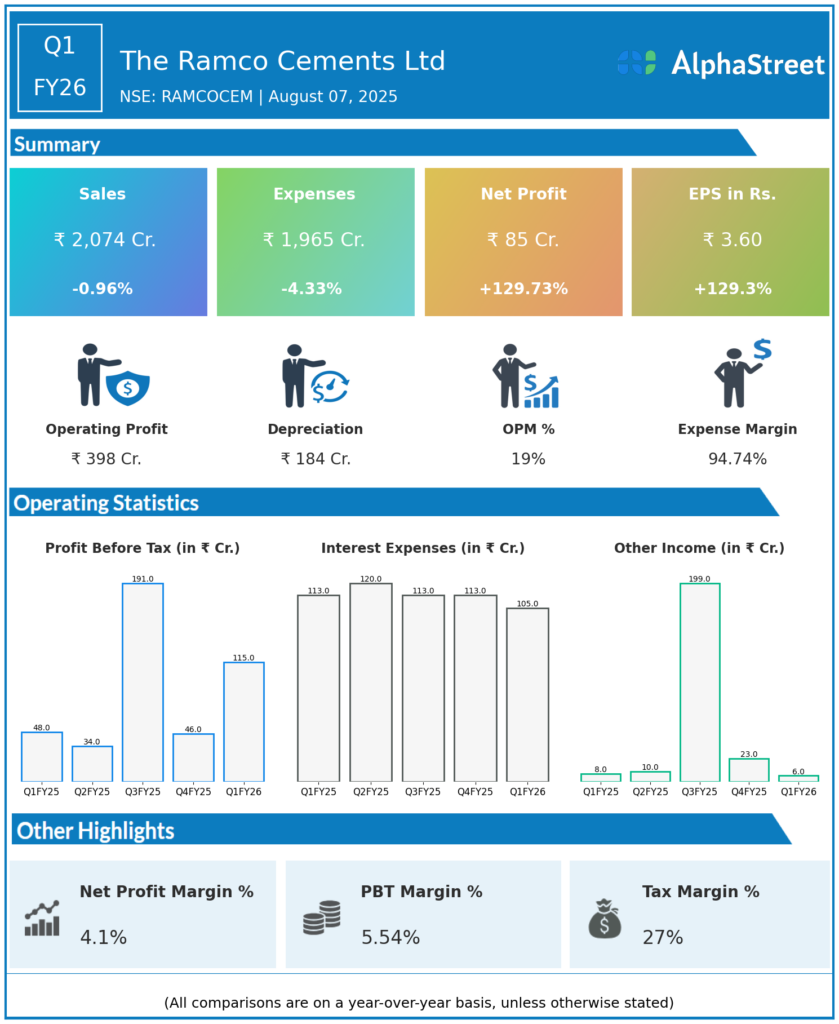

Ramco Cements Ltd is engaged in manufacture of cement, Ready Mix Concrete (RMC) and Dry mortar products. It primarily caters to the domestic market of India. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: Approximately ₹2,074 crore, representing a decline of about a percent year-over-year (YoY) from ₹2,094 crore in Q1 FY25.

-

Net Profit (PAT): ₹85 crore, doubling to more than 100% on the YoY basis compared to ₹37 crore in Q1 FY25.

-

EBIT (Operating Profit): ₹398 crore, up 24% YoY from ₹320 crore in Q1 FY25.

-

EBITDA Margin: The operating profit margin came at approximately 619% for Q1 FY26.

-

Cost Pressure: Total expenses increased significantly by over 33% YoY, impacting profitability.

-

Basic EPS: ₹3.6 for Q1 FY26 versus ₹1.57 in Q1 FY25.

The sharp decline in profit despite revenue growth reflects cost inflation, price pressures, and subdued margin expansion in the quarter.

Key Management Commentary & Strategic Highlights

-

Management noted that Q1 FY26 marked a recovery with strong revenue and profit uplift, driven by improved pricing and increased volumes.

-

Efficiency initiatives and capacity additions in key markets are expected to support continuing growth.

-

The company is focused on maintaining cost discipline amid volatile input costs, including logistics and fuel.

-

Strategic emphasis remains on improving market share, expanding in southern India and eastern markets, and leveraging infrastructure and housing demand growth.

-

Debt metrics and capital expenditure plans continue to support capacity expansions and modernization.

Q4 FY25 Earnings Results

-

Total Income: ₹2,405 crore (down from ₹2,687 crore in Q4 FY24).

-

Net Profit (PAT): ₹31 crore, down significantly from ₹121 crore year-over-year mainly due to operational cost increases.

-

EBITDA: ₹378 crore approximately, reflecting margin pressure.

-

Revenue Decline: Impacted by about 10% YoY drop in cement prices.

-

Other Notes: FY25 reported net revenue ₹8,539 crore against ₹9,392 crore in FY24, reflecting a 9% decline amplitude due to softer cement prices and increased costs.

To view the company’s previous earnings results, click here