% EBITDA growth. ARPU increased to ₹208.8.

-

Jio 5G: Subscriber base crossed 200 million; JioAirFiber now has 7.4 million users, making it the largest FWA provider globally.

-

Retail: Registered customer base grew to 358 million; robust EBITDA and margin growth, new store expansions.

-

Oil-to-Chemicals (O2C): EBITDA improved YoY, bolstered by domestic fuel margins, higher transportation fuels through Jio-bp.

-

Oil & Gas: Marginal EBITDA drop due to natural decline in KG-D6 gas field production.

-

-

Capital Expenditure: ₹29,875 crore during the quarter.

Key Management Commentary & Strategic Highlights

-

Mukesh Ambani (Chairman): “Reliance has begun FY26 with a robust, all-round operational and financial performance, despite significant volatility in global macros. All major businesses delivered strong results – we are committed to our track record of doubling every 4–5 years.”

-

Strategic Initiatives:

-

Continued investment in new energy, consumer, and technology businesses.

-

Focus on indigenization, sustainability, and technological innovation.

-

Retail expanding FMCG portfolio and omnichannel strategy.

-

Jio driving digital leadership, 5G expansion, and FWA.

-

O2C business well-positioned to benefit from domestic demand recovery.

-

Q4 FY25 Earnings Summary

-

Consolidated Revenue from Operations: ₹2,61,388 crore, up 10.5% YoY from ₹2,36,533 crore.

-

Net Profit (PAT): ₹22,611 crore, up 6.4% YoY.

-

EBITDA: ₹43,832 crore, up 3.1% YoY; margin driven by double-digit growth in Digital Services and Retail, offsetting energy softness.

-

Key Segment Drivers:

-

Digital Services (Jio): 17% YoY growth, ARPU at ₹206+, subscriber leadership.

-

Retail: Store, transaction, and revenue expansion.

-

O2C: 15.4% YoY revenue growth; improved volumes, product placement.

-

-

Dividend: Board approved final dividend of ₹5.50/share for FY25.

To view the company’s previous earnings, click here