Rallis India, a Tata Group company Group Co., has a history of over 150 years. The company is into manufacturing of Agrochemicals and is present across the value chain of agriculture inputs – from seeds to organic plant growth nutrients. Rallis is also in the business of contract manufacturing for global corporations. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

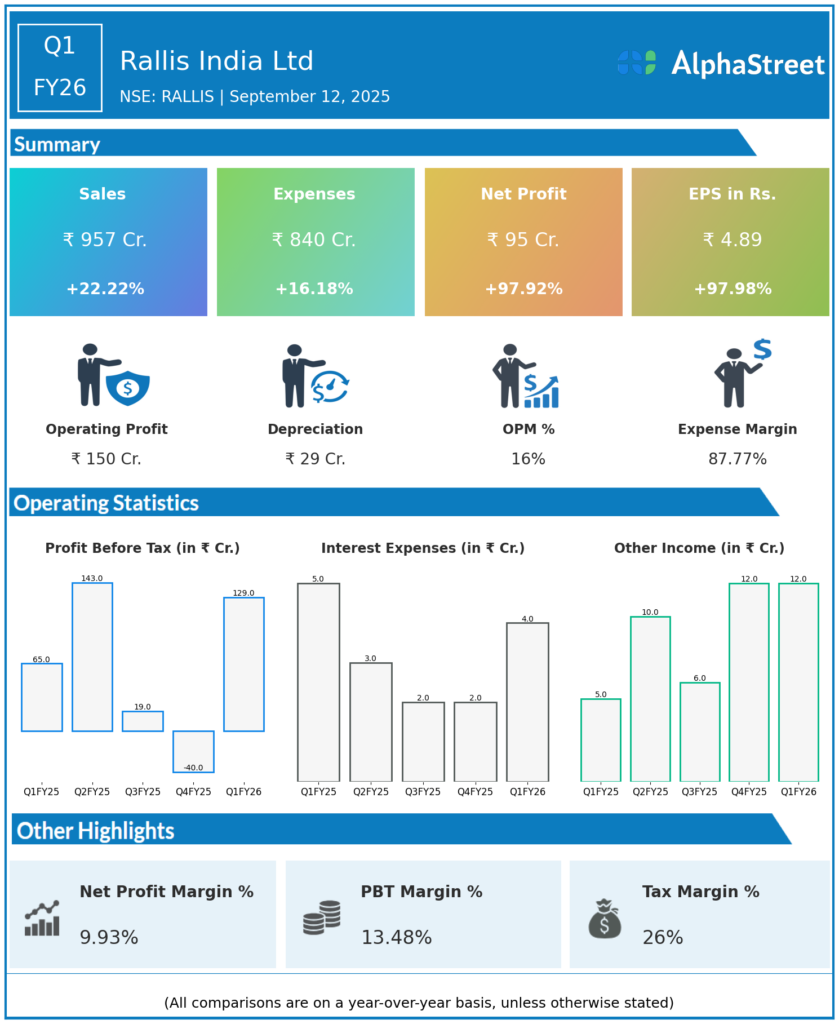

Total Revenue: ₹957 crores, up 22% YoY (Q1 FY25: ₹783 crores).

-

Profit After Tax (PAT): ₹95 crores, up 98% YoY (Q1 FY25: ₹48 crores).

-

EBITDA: ₹150 crores, up 57% YoY (Q1 FY25: ₹96 crores).

-

EBITDA Margin: 15.7%, expanded by 340 bps (Q1 FY25: 12.3%).

-

PAT Margin: Improved to 9.9% (Q1 FY25: 6%).

-

Crop Care B2C Growth: 13% YoY; B2B: 23% YoY; Seeds: 38% YoY; Soil & Plant Health: 33% YoY.

-

Export Revenue: Crop Care B2B exports up 75% YoY; notable product strength in metribuzin, hexaconazole.

-

New Launches: 9 crop protection products (herbicides, fungicides, insecticides); 14 new seed varieties (cotton, bajra, paddy).

-

Balance Sheet: Healthy closing fund balance, strong working capital management.

-

Capex: Projected at ₹100 crores for plant upkeep, R&D, and solar initiatives.

Key Management Commentary & Strategic Highlights

-

CEO Gyanendra Shukla credited early, well-distributed monsoon and operational momentum, including robust new product placement, for volume-led growth across segments.

-

Management highlighted product mix improvement, cost optimization, and margin expansion as key success drivers.

-

Exports showed strong recovery with global demand for select products, while seeds growth was underpinned by new hybrids and renewed market focus.

-

Strategic thrust remains on customer centricity, differentiated solutions, and long-term capability building in manufacturing, digitalization, and alliances.

-

Management remains cautiously optimistic, monitoring product liquidation and anticipating gradual export market recovery.

Q4 FY25 Earnings Results

-

Total Revenue: ₹430 crores.

-

Profit After Tax (PAT): -₹32 crores.

-

EBITDA: ₹102 crores.

- EPS: –₹1.65

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.