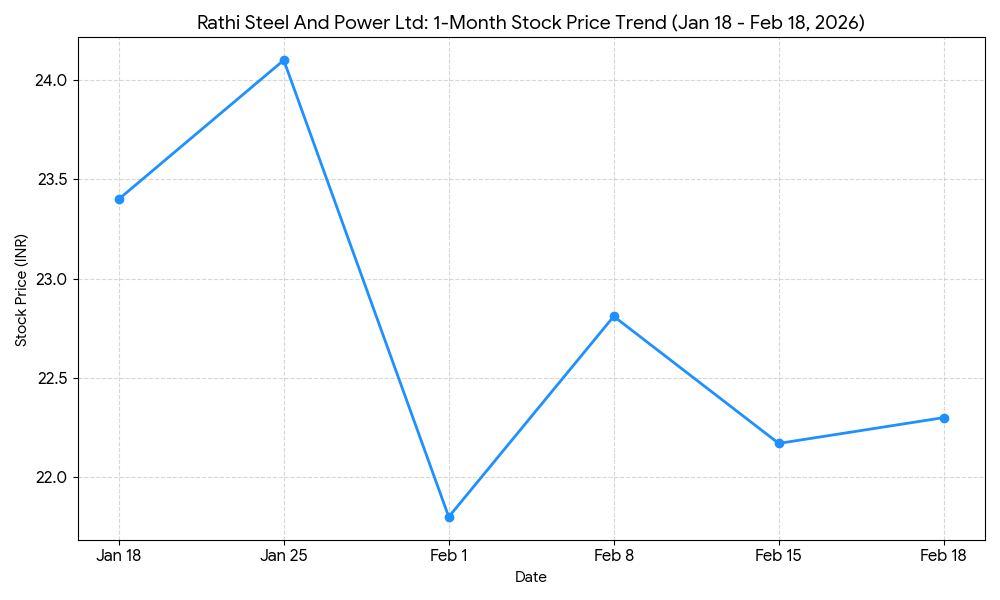

Rathi Steel And Power Ltd (BSE: 504903) shares ended lower on Wednesday, following the disclosure of its third-quarter financial results. The stock closed at 22.15, a decline of 0.09% from the previous session’s close.

Market Capitalization

The market capitalization of Rathi Steel And Power Ltd stood at INR 191.29 crore ($23.05 million) as of the market close on February 18, 2026.

Latest Quarterly Results

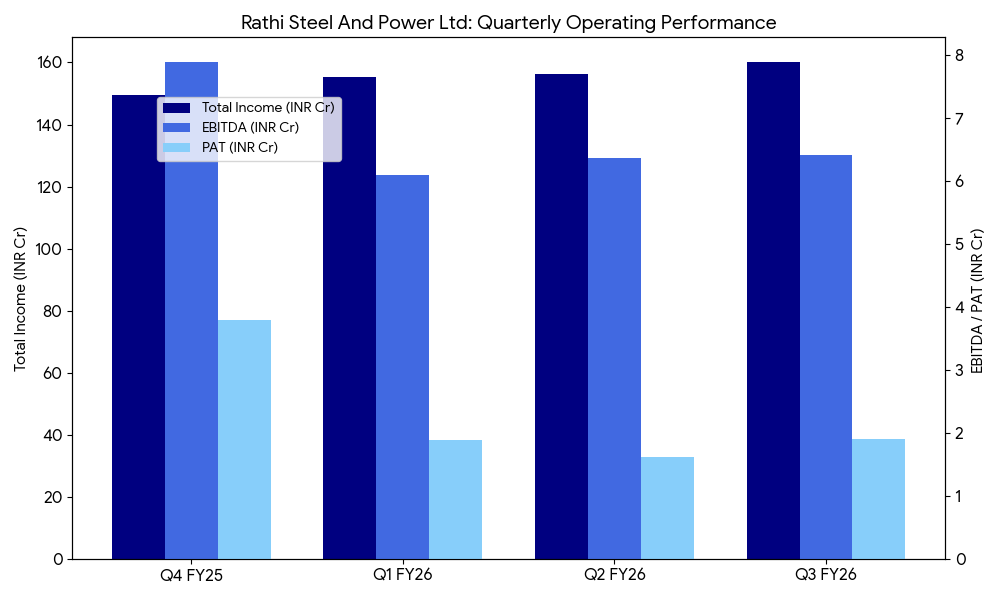

For the quarter ended December 31, 2025 (Q3 FY26), Rathi Steel And Power reported the following standalone financial results:

- Total Income: INR 160.09 crore, an increase of 50.97% compared to INR 106.04 crore in the same period last year.

- Net Profit (PAT): INR 1.91 crore, representing a 262.33% increase from INR 0.53 crore in the year-ago quarter.

- EBITDA: INR 6.41 crore, up 38.17% year-over-year.

- EBITDA Margin: 4.01% compared to 4.44% in the corresponding quarter.

Nine-Month Overview

For the nine-month period ending December 31, 2025 (9M FY26), the company reported:

- Total Income: INR 471.93 crore, compared to INR 355.70 crore in 9M FY25.

- Directional Trend: Revenue and operational earnings maintained an upward trajectory during the period.

Q&A Session Focal Points

During the discussions following the results announcement, corporate participants, including Mr. Mahesh Pareek, Managing Director, addressed the following points:

- Capacity Utilization: Management noted that improving utilization levels across the Ghaziabad unit contributed to the volume growth.

- Product Mix: In response to queries regarding margins, the company stated that the strategic mix of Stainless Steel and TMT Rebars helped mitigate raw material price volatility.

- Monthly Performance: Management highlighted that the company achieved its highest-ever monthly sales of approximately INR 77.45 crore from the Ghaziabad unit in January 2026.

Business & Operations Update

Rathi Steel And Power reported a significant ramp-up in production volumes at its Ghaziabad facility. The company also confirmed receipt of Income Tax assessment orders for previous assessment years totaling INR 38.69 lakhs; however, the company stated it intends to contest these demands and expects no material financial impact.

Cash and Debt Position

As of the end of Q3 FY26, Rathi Steel And Power reported a Total Debt of approximately INR 36.64 crore. The company’s Debt-to-Equity ratio was maintained at 0.29x, reflecting a stable capital structure following previous debt restructuring and asset disposals. Finance costs for the quarter were recorded at INR 1.88 crore, compared to INR 1.71 crore in the year-ago period. The company held Cash and Short-term Investments of approximately INR 1.16 crore at the close of the period.

M&A or Strategic Moves

Management reiterated that the focus remains on “sweating” existing assets following the prior disposal of the Orissa unit.

Guidance & Outlook

The company did not issue specific numerical guidance but identified key factors to watch:

- Sustainability of demand in infrastructure and real estate segments.

- Ongoing momentum in monthly sales volume at the Ghaziabad unit.

- Asset optimization and operational efficiency improvements.

Performance Summary

Rathi Steel And Power stock closed at 22.15, down 0.09%. The company reported a 50.97% increase in Q3 income and a 262.33% surge in net profit. Operations remain focused on the single steel segment.