Raymond Limited incorporated in 1925 is a diversified group with interests in Textile & Apparel sectors as well as presence across diverse segments such as Real Estate, FMCG, Engineering in national and international markets 55+ Countries including the USA, Europe, Japan & Middle East. The Company has a retail network of 1,638 stores, including 1,589 stores in about 600 towns and cities in India and 49 overseas stores in nine countries. It is one of the largest vertically and horizontally integrated manufacturers of worsted suiting fabric in the world. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

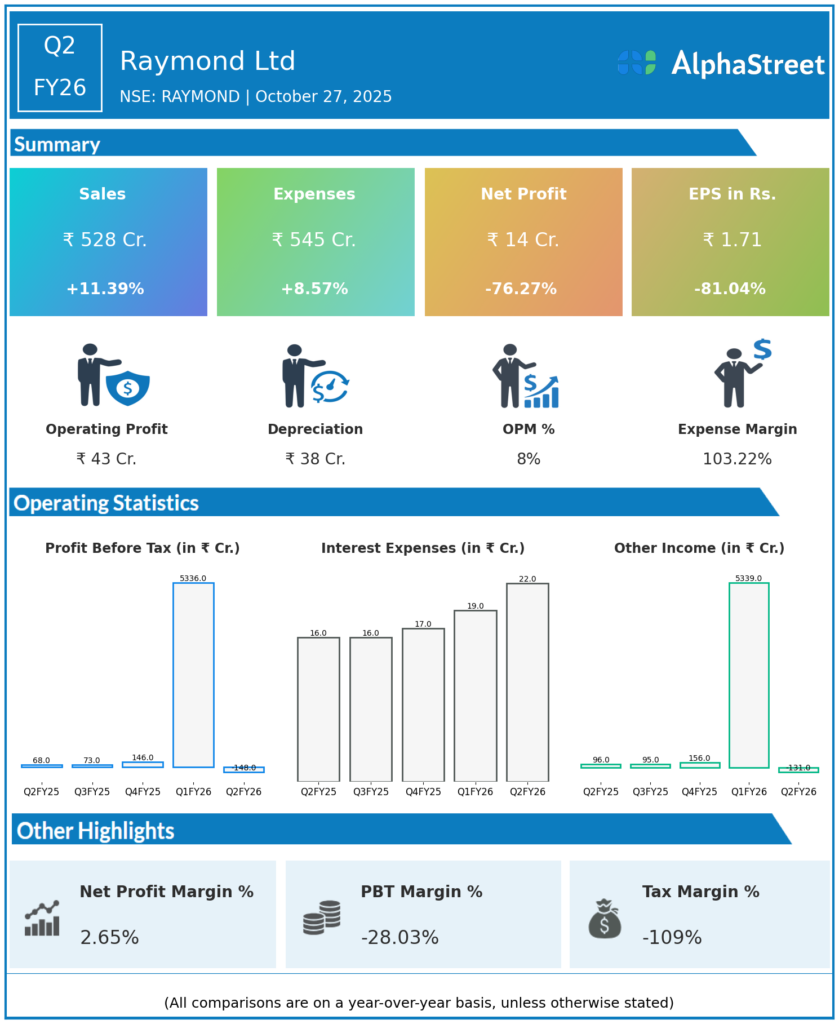

Consolidated Revenue: ₹528 crore, up 11% YoY from ₹514 crore in Q2 FY25.

Consolidated PAT: ₹14 crore, down 76% YoY from ₹21 crore in Q2 FY25, largely due to weaker textile/garnmenting realizations and one-off costs.

EBITDA: Not explicitly reported for Q2, but expected to be materially lower YoY based on margin decline and profit contraction.

Aerospace & Defence, Precision Tech: These segments continued to deliver strong growth (Aerospace up 37% YoY) and mitigated some pressures in the core textile business.

Raymond Lifestyle Q2:

-

Revenue: Not individually reported for Q2, but Q1 was ₹1,475 crore (up 18% YoY).

-

Margins faced pressure with aggressive promotions amid moderate demand growth.

-

Raymond Realty (post-demerger) reported record profit growth, but post-demerger figures are not consolidated with the core business for Q2 FY26.

Management Commentary & Strategic Actions

-

Management stated the quarter was marked by continued strong order momentum in defence, aerospace, and precision engineering verticals, now accounting for over 40% of new business wins.

-

Textile and branded apparel remained soft as discretionary consumer demand and channel stocking remained slow post-festive season, impacting margins.

-

The company accelerated rationalization of product portfolios and lean operations to cushion against top-line volatility.

-

Raymond remains strategic about diversified segment expansion and expects new initiatives in exports (China Plus sourcing) and premiumising its domestic apparel offering.

-

Management highlighted active cost control, R&D for performance fabrics, and a plan to double aerospace and defence business in the next 3–4 years.

-

Guidance for H2 is for margin normalization aided by higher-margin export contracts and festive pickup in domestic demand.

Q1 FY26 Earnings Results

Consolidated Revenue: ₹555.32 crore, up 11.2% YoY from ₹499.52 crore in Q1 FY25.

Consolidated PAT: ₹20.62 crore, down 8.8% YoY.

Lifestyle Division Revenue: ₹1,475 crore, up 18% YoY; EBITDA ₹122 crore (up 36% YoY, margin 8.2%).

Realty Segment: Revenue ₹374 crore, PAT ₹16.5 crore, both up over 100% YoY post-demerger.

Strategic Notes (Q1):

-

Strong growth in aerospace/precision tech, offset by cyclicality in textiles.

-

Continued investment in branded retail, urban retail growth, and China Plus global sourcing efforts.

-

Net cash surplus maintained as of June 2025

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.