REC is a Central Public Sector Undertaking under the Ministry of Power involved in financing projects in the complete power sector value chain from generation to distribution. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

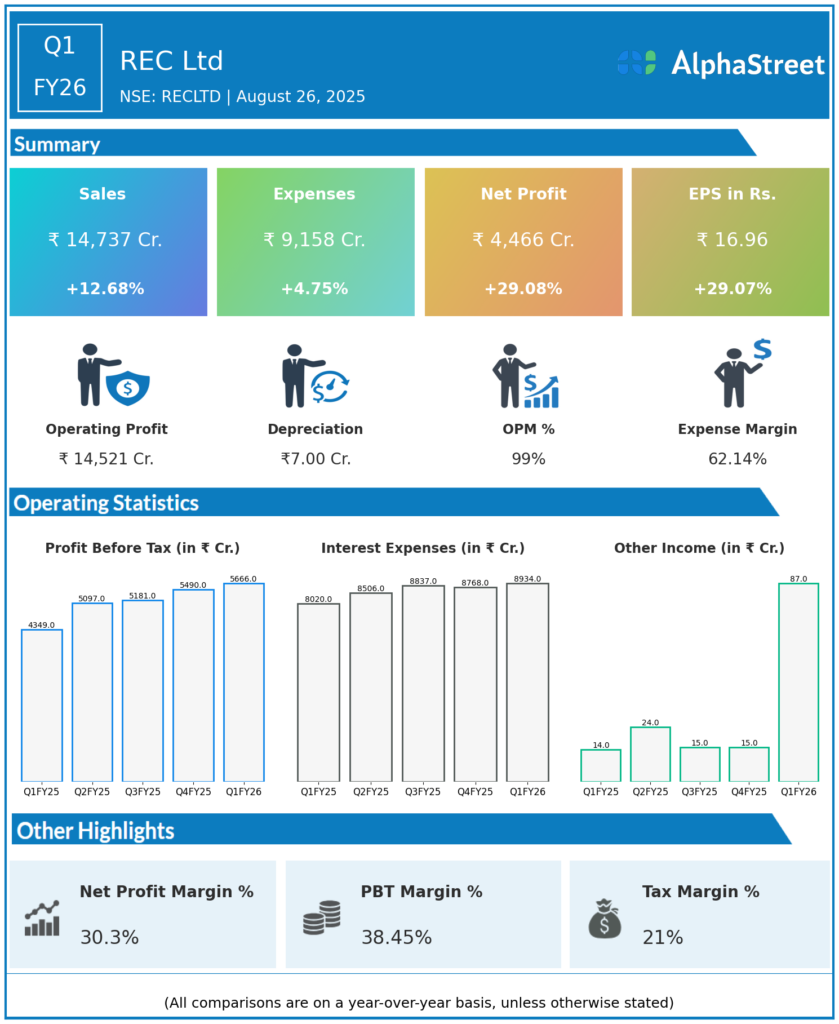

Consolidated Revenue from Operations: ₹14,737 crores, up 12.6% YoY from ₹13,078.66 crores in Q1 FY25.

-

Net Profit (PAT): ₹4,465.7 crores, up 29% YoY from ₹3,460.2 crores.

-

Profit Before Tax (PBT): ₹4,653 crores approximately, up sequentially from previous quarter.

-

Earnings Per Share (EPS): ₹16.96.

-

Net Worth: ₹80,440 crores as of June 2025, up from ₹72,936 crores a year earlier.

-

Debt-Equity Ratio: 6.31; Total Debt to Asset Ratio: 0.80.

-

Capital Adequacy Ratio (CRAR): 23.98%.

-

Asset Quality: Gross Non-Performing Assets (NPAs) improved to 1.05% and Net NPAs to 0.24% compared to previous year.

-

Dividend: Interim dividend of ₹4.60 per equity share announced for FY26.

-

Loan Disbursement: ₹59,508 crores during Q1 FY26, loan book stood at ₹5.85 lakh crore.

Management Commentary & Strategic Decisions

-

Management highlighted strong operational revenues, effective cost controls, and favorable interest income as major profit drivers.

-

Focus remains on maintaining asset quality, strengthening capital base, and expanding loan book in renewable energy and infrastructure financing.

-

The company aims to further improve its credit rating and increase penetration in upcoming projects funded under government infrastructure programs.

-

Management declared confident outlook on dividend sustainability and growth potential in the sector.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹15,352 crores.

-

Net Profit (PAT): ₹4,310 crore.

-

Earnings Per Share (EPS): ₹16.37.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.