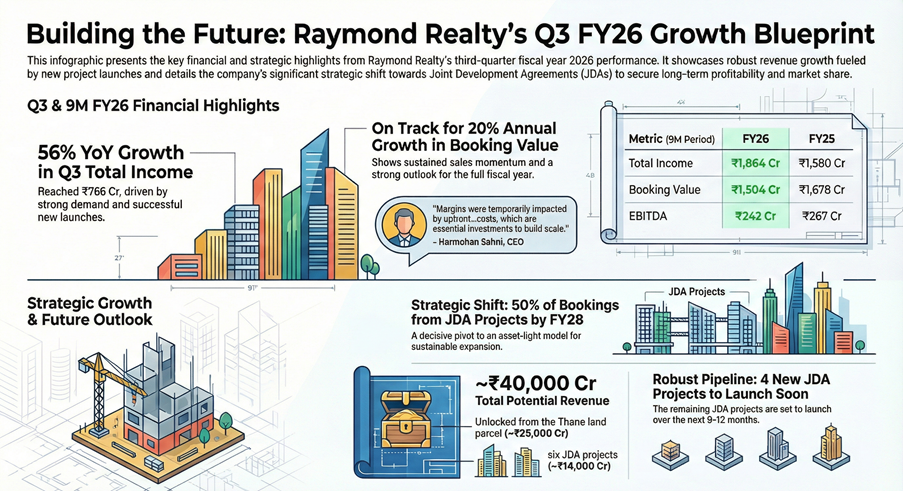

Quarterly income rose 56% year-on-year on new project launches and steady demand, while profitability declined due to product mix and higher launch-related costs. The company continues to expand its joint development pipeline to rebalance its portfolio.

Raymond Realty Limited (NSE: RAYMONDREL) reported a sharp increase in revenue for the quarter ended December 31, 2025, supported by new project launches and sustained housing demand in the Mumbai metropolitan region, though operating margins declined compared with a year earlier.

Strong Q3 Growth

The real estate developer posted total income of ₹766 crore in the December quarter, up 56% from ₹492 crore in the same period last year. Growth was driven by execution of its development pipeline and contributions from recently launched projects, including its second joint development agreement (JDA) project, Invictus by GS in the Bandra Kurla Complex.

During the quarter, the company also outlined a robust launch pipeline for the March quarter, aimed at accelerating pre-sales momentum and expanding market share.

Revenue Grew Amid Margin and Profit Pressure

Despite higher revenue, earnings before interest, tax, depreciation and amortisation (EBITDA) declined to ₹100 crore from ₹105 crore a year earlier. EBITDA margin fell to 13.0% from 21.4% in the December 2024 quarter, reflecting the impact of product mix and higher upfront marketing and approval costs associated with new launches.

Profit before tax, excluding exceptional items, stood at ₹77 crore, down 13% year-on-year. For the nine months ended December 2025, total income increased 18% to ₹1,864 crore, while EBITDA declined 9% to ₹242 crore. The company reported net debt of ₹230 crore as of the end of the quarter.

Raymond Realty Targets ₹40,000 Crore Potential Revenue via JDA Expansion

Raymond Realty is pursuing a strategic shift toward an asset-light JDA-led model. The company aims for JDAs to contribute about 50% of booking value within the next two to three years, compared with 22% in the previous portfolio mix. It currently has six JDAs in its portfolio, with two under development and four additional launches planned over the next 9 to 12 months.

The company estimates total potential revenue of about ₹40,000 crore from its existing real estate portfolio, including approximately ₹25,000 crore from its Thane land parcel and around ₹14,000 crore from JDA projects.

Industry Trends and Raymond Realty’s Growth Approach

India’s residential real estate sector has continued to see demand in premium and mid-income segments, particularly in major urban markets such as Mumbai. Developers have increasingly turned to joint development structures to limit capital intensity and manage balance sheet risk. Against this backdrop, Raymond Realty’s focus on JDAs and diversified launches aligns with broader industry trends, even as near-term margins remain sensitive to launch costs and execution timelines.