Established in the year 1993, Redington Limited is a leading distributor of IT and mobility products and a provider of supply chain management solutions and support services in India, the Middle East, Turkey and Africa. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

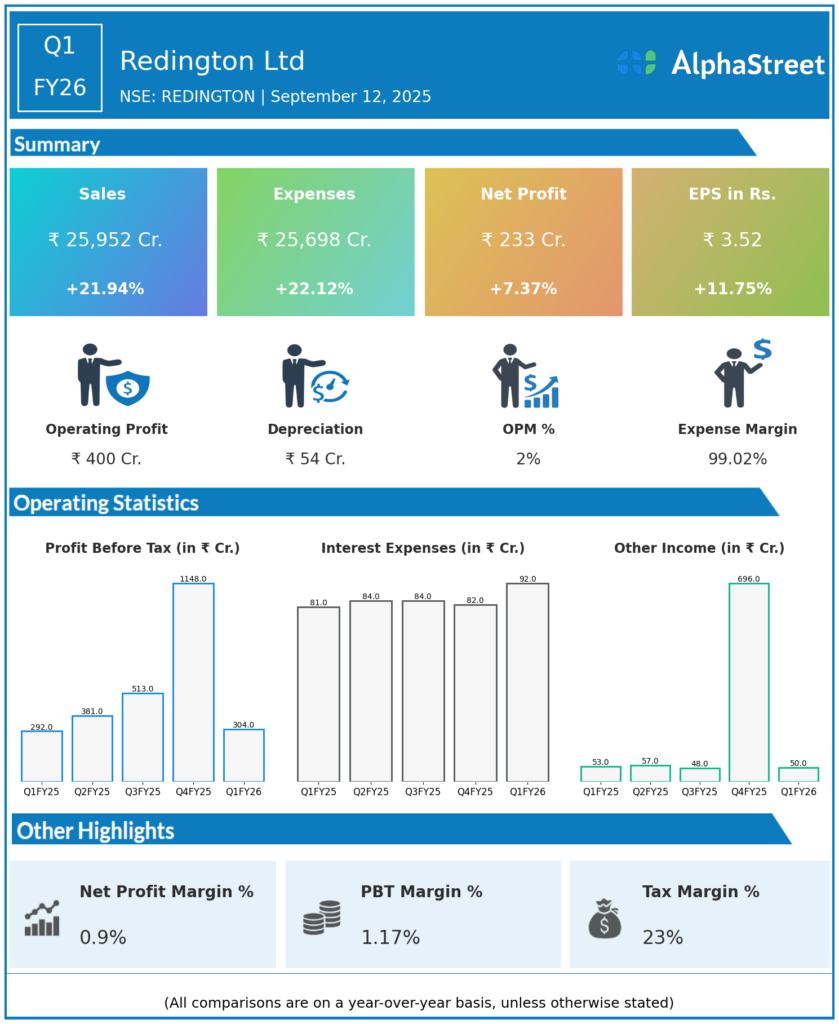

Total Income: ₹25,952 crores, up 15.5% QoQ (Q4 FY25: ₹22,512.73 crores) and up 21.9% YoY (Q1 FY25: ₹21,335.29 crores).

-

Profit After Tax (PAT): ₹232.98 crores, down 28.1% QoQ (Q4 FY25: ₹323.89 crores) but up 7.3% YoY (Q1 FY25: ₹217.04 crores).

-

Earnings Per Share (EPS): ₹3.52, down 16.7% QoQ (Q4 FY25: ₹4.20) but up 11.7% YoY (Q1 FY25: ₹3.10).

-

EBITDA: ₹401 crores, up 8% YoY (Q1 FY25: ₹371 crores); EBITDA margin 1.6% vs 1.7% last year.

-

Profit Before Tax (PBT): ₹304.33 crores, down 20% QoQ (Q4 FY25: ₹380.54 crores), up 4.1% YoY (Q1 FY25: ₹292.46 crores).

-

Tax Expense: ₹71.35 crores, up 25.9% QoQ and down 5.4% YoY.

-

Other Highlights:

-

Cloud solutions reported 41% YoY growth.

-

Premium mobility and large deal wins drove India/UAE business strength.

-

Working capital metrics remain stable; ROCE is 19% as of FY25.

-

Key Management Commentary & Strategic Highlights

-

CEO Hariharan emphasized robust execution, expanding cloud/software offerings, and digital transformation as core growth drivers; cloud segment grew 41% YoY.

-

The company sharpened focus on cyber-security, application software, and subscription-model solutions to capture the next wave of technology distribution.

-

International business (notably UAE and India) saw strong momentum from premium mobility segment and large contract executions.

-

Despite revenue growth, profit softness was partly due to higher taxes and margin pressure from competitive intensity in hardware distribution.

-

Management continues to invest in digital capabilities and geographic reach, positioning Redington for further business scalability.

Q4 FY25 Earnings Results

-

Total Income: ₹26,440 crores.

-

Profit After Tax (PAT): ₹918 crores.

-

Earnings Per Share (EPS): ₹8.51.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.