Raymond Limited incorporated in 1925 is a diversified group with interests in Textile & Apparel sectors as well as presence across diverse segments such as Real Estate, FMCG, Engineering in national and international markets 55+ Countries including the USA, Europe, Japan & Middle East. The Company has a retail network of 1,638 stores, including 1,589 stores in about 600 towns and cities in India and 49 overseas stores in nine countries. It is one of the largest vertically and horizontally integrated manufacturers of worsted suiting fabric in the world.

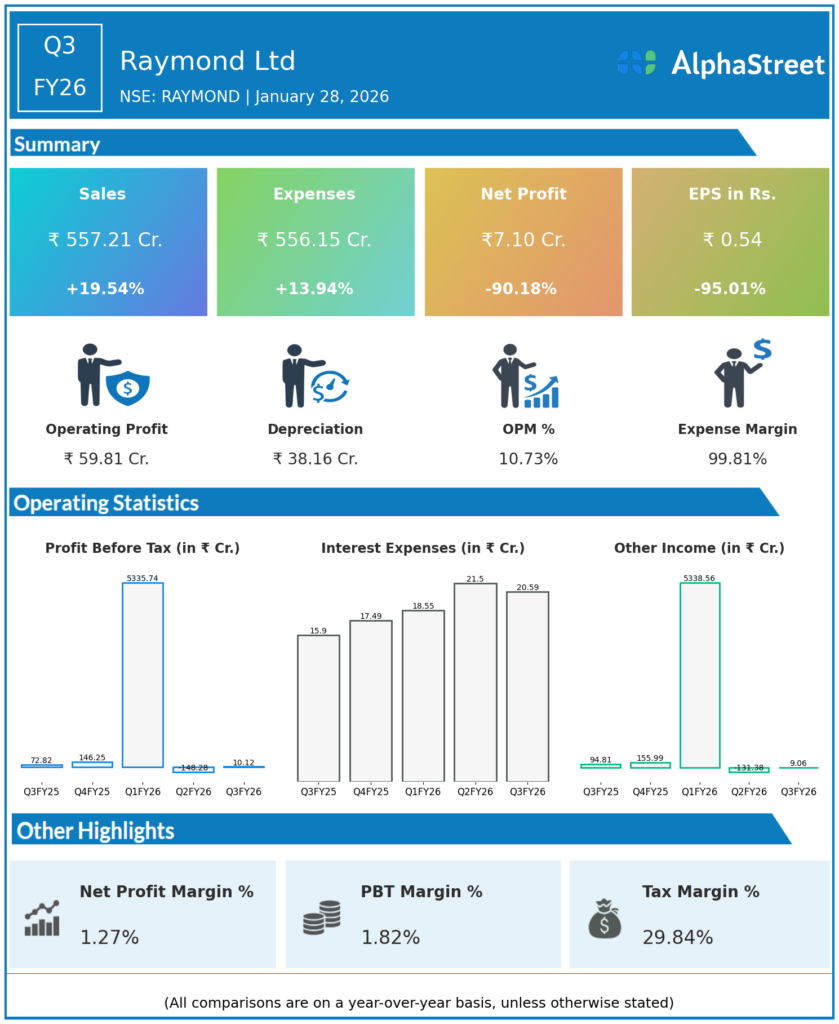

Q3 FY26 Earnings Results

- Revenue from Operations: Consolidated ₹557 cr, +19.5% YoY vs ₹466 cr, +5.6% QoQ vs ₹527 cr; standalone net sales ₹122 cr (+32% YoY, +38% QoQ), driven by fabric/apparel demand, engineering growth, but lifestyle exports pressured.

- EBITDA: ₹83 cr, +27% YoY vs ₹65 cr (Raymond Ltd), margin 14.3% (+100 bps YoY); consolidated operating PBDIT excl OI ₹60 cr, margin 10.8% (+244 bps YoY), reflecting efficiency despite costs.

- PAT: Consolidated ₹3.6 cr (−95% YoY vs ₹72 cr due to exceptional/tax items); standalone ₹7.1 cr (+78% YoY); EPS impacted by one-offs.

- Other key metrics: 9M revenue ₹1,609 cr (+ sustained double-digit growth); Raymond Lifestyle income ₹1,883 cr (+5% YoY); Realty bookings ₹743 cr (9M ₹1,504 cr), collections ₹1,210 cr; net cash ₹214 cr.

Management Commentary & Strategic Decisions

- Operational resilience with revenue/margin gains overshadowed by exceptional items/tax; lifestyle domestic strength offsets exports.

- Strategic moves: Demerger de-risks into lifestyle (fabrics/garments/branded apparel) and realty; net debt-free engineering (₹27 cr surplus Q2), aerospace/defence +15% revenue; focus on high-margin segments, launches.

Q2 FY26 Earnings Results

- Revenue from Operations: Consolidated ₹528 cr (+11% YoY vs ₹514 cr); total income ₹564 cr (+10% YoY); lifestyle strong, engineering +9.9%.

- EBITDA: ₹79 cr (+3% YoY), margin 14.1% (−100 bps YoY); aerospace ₹17 cr (+34% YoY, 21% margin); precision ₹57 cr (+57% YoY, 13.9% margin).

- PAT: Consolidated ₹14 cr (−76% YoY due to realizations/one-offs); standalone −₹2.85 cr.

- Other key metrics: H1 lifestyle revenue ₹1,475 cr (+18% YoY); net cash ₹27 cr; Realty H1 revenue ₹1,071 cr (+201% YoY), PAT surge.

Management Commentary Q2

- Balanced growth across segments amid competitive pressures; margin dip from costs, but engineering shines.

- Strategic moves: Post-demerger focus on lifestyle/realty synergy; debt reduction to net cash; expansion in defence/auto components, branded apparel.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.