Ratnamani Metals & Tubes Ltd is engaged in the manufacturing of stainless steel pipes and tubes and carbon steel pipes from its manufacturing facilities in India. The company owns and operates 3 manufacturing facilities in Gujarat. It is one of the largest players in the Stainless Steel Seamless segment in India, with a capacity to 61,500 TPA and a capacity of 5,10,000 TPA in the carbon steel pipes segment. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

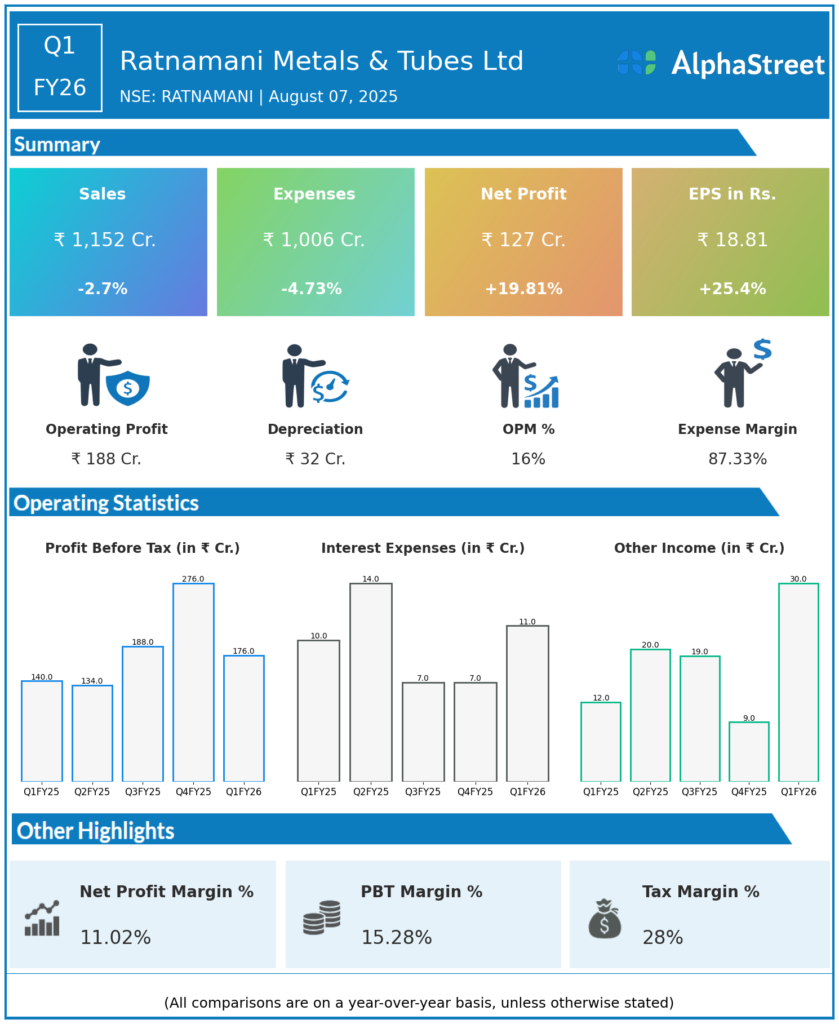

Consolidated Revenue: ₹1,151.6 crore, down 2.7% year-over-year (YoY) from ₹1,183.7 crore and down 32.9% quarter-over-quarter (QoQ) from Q4 FY25.

-

Net Profit (PAT): ₹127 crore, up 19.8% YoY from ₹106 crore last year, but down sharply from the previous quarter.

-

Standalone Revenue: ₹1,062.4 crore, down 4.3% YoY.

-

Basic EPS: ₹20.68, up from ₹15.02 YoY.

-

Operating Margin: 13.9%, down ~370 basis points YoY; operating profit at ₹164 crore.

-

Volume: Grew by 10% YoY; though revenue fell due to a lower steel price environment and postponement of a few high-margin stainless steel (SS) export orders to subsequent quarters.

-

Order Book: Revived to approximately ₹2,900–2,940 crore, up 16% YoY, as per management commentary.

-

Key Notes: Margin decline reflected a less favorable product mix and low-margin SS pipe execution, while volume growth was robust.

Key Management Commentary & Strategic Highlights

-

Management noted the quarter as “subdued” with margin softness, attributed to postponement of export orders and lower realizations as steel prices fell.

-

Despite flat or lower topline, profitability improved YoY on account of better cost management and product mix optimization in carbon steel line pipes.

-

Orders and execution were weaker in international markets due to the timing of project deliveries for SS pipes—catch-up expected in subsequent quarters.

-

The company remains debt-free on a standalone basis, maintains a strong balance sheet, and continues to invest in technology and plant upgrades to diversify its portfolio.

-

Expansion: Projects to enhance capacity and automation in the ball-bearing and nuclear power segment are progressing on track, with a new plant planned to triple production in key segments.

-

Strategic Outlook: Ratnamani is positioned for strong medium- to long-term growth from government infrastructure, oil & gas, and water segments. Management is confident about executing the robust order book and sees margin improvement as higher-value orders are scheduled for H2 FY26.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹1,724 crore, up 12.4% YoY from ₹1,534.5 crore.

-

Net Profit (PAT): ₹207.1 crore, up 7.8% YoY from ₹192.2 crore.

-

Basic EPS: ₹28.98, up 5.2% YoY.

-

Operating Profit Margin: Margins and profitability improved on a sequential basis, with strong cost controls and higher contribution from value-added products.

-

Order book: Continued to rise, reflecting increased market share and execution capabilities across oil & gas and infrastructure sector demand.

-

Dividend: Board proposed a ₹14/share dividend for FY25, subject to AGM approval.

-

Operational Highlights: FY25 marked record-high sales, a debt-free balance sheet, and significant cash generation.

To view the company’s previous earnings, click here