Rane (Madras) Limited (NSE: RML) shares rose 1.52 percent to close at 831.80 on Tuesday, following the release of the company’s third-quarter financial results. The stock fluctuated between an intraday low of 810.00 and a high of 837.90 during the session on the National Stock Exchange.

Market Capitalization

As of February 17, 2026, the market capitalization of Rane (Madras) Limited stands at INR 23.03 billion (approximately USD 274 million).

Latest Quarterly Results

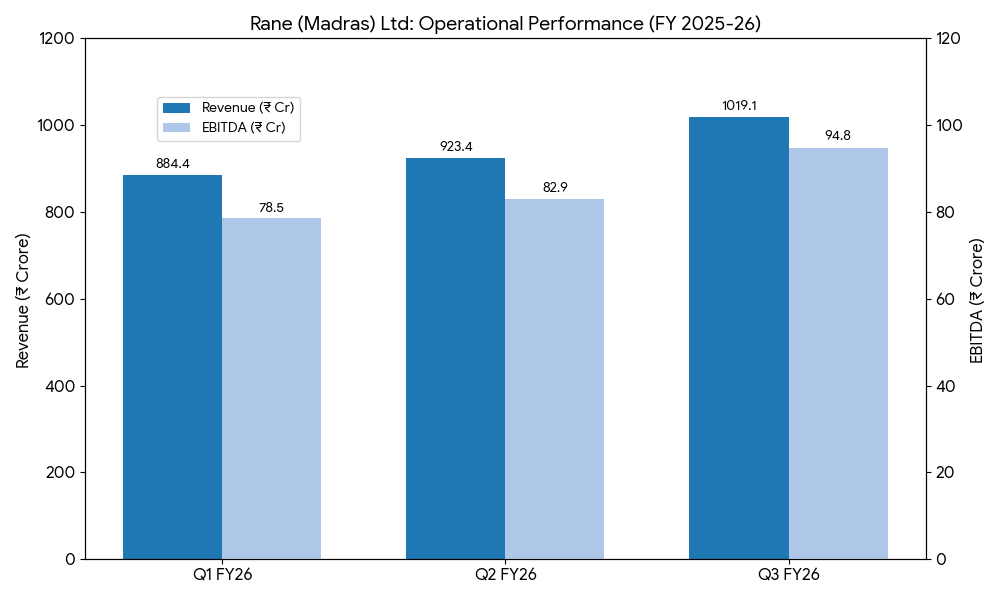

For the quarter ended December 31, 2025, Rane (Madras) reported a consolidated revenue of INR 1,019.1 crore, representing a 21.3 percent increase compared to INR 840.5 crore in the same period of the previous year.

Consolidated net profit reached INR 30.5 crore, a significant increase from INR 0.4 crore in the year-ago quarter. The company noted that the prior year’s profit was impacted by a one-time tax credit reversal of INR 8.27 crore.

Segment Performance Highlights:

- Domestic OE Sales: Revenue increased 18 percent year-on-year, supported by demand across passenger and commercial vehicle segments.

- International Sales: Revenue grew 21 percent, driven primarily by the steering products category.

- Aftermarket Sales: Revenue rose 32 percent, though the company noted this figure is not directly comparable due to business restructuring in the previous fiscal year.

FINANCIAL TRENDS

Nine-Month Overview

For the nine-month period ended December 31, 2025, the company reported a total income of INR 2,824.7 crore, compared to INR 2,514.0 crore in the previous year. This represents an 12.4 percent growth in revenue.

Net profit for the nine-month period stood at INR 74.2 crore, up from INR 41.0 crore in the prior year. The directional trend indicates growth in both revenue and profitability over the three quarters of the fiscal year.

Business & Operations Update

Rane (Madras) announced the appointment of Konark Kumar Gupta as President of the Aftermarket Products Business, effective February 9, 2026. The company also secured new orders worth INR 135 crore during the quarter, including INR 115 crore in the steering and linkages business and INR 20 crore in brake components.

Discussion Focal Points (Q&A Session)

During the Q3 2026 earnings conference call, the management of Rane (Madras) Limited addressed several focal points regarding the company’s financial health and strategic direction:

- Margin Expansion and Cost Management: Analysts questioned the sustainability of the 310 basis point improvement in EBITDA margins. Management attributed this to favorable product mix and operating leverage, noting that while raw material costs have stabilized, they remain focused on value engineering to offset any potential volatility in steel prices.

- International Order Pipeline: In response to queries about the 21% growth in export sales, the executive team highlighted a strong order book in the steering linkages segment for North American and European heavy-duty platforms, projecting a steady execution timeline over the next 18 to 24 months.

- Aftermarket Restructuring: Following the 32% growth in aftermarket revenue, management clarified that the integration of the previous year’s business acquisition is now complete. They stated that the focus has shifted toward geographic expansion within India and increasing the penetration of friction products.

- Debt Reduction and Capex: Regarding the balance sheet, the management confirmed a disciplined approach to capital expenditure, prioritizing internal accruals for capacity debottlenecking. They signaled a commitment to further reducing the debt-to-equity ratio, which has seen sequential improvement.

- Tax Litigation Status: Addressing the INR 12.23 crore CGST demand, the company stated it has received legal counsel suggesting a strong merit-based case for appeal and does not expect a material adverse impact on the current fiscal year’s liquidity.

Capital Expenditure & Strategic Outlook

Management has outlined a disciplined Capex plan aimed at supporting new order wins and enhancing manufacturing efficiency.

- FY2026-27 Capex Outlay: The company is prioritizing internal accruals to fund its capacity expansion. While specific aggregate figures for the upcoming year are typically finalized in the Q4 board meeting, management indicated that the current focus is on debottlenecking existing lines in the Steering & Linkages division.

- Expansion of High-Growth Segments: A significant portion of the planned investment is directed toward the Light Metal Castings division and the Brake Components business, where the company recently secured new orders worth INR 20 crore.

- International Fulfillment: To service the INR 75 crore in new international steering orders, the company is upgrading its automated machining and assembly lines to meet global quality standards and “Just-in-Time” delivery requirements.

Performance Summary

Rane (Madras) shares closed 1.52 percent higher today at 831.80. Third-quarter consolidated revenue grew 21.3 percent to INR 1,019.1 crore, while net profit rose to INR 30.5 crore. Segment growth was led by a 32 percent rise in aftermarket sales and 21 percent growth in international markets.