RattanIndia Power Limited is one of India’s largest private power generation company, with installed capacity of 2,700 MW thermal power plants at Amravati and Nashik (1,350 MW at each location) in Maharashtra, India. Presenting below are its Q1 FY26 earnings results.

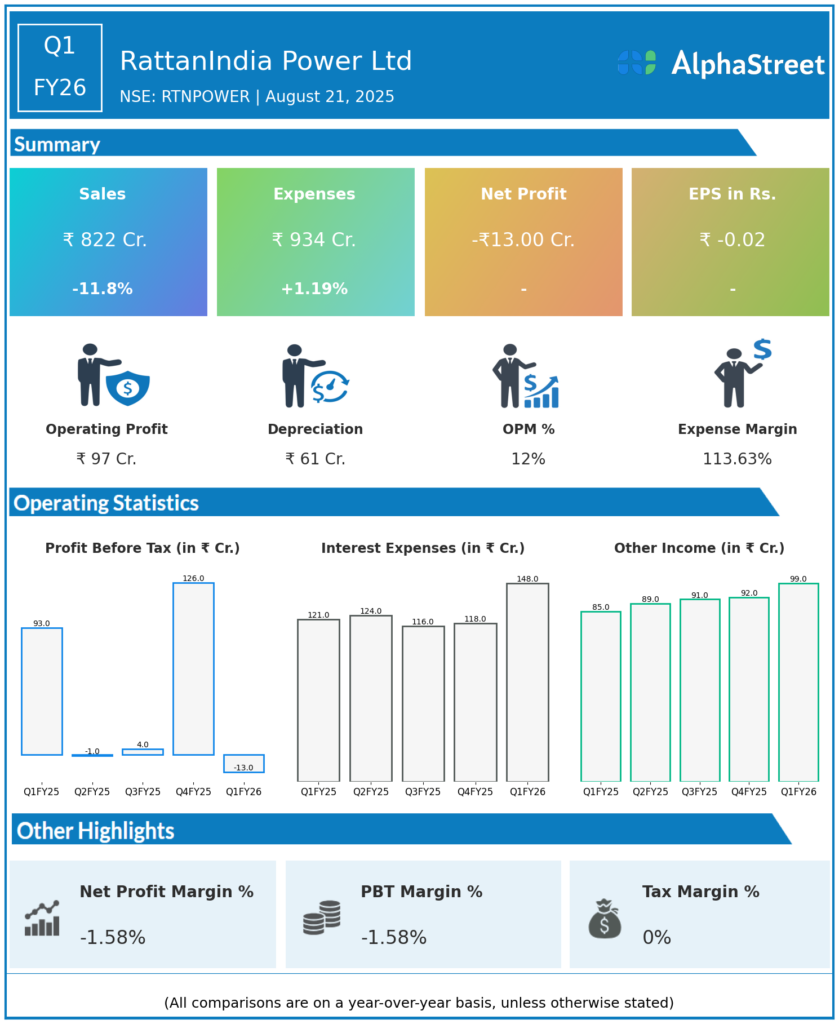

Q1 FY26 Earnings Results

-

Total Income: ₹930.03 crores

-

Revenue from Operations: ₹821.96 crores, down by 11.8 percent on the YoY basis.

-

Other Income: ₹108.07 crores

-

Total Expenses: ₹934 crores approximately (including fuel, employee costs, finance cost, depreciation, other expenses). This depicted a growth of 1 percent over the last year.

-

EBITDA: ₹196 crores

-

Profit Before Tax (PBT): -₹14.60 crores (loss)

-

Net loss (PAT): -₹13 crores vs -₹93 crores during the same quarter, last year

-

EPS: -₹0.02 vs ₹0.17 during the same quarter, last year.

-

Power Generation: Amravati plant operated at 91% Plant Load Factor (PLF) and 97% availability.

-

The company also sold 12.09 MUs of power on the power exchange generating ₹9.36 crores additional revenue.

-

Finance costs and depreciation were stable compared to the previous quarter.

Q4 FY25 Earnings Results

-

Total Income: ₹1,037.64 crores

-

Revenue from Operations: ₹936.25 crores, up by 2.14 percent on the YoY basis.

-

Other Income: ₹101.39 crores

-

Profit Before Tax (PBT): ₹124.43 crores

-

Net Profit (PAT): ₹124.43 crores, down by more than 500 percent from the same quarter, last year

-

EPS: ₹0.23 vs ₹19.86, during the same quarter, last year

Management Commentary & Strategic Highlights:

-

The shift to a loss in Q1 FY26 from profit in Q4 FY25 is attributed mainly to a decrease in power sales volume and higher operational expenses.

-

The Amravati plant remains a strong performer with high availability and PLF, contributing positively to operations.

-

Management cited positive regulatory rulings for receivables as a supportive factor amidst market challenges.

-

The company continues focusing on optimizing operations, improving plant efficiencies, and managing costs amid volatile energy demand and pricing.

-

A strategic emphasis on renewable energy integration and expansion of power trading activities is ongoing to diversify income sources.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.