Rallis India, a Tata Group company Group company, has a history of over 150 years. The company is into manufacturing of Agrochemicals and is present across the value chain of agriculture inputs – from seeds to organic plant growth nutrients. Rallis is also in the business of contract manufacturing for global corporations.

Q3 FY26 Earnings Results

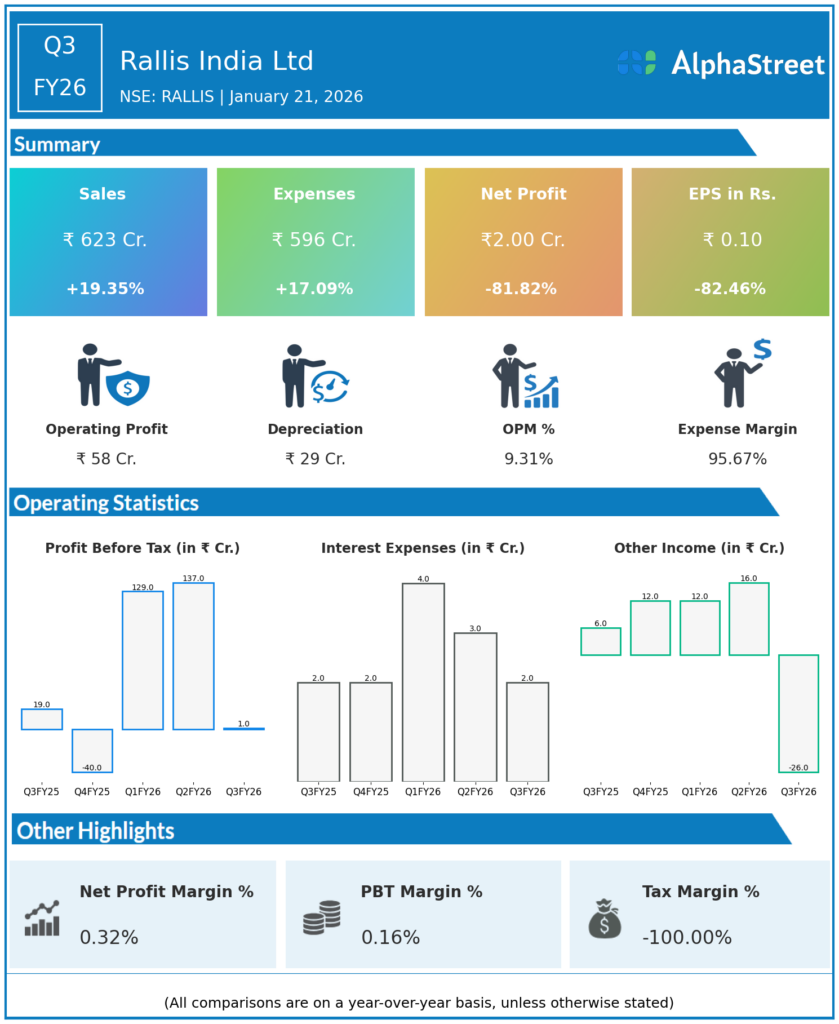

- Revenue from Operations: ₹623 crore, up 19% YoY from ₹522 crore.

- EBITDA: ₹58 crore, up 32% YoY from ₹44 crore; EBITDA margin 9.3% vs 8.4% in Q3 FY25 (about 90 bps expansion).

- Profit Before Tax (PBT) before exceptional items: ₹36 crore, up ~90% YoY from ₹19 crore in Q3 FY25.

- Exceptional item (New Wage Code): Additional gratuity provision taken in Q3, pulling down reported profitability.

- Profit After Tax (reported): ₹2 crore, down ~82% YoY from ₹11 crore; PAT margin ~0.3% vs 2.1% in Q3 FY25, entirely due to the one‑time gratuity provision.

- 9M FY26 performance:

- Revenue: ₹2,441 crore, up 9% YoY.

- EBITDA: ₹362 crore, up 18% YoY; margin improvement supported by better gross contribution and operating efficiencies.

- PBT (after exceptional items): ₹267 crore vs ₹227 crore in 9M FY25.

- PAT: ₹199 crore, up 26% YoY.

Management Commentary & Strategic Decisions – Q3 FY26

- Management highlighted that Q3 delivered volume‑led growth across businesses, with crop care, seeds and B2B all posting strong volume traction, aided by focused execution, improved field activity, and stronger customer engagement.

- Despite moderate and seasonally fluctuating demand, revenue grew 19% and EBITDA 31%, reflecting operating leverage and disciplined cost management; the steep PAT decline was explicitly linked to the one‑time gratuity provision under the New Wage Code.

- Strategic themes and actions:

- Continued strengthening of the product portfolio (including new launches like Fateh Nxt and herbicide combinations) and digital engagement with farmers and channel partners.

- Focus on improving quality of sales and driving further volume expansion in upcoming seasons through product launches and market‑activation initiatives.

- Sustained emphasis on operational efficiency and gross‑margin improvement to support medium‑term profitability, while treating the New Wage Code impact as a one‑off adjustment.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹861 crore, down 7.2% YoY from ₹928 crore in Q2 FY25, impacted by erratic monsoon and subdued rural demand.

- EBITDA: ₹154 crore, down 6% YoY from ₹166 crore; EBITDA margin 10.5%, up 210 bps YoY from 8.4% on better mix and efficiency.

- Profit Before Tax (PBT): ₹137 crore, down 6% YoY from ₹143 crore.

- Profit After Tax (PAT): ₹102 crore, up 4% YoY from ₹98 crore; PAT margin 5.5% vs 3.3% in Q2 FY25.

- Segment colour:

- Domestic Crop Care: Flat YoY amid weak monsoon and rural stress.

- Exports: Volumes improved in key geographies, driving ~9% QoQ recovery.

- Seed Business: Stable contribution supported by Kharif hybrid sales.

Management Commentary & Strategic Directions – Q2 FY26

- Management underscored that, despite top‑line pressure from weather and rural demand, margins improved due to a better product mix and continued operational‑efficiency initiatives.

- Strategic focus in Q2 included:

- Protecting profitability through mix upgrade and cost optimisation while navigating erratic rainfall and channel‑inventory challenges.

- Strengthening exports and B2B relationships to balance domestic volatility.

- Leveraging R&D, process chemistry capabilities, and five owned manufacturing facilities (Akola, Lote, Ankleshwar, etc.) to support pipeline execution and future growth.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.