Refex Industries Limited specializes in trading eco-friendly refrigerant gases and providing comprehensive solutions for responsible coal procurement and ash disposal.

Q3 FY26 Earnings Results

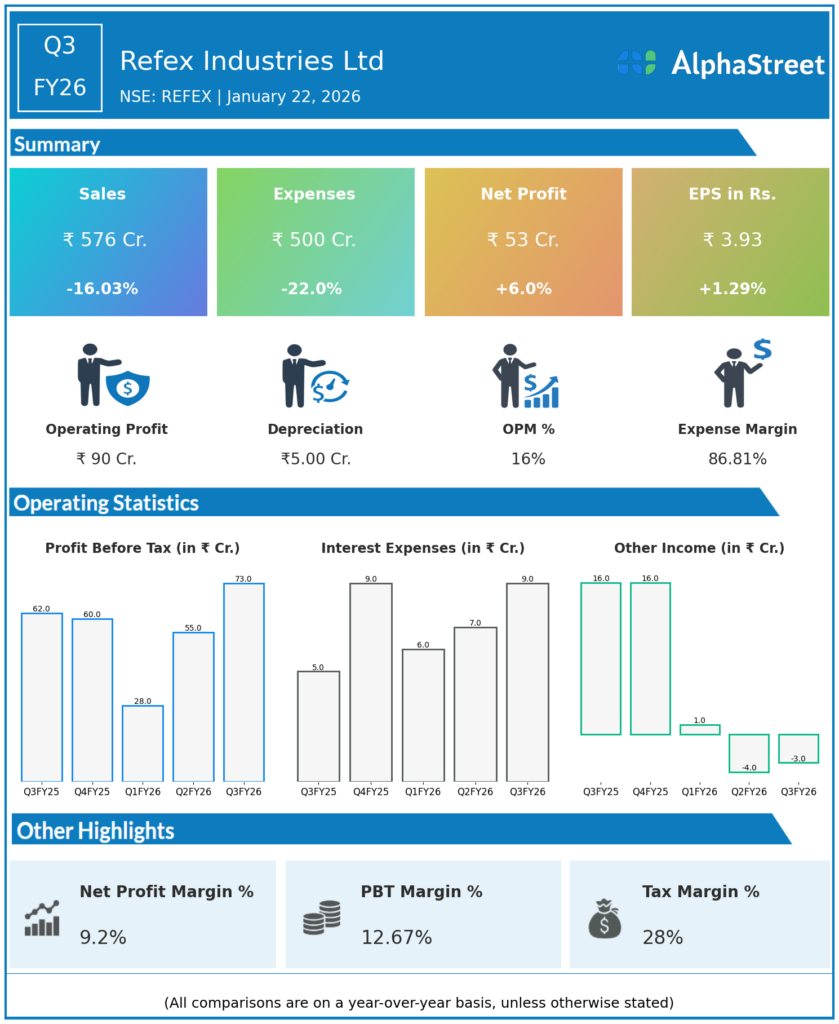

- Revenue from Operations: ₹576.01 crore, down 16.0% YoY from ₹686.04 crore in Q3 FY25; up 37.2% QoQ from ₹419.88 crore in Q2 FY26.

- Total Income: ₹590.29 crore, up 38% QoQ.

- EBITDA: ₹93.91 crore, up 76.3% YoY from ₹53.28 crore; EBITDA margin 16.1% vs 7.8% YoY (830 bps expansion).

- PBDT: ₹86.41 crore, up 18% YoY from ₹73.01 crore.

- PBT: ₹81.37 crore, up 16% YoY from ₹70.38 crore.

- Profit After Tax (PAT): ₹53.92 crore, up 7.7% YoY from ₹50.05 crore; up 44% QoQ from ₹37.44 crore.

- PAT margin: 9.4% vs 7.3% YoY.

- 9M FY26:

- Total Income: ₹1,398.68 crore, down from ₹1,853.44 crore.

- EBITDA: ₹207.38 crore, up from ₹153.21 crore; margin 15.1% vs 8.4%.

- PAT: ₹112.53 crore, up from ₹110.46 crore.

Management Commentary & Strategic Decisions – Q3 FY26

- Management highlighted strong sequential growth driven by Ash & Coal Handling segment momentum and new project ramp‑ups, despite YoY revenue decline from discontinued non‑core businesses.

- Strategic realignment: Board approved discontinuance of low‑margin Refrigerant Gases business to focus on high‑margin Ash & Coal Handling (order book ₹1,500 crore) and emerging Wind Energy segment (deliveries from Feb 2026, substantial FY26 revenue expected).

- Promoter pledge reduction: Plans to substantially reduce 25–26% promoter pledge over 6 months, strengthening ownership structure.

- Outlook: Strong Ash & Coal order book provides visibility; Wind business to contribute meaningfully by FY26 end.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹419.88 crore.

- Total Income: ₹433 crore, up 15% QoQ.

- EBITDA: ₹75.3 crore, margin 17.4% (up from 10.9% prior quarter).

- PAT: ₹37.44 crore.

- H1 FY26: PAT ₹59.62 crore.

Management Commentary & Strategic Directions – Q2 FY26

- Q2 showed strong sequential recovery in Ash & Coal Handling despite early monsoon impact; focus on cost discipline and high‑margin segments positioned company for H2 acceleration.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.