Ramkrishna Forgings Ltd is primarily engaged in manufacturing and sale of forged components of automobiles, railway wagons & coaches and engineering parts. It is the 2nd largest forging player in India. Presenting below are its Q1 FY26 earnings.

Q1 FY26 Earnings Results

-

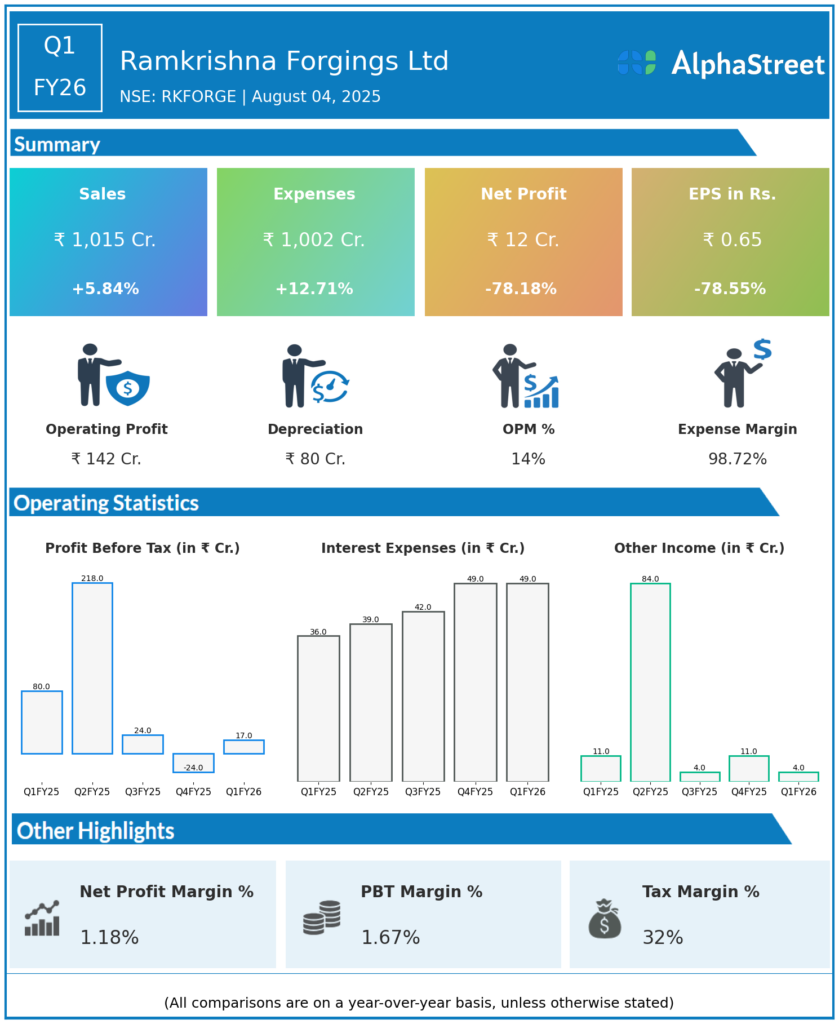

Consolidated Revenue from Operations: ₹1,015 crore, up about 6% year-over-year (YoY).

-

EBITDA: ₹148.6 crore, margin expanded by 298 bps YoY to 14.6%.

-

Profit Before Tax (PBT): ₹24 crore, down 81.3% YoY.

-

Net Profit (PAT): ₹11.8 crore, down 78% YoY from ₹80.9 crore Q1 FY25 and also fell sharply from ₹93.9 crore in Q4 FY25.

-

Earnings Per Share (EPS): ₹0.65 vs ₹4.50 Q1 FY25.

-

Total Expenses: ₹994.9 crore, up 10.9% YoY.

-

Production Volume: 44,170 tons; capacity utilization at 69%.

-

Order Book: ₹683 crore in new orders during Q1, including ₹502 crore for exports (notably from a major American OEM).

-

Growth Drivers & Challenges: Revenue growth was sustained, but sharp cost increases and margin compression, along with a weak global/export environment and higher expenses, drove a significant fall in profit.

Key Management Commentary & Strategic Highlights

-

MD Naresh Jalan stated that despite export headwinds and global macro pressures, revenue resilience continued, and the order book was healthy with new wins across automotive, railways, and non-automotive.

-

Management remains focused on further utilization improvement, margin restoration, and cost control. Expectation for margin improvement in the second half of FY26 as market conditions normalize.

-

Major board/leadership moves included reappointments and committee reshuffles to strengthen governance for the next growth phase.

-

The company continues to invest in capacity expansion (cold/hot forging plants) and diversification, targeting higher exports and new sectors.

-

Outlook: While near-term profitability is under pressure, management is optimistic about operational gains and margin recovery in the coming quarters with a robust order pipeline and improved efficiency.

Q4 FY25 Earnings Results:

-

Consolidated Revenue: ₹947 crore, down 3% YoY.

-

EBITDA: ₹99 crore, sharply down from ₹188 crore YoY, amid margin pressures.

-

Net Profit (PAT): ₹200 crore, boosted by a one-off deferred tax credit from a merger (underlying operational PAT much lower).

-

Order Wins: ₹710 crore, with strong automotive and non-automotive contributions.

-

Operational Notes: The quarter saw the impact of inventory discrepancies (addressed in FY25), higher working capital requirements, and a 10% US duty that led to revenue deferment.

-

Full FY25: Revenue of ₹4,034 crore, EBITDA of ₹560 crore, PAT of ₹332 crore

To view its previous earnings, please visit: Click Here