RBZ Jewellers (BSE: 544060, NSE: RBZJEWEL) is a leading organized manufacturer of gold jewellery in India. RBZ Jewellers Q3 FY26 earnings exceeded expectations with robust festive and wedding season demand. The company delivered improved performance across retail, wholesale, and job work segments. Official RBZ Jewellers Q3 FY26 Earnings Presentation

Market Performance

As of December 31, 2025, RBZ Jewellers traded at ₹139.40 with a market capitalization of ₹5,576 million. The company’s stock has 40 million shares outstanding. Trading volume averaged 172,500 shares daily over the past year. The 52-week trading range stood at ₹252.50 to ₹107.60, indicating volatility in the bullion sector. Return on equity (ROE) reached 17%, while return on capital employed (ROCE) hit 26% in FY25.

RBZ Jewellers Q3 FY26 Earnings: Financial Results

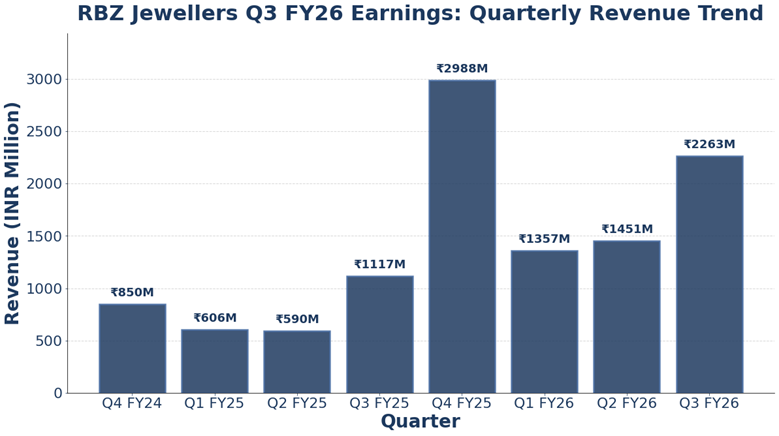

RBZ Jewellers Q3 FY26 earnings surged with revenue of ₹2,263 million. This marked a 16.8% gain over Q3 FY25 revenue of ₹1,938 million. Also, Q-o-Q, third quarter revenue jumped 56.0% from ₹1,451 million in Q2 FY26. Profit after tax (PAT) reached ₹174 million, up 32.8% from ₹131 million in Q3 FY25. So, the company delivered net profit margins of 7.69% in the quarter.

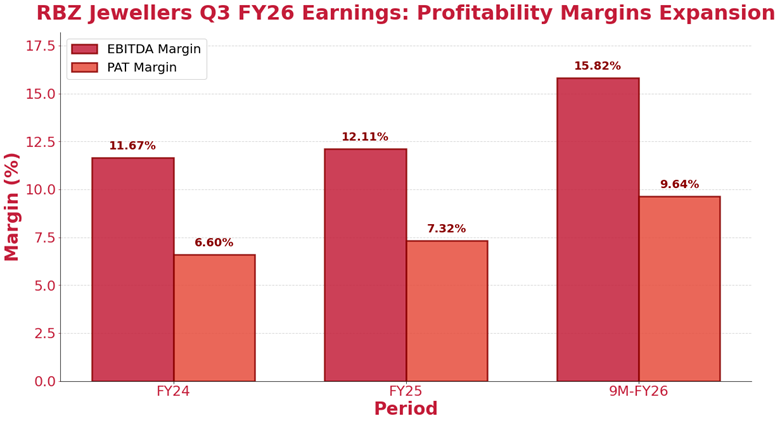

Earnings before interest, tax, depreciation, and amortization (EBITDA) hit ₹295 million in Q3 FY26. This surged 35.9% from ₹217 million in the year-ago quarter. EBITDA margins came in at 13.04% versus 11.20% in Q3 FY25. In fact, this 184 basis point expansion reflects better operational efficiency and production optimization.

Nine-Month Performance and Growth Momentum

Revenue for the first nine months of FY26 reached ₹4,470 million. This compares with ₹3,929 million in 9M FY25, marking a 13.8% year-over-year gain. Plus, net profit surged 42.7% to ₹431 million from ₹302 million in the same period last year. PAT margins improved to 9.64% from 7.69%, reflecting a 195 basis point expansion. So, EBITDA for 9M FY26 reached ₹707 million, up 42.3% from ₹497 million in 9M FY25.

The company maintained robust momentum with a three-year revenue CAGR of 28%. Also, net profit grew at a 39% CAGR over the same period. This showcases the company’s ability to scale and expand profitability rapidly.

Quarterly Revenue Trend

Chart 1: RBZ Jewellers Q3 FY26 Earnings: Quarterly Revenue Trend. The chart displays eight quarters of revenue data, showcasing the company’s growth trajectory. Q3 FY26 revenue reached ₹2,263 million, marking a robust continuation of momentum.

Segment Breakdown and Retail Growth

The retail segment delivered outstanding performance in Q3 FY26. Retail revenue hit ₹1,548 million, up sharply from ₹1,117 million in Q3 FY25. Also, this represents a 38.6% year-over-year jump. Plus, Q-o-Q, retail revenue surged 79.1% from ₹865 million in Q2 FY26. The flagship Ahmedabad showroom benefited from robust festive demand and wedding season traffic.

Wholesale revenue for Q3 FY26 totaled ₹700 million. This declined from ₹793 million in Q3 FY25 (down 11.7%). However, Q-o-Q improvement was notable, with Q2 FY26 wholesale at ₹558 million. So, the 25.6% Q-o-Q rise shows recovery in B2B demand as retailers replenished inventory.

Job work services revenue came in at ₹15 million in Q3 FY26. While smaller than Q3 FY25 (₹28 million), job work remains high-margin. The segment helps optimize production capacity and supports profitability.

Profitability Margins Expansion

Chart 2: Profitability Margins Expansion. The chart shows EBITDA and PAT margins improving steadily across periods. EBITDA margins reached 15.82% in 9M FY26, up from 12.11% in FY25. PAT margins hit 9.64% in 9M FY26 from 7.32% in FY25, demonstrating operating leverage.

Business Drivers and Strategic Actions

RBZ Jewellers Q3 FY26 earnings benefited from multiple growth drivers. The company participated in five exhibitions during the quarter. Also, two national-level and three state-level events strengthened market presence. These activities deepened customer engagement across both B2B and B2C segments.

The company launched approximately 951 new designs in Q3 FY26. This translates to about 12 designs per day. So, the ongoing design innovation strengthens the product portfolio. The company plans to introduce in-house daily wear production starting Q1 FY27.

Digital marketing campaigns drove brand reach and customer engagement. Social media followers reached 1,85,000 by 2026. Plus, campaigns featured both occasion wear and daily wear collections, targeting diverse consumer segments across India.

Retail Expansion and Growth Strategy

RBZ Jewellers plans to expand showroom presence across Gujarat. The company will open showrooms in Surat and Rajkot. Both showrooms are scheduled to launch in Q2 FY27. So, the Ahmedabad flagship showroom success is driving regional expansion strategy.

The 23,966 square foot manufacturing facility operates at rising capacity utilization. Advanced technology including casting, laser, and 3D printing supports production efficiency. Also, 250+ skilled artisans and 200+ professionals enable consistent quality output. The company targets maximum capacity use in FY26.

Competitive Position and Market Share

RBZ Jewellers holds approximately 1% of India’s organized wholesale gold jewellery market. The company supplies to over 190 retailers in the wholesale segment. These retailers span 20 states and 72 cities across India. Plus, major clients include Titan Company Limited, Malabar Gold Private Limited, and Senco Gold Limited.

The 30-year legacy of the Zaveri family supports brand trust. RBZ specializes in antique gold designs including Jadau, Meena, Kundan, and Polki varieties. These traditional designs resonate with consumers seeking heritage-crafted jewellery. So, the positioning helps differentiate from mass-market competitors.

Industry Trends and Sector Outlook

The organized gold jewellery sector in India is experiencing transformation. Rising wealth among high-net-worth individuals drives demand for luxury jewellery. Also, consumers increasingly seek sustainable and ethical jewellery products. Demand for unique, one-of-a-kind pieces and investment-potential jewellery is rising.

Wedding season demand continues to support both retail and wholesale segments. Robust festive seasons (Diwali, Dussehra) fuel retail showroom traffic. Plus, the company is well-positioned for sustained growth with showroom expansion plans.

Forward Guidance and Outlook

Management delivered steady performance despite a dynamic global environment. The company is strategically positioned for the upcoming wedding season. Also, International Women’s Day and local festivals will drive seasonal demand. Consumer demand for occasional wear remains robust.

The company continues optimizing inventory mix with lightweight and budget-friendly offerings. So, this strategy supports market access across consumer segments. Capital expansion plans (showrooms in Surat, Rajkot) will drive medium-term growth.

Key Takeaways from RBZ Jewellers Q3 FY26 Earnings

RBZ Jewellers Q3 FY26 earnings showcase robust business momentum. Revenue surged 16.8% Y-o-Y to ₹2,263 million with exceptional profit growth. Also, net profit jumped 32.8% to ₹174 million, reflecting operational excellence. EBITDA margins expanded to 13.04% from 11.20%, a gain of 184 basis points. Retail segment delivered exceptional growth, up 38.6% year-over-year.

For more details, click here to visit the AlphaStreet website.